[Notices]

○Watch out for malicious solicitations for funds!

Business operators must be registered to solicit investments in funds.On September 30, 2007, the Financial Instruments and Exchange Act (FIEA) came into force, and an obligation to register with local finance bureaus (including the Fukuoka Local Finance Branch Bureau and the Okinawa General Bureau) was placed upon business operators engaged in soliciting general investors to invest in funds. (Business operators engaged in services for professional investors (= specially permitted businesses for qualified institutional investors, etc.) were similarly imposed with an obligation of notification.)

Specifically, business operators who

1. Collect money from others (solicit for equity investments),

2. Conduct some kind of business or investment, and

3. Operate a system whereby revenues generated from the business or investment are distributed to the equity investors

are now required to register with, or notify, their local finance bureaus.

Registered fund managers and notified fund managers can be checked on the FSA website.

Great care should be taken against investment solicitations and so forth from unregistered persons.

Furthermore, when soliciting contributions and so forth, even registered fund managers must, for instance, abide by the following rules:

- When making public advertisements, the business operator must indicate that it is a financial instruments business operator, and must indicate its registration number; and with regard to the outlook of profits, the business operator shall not make any indications that are significantly contradictory to facts or seriously misleading.

- When the business operator intends to conclude a contract, it shall deliver to the customer in advance a document containing the business operator’s registration number, an outline of the contract and an outline of the fees.

- The business operator shall not “deliver false information” or “solicit by providing an assertive judgment on uncertain matters.”

- The business operator shall not compensate for losses.

The FSA recommends that people act with caution if they are not sure whether a fund manager is trustworthy, even if that manager is registered.

With respect to notified fund managers, they are able to engage in business as long as they give notification to the FSA. At the time of notification, the FSA does not perform any screening or other kind of examination. Therefore, just because notification has been made does not necessarily mean that reliability can be assured, and so people should exercise great care when conducting transactions.

○Protecting the markets with information received from the public!

The mission of the Securities and Exchange Surveillance Commission (SESC) is to ensure the fairness and transparency of Japan’s markets and to protect investors, through exerting its authority of market surveillance, inspections of securities companies, administrative monetary penalties investigations, disclosure documents inspections and investigations of criminal cases.

The SESC receives a wide range of information from the general public via phone, mail, fax and the internet, relating to suspected misconducts in the market such as those below. Information received is effectively used as reference material in its investigations, inspections and other activities. During business year 2008, the SESC received 6,412 items of information.

« Information on specific stocks »

|

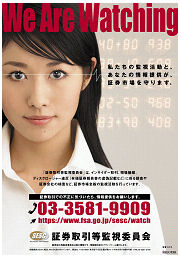

Poster calling on the general public to provide information |

« Information on financial instruments business operators, etc. »

- Wrongful acts by securities companies, foreign exchange margin (FX) traders, management firms, investment advisory companies, etc. (inadequate explanation of risks, system-related problems, etc.)

- Problems related to business management systems or financial conditions (risk management, customer asset segregation, calculation of capital adequacy ratio, etc.)

« Other information »

- Information on suspicious financial instruments, suspicious funds (fraudulent fund-raising schemes, etc.) or on unregistered business operators

- Information on market participants who are likely to impair the fairness of markets (so-called speculator groups, etc.)

If you have any information like that described above, please be sure to submit it to the SESC. In addition to information on shares, the SESC also accepts a wide range of information on derivatives, bonds and other financial instruments. (Please note that the SESC does not accept individual requests for dispute resolution and inspections.)

To submit information via the internet, please access the Securities Watch & Report Portal on the SESC website.

♦SESC Securities Watch & Report Portal

Information Processing Officer, Market Surveillance Division,

Executive Bureau, Securities and Exchange Surveillance Commission

Central Government Office Building No.7, 3-2-1 Kasumigaseki, Chiyoda-ku, Tokyo, JAPAN 100-8922

Direct line: +81 (3) 3581-9909

Switchboard: +81 (3) 3506-6000 (extensions 3091, 3093)

Fax: +81 (3) 5251-2136

https://www.fsa.go.jp/sesc/watch/![]()

○Beware of malicious phone calls from people pretending to be from the FSA or SESC! Warnings about unlisted shares.

Many reports have been received of people claiming affiliation with the Financial Services Agency (FSA), the Securities and Exchange Surveillance Commission (SESC) or other organizations with similar sounding names, and who:

○ Indicate they are “conducting a survey of victims related to unlisted shares,” or that “the unlisted shares the customer has at hand are safe because it has been decided to list them”; and then at about the same time, a person claiming to be the issuer of the unlisted shares suggests an additional purchase of the unlisted shares; or

○ Indicate they are “negotiating on behalf of the victims of the unlisted shares for the company to repurchase the shares,” and who then request some kind of fee or remuneration.

Note: Examples of names that are suggestive of the Securities and Exchange Surveillance Commission: Securities Surveillance Commission, NPO Securities Surveillance Commission, Securities and Exchange Audit Commission, Securities and Exchange Surveillance Association, etc.

Please be very careful of suspicious calls like those above. Personnel from the FSA and the SESC would never mention on the phone when unlisted shares are to be listed, or negotiate the purchase of unlisted shares. Nor would they ever outsource such operations.

If you receive such a call, please contact the FSA Counseling Office for Financial Services Users or the SESC Securities Watch & Report Portal![]() and provide them with your information. Also, please report the incident to your nearest police station.

and provide them with your information. Also, please report the incident to your nearest police station.

♦FSA Counseling Office for Financial Services Users

Phone (Navi-Dial): 0570-016811

* (from IP phones or PHS): +81 (3) 5251-6811

Fax: +81 (3) 3506-6699

♦SESC Securities Watch & Report Portal

Information Processing Officer, Market Surveillance Division,

Executive Bureau, Securities and Exchange Surveillance Commission

Direct line: +81 (3) 3581-9909 Fax: +81 (3) 5251-2136

Switchboard: +81 (3) 3506-6000 (extensions 3091, 3093)

Site Map

- Press Releases & Public Relations

- Press Releases

- Press Conferences

- Official Statements

- FSA Weekly Review & ACCESS FSA

- Speeches

- For Financial Users

- Others

- Archives

- Laws & Regulations

- Name of Laws and Regulations(PDF)

- Recent Changes (Legislation, Ordinances, Guidelines)

- Guidelines

- Financial Instruments and Exchange Act

- Financial Monitoring Policy

- Public Comment

- No-Action Letter System

- Procedures concerning Foreign Account Management Institutions

Search

Search