[Explanation of Laws and Regulations]

Outline of the Electronically Recorded Claims Act

I. Background

The Electronically Recorded Claims Act (Act No. 102 of 2007) was enacted at the 166th ordinary session of the Diet on June 20, 2007 and was promulgated on June 27. (The effective date is to be a date specified by a Cabinet Order within a period not exceeding one year and six months from the day of promulgation.)

The background of enactment of this Act and developments of discussions on the bill are outlined below.

1. Needs for developing a new fund-procurement environment

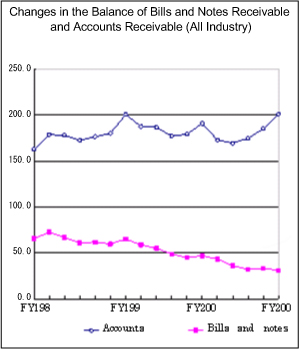

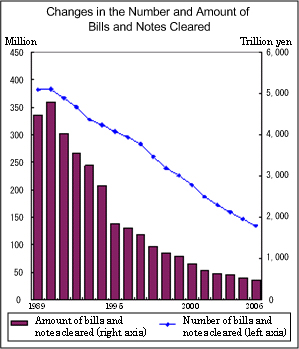

Bills and notes, which are means for inter-business credit, have various problems attributable to the use of a paper medium, such as the risk of being lost or stolen or the costs involved in creating or storing them. In addition, nominative claims also have such problems as the risk of double assignment and the costs involved in confirming the existence of claims. These problems had served as restraints to funding activities by business operators.

Due to progress in the use of information technology in the economy and society, services using electronic means have also become popular in the fields of commercial transactions and financial transactions. In such a situation, there have been expectations to introduce a new system to secure the safety of transactions and liquidity of claims by having establishment of claims take effect by electronically recording them, in order to overcome the problems mentioned above and to improve the fund-procurement environment for business operators, including small and medium-sized enterprises (SMEs).

|

|

|

| Source: ''Financial Statements Statistics of Corporations by Industry'' (chronological data of annual surveys), Policy Research Institute, Ministry of Finance | Source: ''Annual Report of Settlement Statistics (2006),'' Japanese Bankers Association |

2. Discussions leading up to submission of the bill

A system of electronically recorded claims has been discussed by the Ministry of Economy, Trade and Industry (METI), the Ministry of Justice (MOJ) and the Financial Services Agency (FSA) since the announcement of ''e-Japan Strategy II'' in July 2003, based on subsequent decisions of the IT Strategic Headquarters, in order to develop a fund-procurement environment for SMEs and other businesses by promoting assignment of claims using electronic means. In December 2005, METI, the MOJ and the FSA compiled the ''Basic Concept of Electronic Claims.'' Furthermore, the ''Three-Year Program for Promoting Regulatory Reform and Privatization (further revised),'' which was adopted by the Cabinet in March 2006, stated that the Japanese government will further the discussions toward enactment of an Electronic Claims Act (tentative name) based on the outline of the electronic claims system clarified in December 2005, and will aim at concretizing the legal framework by the end of FY2006.

The Legislative Council (Subcommittee on the Electronic Claims Act) of the MOJ examined the basic characterization of electronically recorded claims and their positioning under private law toward development of the Electronically Recorded Claims Act. At the same time, at the joint meeting between the Second Subcommittee and the Information Technology Innovation Working Group of the Financial Service Council of the FSA, discussions were mainly held on requirements for electronic claim record-keeping organizations (hereinafter referred to as ''record-keeping organizations''). As a result, the councils respectively compiled and published the ''Outline of the Private Law Aspect of the Legal System of Electronically Registered Claims'' (February 2007) and ''Toward Enactment of the Electronically Registered Claims Act (tentative name): Focusing on Requirements for the Management Organizations of Electronically Registered Claims'' (December 2006).

Based on these results, the FSA and the MOJ jointly carried out the drafting work and finally submitted the bill to the 166th session of the Diet on March 14, 2007.

N.B.: While such tentative terms as ''electronic claims'' and ''electronically registered claims'' had been used at the discussion phase, the term ''electronically recorded claims'' was used when submitting the bill.

II. Outline of the Electronically Recorded Claims Act

The Electronically Recorded Claims Act provides for electronically recorded claims of which establishment and assignment need to be electronically recorded in the record registry, prepared by an electronic claim record-keeping organization (hereinafter referred to as a ''record-keeping organization''), in order to take effect. The Act also stipulates the necessary matters concerning the operations and supervision of record-keeping organizations that keep such electronic records.

