Events

- HOME

- FSA's Support

- Materials and Information

- Events

- Seminar Summary

Seminar Summary

Market Expansion Webinar Series: New Business Opportunities in Japan for Overseas Asset Managers 2022

June 23, 2022 | 4 PM

Guest Speakers

Richard Clairmont

CEO, ABN AMRO Clearing Tokyo

Hiroki Tomiyasu

Managing Director, Morgan Stanley MUFG Securities

Featured Speakers

Takuma Tanaka

Deputy Director, Financial Services Agency

Scott Sato

CEO, Tricor Japan

Moderator

Gary Tok

Group Chief Commercial Officer, Tricor Group

Gary Tok (Chief Commercial Officer (CCO), Tricor Group)

How significant are the implications of government reforms under the International Financial Center Initiative for Japanese asset managers?

Richard Clairmont (CEO, ABN AMRO Clearing Tokyo)

There are various forms of assistance provided by the JFSA and other similar programs currently in place with metropolitan governments across Japan. It's significant. These programs are trying to address some of the administrative difficulties that people perceive about coming to Japan, like applying for visas and license applications. Simply the fact that these programs have been established is an indication that Japan is really serious about making it easy for professionals to move here.

Gary Tok (CCO, Tricor Group)

How would that impact any expatriates who are thinking of relocating to Japan?

Richard Clairmont (CEO, ABN AMRO Clearing Tokyo)

Let me share some comments based on my experience, as an expatriate worker in Japan. It is good to look at it from a professional point of view as well as from a personal point of view.

First, professionally speaking, the experience of working in Japan is fabulous. There is a number of reasons for it.

Based on my position of running a company, I'm really able to rely upon a high quality of work. In addition, infrastructure works here, and we can expect things to work properly. From a company's point of view, we use vendors for a number of things, such as IT development. Deliveries are made on schedule as promised and the quality matches the expectation that you're dealing with. At a broader level, the real ecosystem in my industry, financial services, brokerage, is professional. And it just really makes it easier to succeed here in Japan.

The last point from a professional point of view is about language. In industries like financial services, where people tend to come from higher levels of education, people that you work with in an office day-to-day in Japan all typically speak English, so the perceived language barrier is not quite as high once you arrive here and experience it..

Then, I will talk more from a personal point of view.

Slide 1 shows that Japan offers various sorts of lifestyle. People are probably aware of a wonderful skiing environment, but there's a lot to do in Japan: beautiful beaches, and surfing. My children also play ice hockey in Japan. It is really quite diverse.

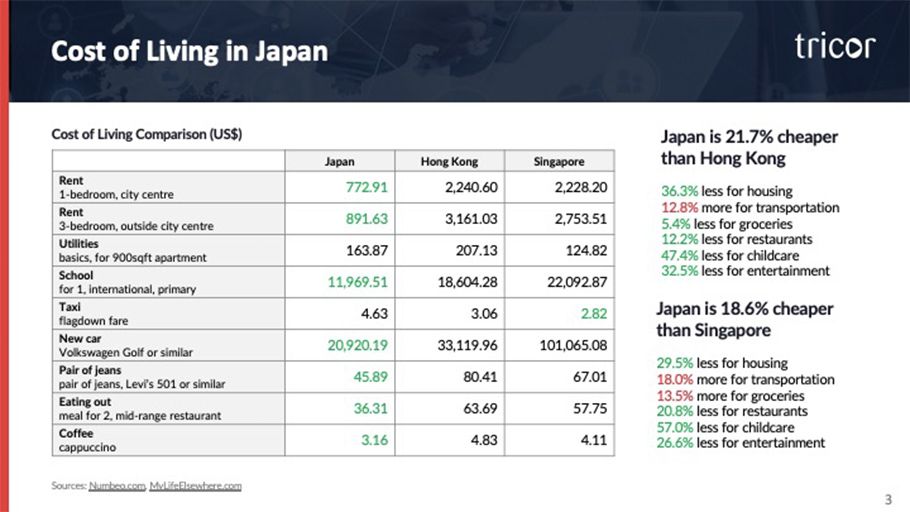

The cost of living is another perceived difficulty in Japan, but again, my personal experience over many years as an expatriate living in Japan has been that the perceived costs of living, rent, foods are not as high as people would think (See Slide 2).