The main contents of the Act are shown below.

[Basic Scheme of Electronically Recorded Claims]

![[Basic Scheme of Electronically Recorded Claims]](/en/newsletter/2007/08/03.jpg)

1. Rules on electronically recorded claims under private law

(1) Characteristics of electronically recorded claims

An electronically recorded claim is a monetary claim of which establishment and assignment need to be electronically recorded in the record registry that is prepared in the form of a magnetic disk or such in order to take effect. The contents of the right are decided by the claim record that has been recorded in the record registry.

Various matters (e.g., detailed special provisions on syndicate loans) can be recorded as voluntarily recorded matters.

(2) Ensuring safety of transactions of electronically recorded claims

(a) Presumption of rights

The person recorded in a claim record as the creditor is presumed to be the holder of the rights concerning the electronically recorded claim (Article 9).

(b) Record-keeping organization's liability for damages

With regard to a claim for damages filed against a record-keeping organization by an injured party who has incurred damages from the record-keeping organization's act of electronically recording a false matter or conducting electronic record-keeping based on a request by an unauthorized agent, the burden of proof is shifted to the record-keeping organization, and the record-keeping organization is liable for such damages, unless it proves that its officers and employees were not negligent of duty of care (Article 11 and Article 14).

(c) Special provisions on invalidation or rescission of manifestation of intention

There are no provisions under the Civil Code to protect third parties in the case where manifestation of intention is invalidated due to concealment of the true intention or due to a mistake or where manifestation of intention has been rescinded due to fraud or duress. However, this Act has provisions to protect such third parties as long as they were without knowledge and gross negligence (Article 12).

(d) Special provisions on the liability of an unauthorized agent

In the case where an unauthorized agent has requested to conduct electronic record-keeping, this Act does not allow the unauthorized agent to be discharged from liability unless there has been gross negligence on the opponent's side, adopting stricter requirements for discharge than under the Civil Code (Article 13).

(e) Acquisition without knowledge and cutoff of personal defense

There is a system of acquisition without knowledge, which allows an assignee to acquire an electronically recorded claim even if the relevant assignment record was invalid, as long as the person who was recorded as the assignee in the assignment record was without knowledge and gross negligence (Article 19). There is also a system to cut off personal defense wherein a debtor cannot duly assert against the assignee by a defense based on his/her personal relationship with the assignor, unless the assignee had an intent to harm (Article 20).

(f) Discharge from payment

There are provisions on discharge from payment, stipulating that a payment is valid as long as the payment is made to the person who is recorded in the claim record as the creditor, even if such recorded person was not entitled to the rights, provided that the person who made the payment was without knowledge and gross negligence (Article 21).

(3) Others

(a) Consumer protection

Since there is a gap between consumers and business operators in terms of bargaining power and quality of accessible information, consumer protection is given higher priority than safety of transactions of electronically recorded claims. At the same time, however, consideration is to be given to the needs of individuals who are business operators in regards to their use of electronically recorded claims. Specifically, the Act provides as below.

(1) When an individual uses an electronically recorded claim, such provisions as acquisition without knowledge will not be applied.

(2) However, even in the case of an individual, if there is a record stating that the individual is an individual business operator, the provisions including acquisition without knowledge will be applied.

Even when there is a record stating that the individual is an individual business operator, if the individual was in fact using the electronically recorded claim as a consumer, said record will be invalid, and such provisions as acquisition without knowledge will not be applied.

(b) Others

There are provisions on division of an electronically recorded claim, change of recorded matters, guarantee of an electronic record that has similar independence as guarantee of a bill, a system for pledging electronically recorded claims, and disclosure of claim records.

2. Supervision of record-keeping organizations

(1) Securing fairness in operations of record-keeping organizations

(a) Designation of persons who operate electronic claim record-keeping business

Since the contents of electronically recorded claims are fixed by the electronic record-keeping carried out by a record-keeping organization, the electronic claim record-keeping business needs to be operated by credible organizations. Therefore, the competent minister is to receive applications and designate stock companies that have financial basis and appropriate ability to perform tasks as record-keeping organizations, from the viewpoint of ensuring stable and continuous business operation by record-keeping organizations. Record-keeping organizations are important entities that involve in establishment and assignment of electronically recorded claims. Therefore, they are to be stock companies that have a board of directors, a board of company auditors or an audit committee, and accounting auditors, from the perspective of securing credible corporate governance under the Companies Act and flexible and agile business operation based on diverse fund-procurement means (Article 51).