I work for ABN AMRO in Tokyo. We have offices in other locations around the world. Certainly, many of my peers in the company living in other financial centers, typically will not necessarily own a house, perhaps have a smaller condominium. They are always surprised to hear that I live in a house and fairly central Tokyo. It is not as expensive as you would think actually. So, the cost of living in Tokyo is not a real concern.

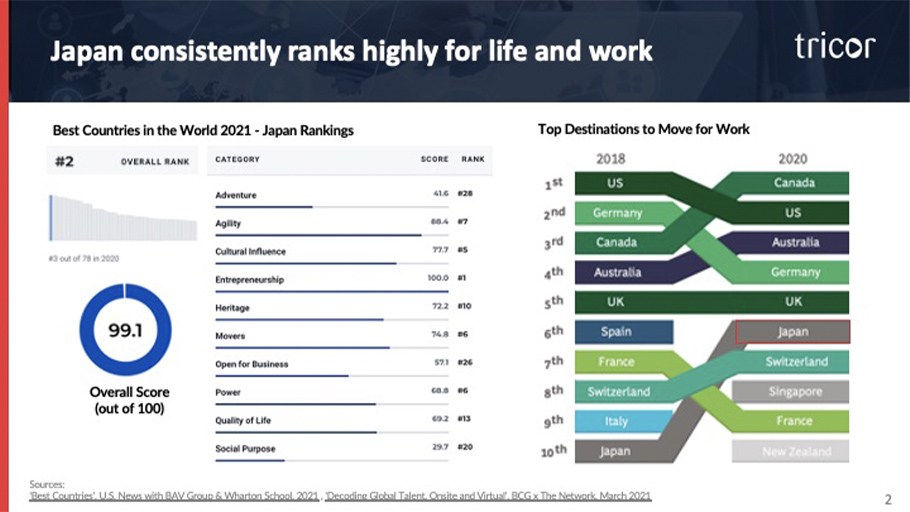

Slide 3 summarizes two studies. The first one on the left is a survey of the best countries in the world done by U.S. News and Wharton Business School. It looks at a number of factors: Quality of life, Job market, Economic stability, Family friendliness. In 2021, Japan ranked Top 2 in the world behind Canada. Japan just does extremely well on a number of factors. On the right side of the page is another study conducted by Boston Consulting Group and this asks a simple question, which is, “What country would you be most interested in relocating to for work?” You can see that in 2020, Japan was No.6 on the list behind Canada, the United States, Australia, Germany and UK.

People come to Japan not necessarily realizing many of these things and in many cases, they came with the intention of being here for 2 to 3 years. And then like me, 15-20 years later, they say, wait a minute, I have been here for my entire life. Because, again, the quality of professional experience and the personal experiences are really that great.

Gary Tok (CCO, Tricor Group)

I would love to hear your perspectives more on how an expat worker fit into a local community in Japan, what you think about language barriers, and how you settle in with your family.

Richard Clairmont (CEO, ABN AMRO Clearing Tokyo)

In my experience, it has never been anything but welcoming. I have worked both in tech and financial services in Japan and, throughout my experience, it has always been very easy to blend in. I started my career in Japan in Osaka. I worked for a Japanese company in Tokyo, and I worked for foreign companies. Perhaps, a natural perception would be, it must have been easier to work for foreign American companies in Tokyo but actually my experience working for a mid-sized company in Osaka was also fabulous and rewarding.

About the language barrier, I made an effort to learn to speak Japanese. I have passed the Level-1 Japanese proficiency test, but I end up speaking English because many of my colleagues are really quite proficient with English. Anyway, at least in my professional sphere, there are not any real insurmountable language barriers.

You also asked about acceptance of family. My children are half Canadian, half Japanese, my wife is Japanese. We had them go to the local Japanese neighborhood, elementary schools, and my children had just a really wonderful experience, absolutely welcomed and this is probably something that people from outside Japan would never guess. When I go to my daughter's elementary school for sports days or track and field days, it's really becoming more and more common to see kids in the school who are not Japanese or half Japanese, blond haired kids from other countries. I think it is a nice sort of indication how welcoming life is here.