Electronically recorded claims are expected to be used in various situations, such as using them similarly to bills and notes by recording limited matters or using them for syndicate loans by recording diverse matters. Thus, there should not be just one single record-keeping organization. Instead, several record-keeping organizations should be established in response to the needs of the private sector so that their service quality would improve through competition.

(b) Prohibition of operation of other business

Due to the need to secure fairness and neutrality, such as deterring misappropriation of information, and to eliminate the risk of failure caused by other businesses, record-keeping organizations are not allowed to operate business other than the record-keeping business and business incidental thereto. Because of this, a business company operating another business cannot directly operate the electronic claim record-keeping business, but various entities can enter the electronic claim record-keeping business by establishing a record-keeping organization as a subsidiary (Article 57).

As it is also important to ensure convenience for users of electronically recorded claims and operational efficiency of record-keeping organizations, record-keeping organizations can entrust part of its electronic claim record-keeping business to a bank or any other party by obtaining the approval of the competent minister (Article 58).

(c) Securing simultaneous execution of payment and recording of payment, etc. (a measure concerning settlement of remittance between accounts)

In order to ensure to the greatest extent possible that the payment and the recording of payment, etc. are executed with the same timing, there is a system wherein an agreement is concluded between the record-keeping organization, the debtor and the financial institution. Per this agreement, the financial institution handles payment from the debtor's account to the creditor's account based on information such as the payment date provided by the record-keeping organization. At the same time, the record-keeping organization immediately records the payment, etc. upon its own authority when it has received a notice from the financial institution managing the debtor's account that remittance has been completed for the full amount of the debt, without waiting for a request by the parties concerned (Article 62 and Article 63).

Apart from this method, the record-keeping organization is also allowed to record the payment, etc. upon its own authority when it can be ensured that payment of the debt has been made, based on an agreement between the parties concerned (Article 64 and Article 65).

(d) Others

In addition to the matters above, there are also provisions on the minimum amount of stated capital (an amount specified by a Cabinet Order of not less than 500 million yen), confidentiality (Article 55), protection of persons using a record-keeping organization (Article 59) and prohibition of unreasonable discriminatory treatment to specific persons (Article 61).

(2) Inspections/supervision of record-keeping organizations

There are provisions on the necessary inspections and supervision for ensuring appropriate and secure execution of business. Specifically, there are provisions on collection of reports and on-site inspections (Article 73), business improvement orders (Article 74), rescission of designation (Article 75) and business transfer orders (Article 76). In addition, record-keeping organizations are required to prepare and submit a report on their business and property every business year (Article 68). It is also provided that reduction of the amount of stated capital (Article 69), a change to the articles of incorporation or operating rules (Article 70), discontinuance (Article 71), and merger or dissolution (Articles 78 to 82) only take effect with the approval of the competent minister.

(3) Others

Since there is a risk of electronically recorded claims being used as a means to conceal criminal proceeds or camouflage fund transfers, record-keeping organizations are obligated to confirm the identity of users and to notify of any suspicious transactions as specified business operators in accordance with the Act on Prevention of Transfers of Criminal Proceeds.

When electronically recorded claims are to be widely traded as financial instruments, the regulatory provisions of the Financial Instruments and Exchange Act will be applied.

III. Future Prospects

Electronically recorded claims can flexibly respond to various business needs and information technology innovations. They are expected to be used not only as substitutes for bills and notes, but for diverse purposes including use for syndicate loans. They are believed to become important infrastructure for the future of electronic financial transactions.

In order for electronically recorded claims to be used in ways that appropriately meet the business needs of the private sector, practical operation rules that comply with the actual uses need to be established by private business operators, just as the widely used system of bills and notes has been operated based on the rules of the private sector.

The government will also exert efforts to lay the groundwork, such as preparing necessary cabinet orders and ministerial ordinances, toward appropriate and smooth implementation of the system, so that the use of electronically recorded claims will be promoted.

It is hoped that record-keeping organizations will be established at an early stage and electronically recorded claims will actually become widely used as a result of such efforts by the private sector and the government.

Site Map

- Press Releases & Public RelationsPage list Open

- Press Releases

- Press Conferences

- Official Statements

- FSA Weekly Review & ACCESS FSA

- Speeches

- For Financial Users

- Others

- Archives

- Laws & RegulationsPage list Open

- Name of Laws and Regulations(PDF)

- Recent Changes (Legislation, Ordinances, Guidelines)

- Guidelines

- Financial Instruments and Exchange Act

- Financial Monitoring Policy

- Public Comment

- No-Action Letter System

- Procedures concerning Foreign Account Management Institutions

Search

Search