Gary Tok (CCO, Tricor Group)

Hiroki, can you provide your view from a different perspective? In terms of the financial hubs of Japan, most people often associate that with Hong Kong and Singapore, but Tokyo is just one of the renowned cities in the world and one of the leading financial hubs in the APAC region. What kind of misconception do you think people have?

Hiroki Tomiyasu (Managing Director, Morgan Stanley MUFG Securities)

Sure. I am the Chair of the International Finance Center committee of FIA (Futures Industry Association) of Japan. We hosted a series of roundtables with global asset managers. It's always good to have more people working in the industry in Japan because we will have more innovations, competitions, new ideas and new technology. We welcome more entrants to Japan.

During the series of roundtable sessions, many asset management companies raised various issues, like tax, licensing, hiring helpers, costs of living, but I think the recent government program addressed most of the concerns. Surprisingly, most of them were not aware of the recent developments. In the past 20-30 years, we were not that serious. But, this time, the Japanese government is so serious about inviting more people into Japan.

Nonetheless, we recognize there exist the lack of understanding and some misconceptions, which made me think we just need to promote our efforts more efficiently. When I help those people who are moving to Japan, it is actually not that easy to get all the information compared to Singapore or Hong Kong, where it is all available in English. So, I have to help provide more information.

They initially think that the tax is a big problem. But then they realize, after I explain, there are so many offsetting benefits, so overall costs shouldn't be that high.

· For example, the biggest cost is rent. But the rent can be deductible for Japanese tax purposes, in which case the effective tax rate is not that high.

· There are many tax-deductible items, including commuting expenses, social insurance, and certain medical expenses. You cannot just compare the headline tax rates. You have to go into details.

· Taxes on your foreign source income, including capital gain are also exempt in the first 5 years after you move to Japan.

Many of the colleagues who already moved into Japan thought that it is just 2 years or 3 years assignment, but many people I know prefer to stay here longer and they reject going back to their home country because of the lifestyle here, and they are so accustomed to the environment where you can let your kids play in the park and take the public transportation without worrying about the safety, and the medical costs are cheap. They enjoy a lot of activities as Richard mentioned, and as they know the reality, they have cleared all the misconceptions. That is what I think we need to promote more.

Gary Tok (CCO, Tricor Group)

Are there any closing statements that anybody wants to share before we close off the panel?

Richard Clairmont (CEO, ABN AMRO Clearing Tokyo)

I think Hiroki summarized the whole discussion really nicely in one sentence, and I will reiterate it. There is really so much positive here and I think it is just not apparent to many people outside Japan. When they finally come and realize, they tend to stay for a very long time.

Takuma Tanaka (Deputy Director, JFSA)

Since our strict border control and quarantine measures loosened, overseas investment professional started to visit our offices for face-to-face meetings. So, if you come to Japan and you are interested in having a one to one with the Financial Markets Entry Office, please drop us an email. We are always ready to welcome you.

Richard Clairmont

CEO, ABN AMRO Clearing Tokyo

Mr. Clairmont moved to Japan in the 1990s and has spent his career in both finance and technology at a number of global firms in Japan. He is now CEO of ABN AMRO Clearing Tokyo and Chairman of FIA Japan.

Hiroki Tomiyasu

Managing Director, Morgan Stanley MUFG Securities

Mr. Tomiyasu has more than 30 years in the finance industry. He supports Japan FSA's initiatives as the chair of International Financial Center Committee of FIA Japan.

Takuma Tanaka

Deputy Director, Financial Services Agency

Mr. Tanaka is a public policy expert in international finance. As Deputy Director at JFSA, he is spearheading initiatives in financial regulation, tax, business incubation and livelihood support for investment professionals around the world.

Scott Sato

CEO, Tricor Japan

Based in Tokyo, Mr. Sato is responsible for driving the overall business performance of Tricor Japan, enhancing client and partner experience, as well as engaging with stakeholders from the financial, government and industry sectors to foster long-term relationships.

Gary Tok

Group Chief Commercial Officer, Tricor Group

Mr. Tok leads sales and business development activities for Tricor’s full range of services across 21 markets worldwide. With over 20 years of experience in sales, business development, marketing and account management across the Asia Pacific region, he has led and nurtured high performing sales and account management teams in human resources consulting, insurance brokerage, and digital health sectors.