- HOME

- Press Releases and Publications

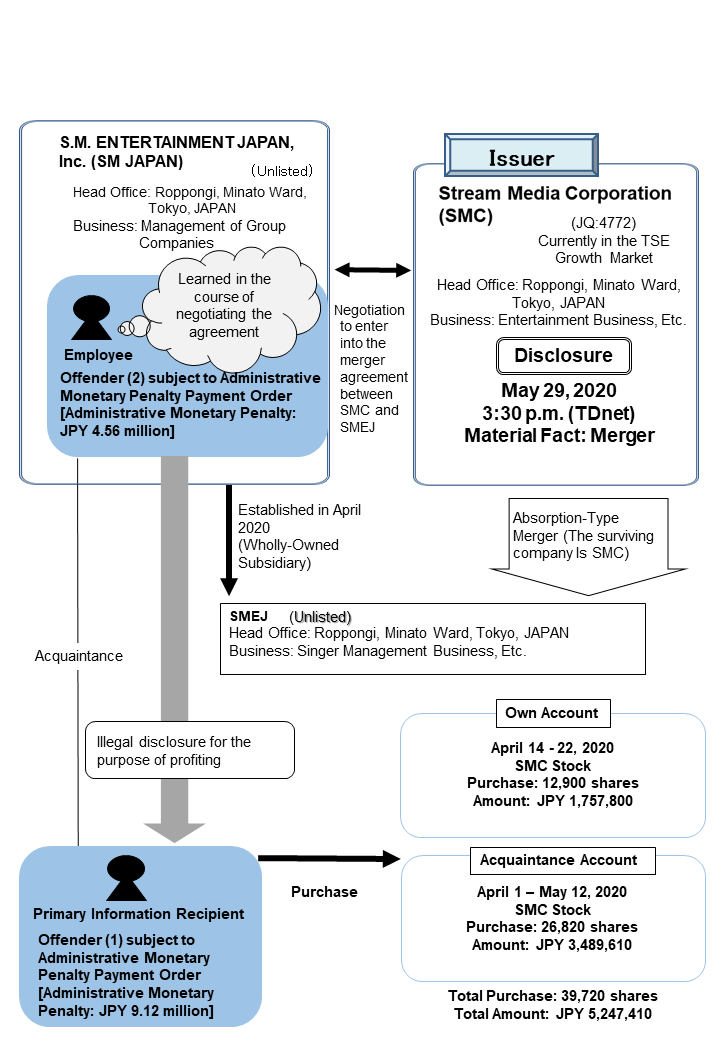

Recommendation for Administrative Monetary Penalty Payment Orders against a Person for Insider Trading and an Employee for Giving Insider Information While Their Company Negotiated an Agreement with Stream Media Corporation

1. Contents of the Recommendation

The Securities and Exchange Surveillance Commission today made a recommendation to the Prime Minister and the Commissioner of the Financial Services Agency that administrative monetary penalty payment orders be issued in regard to insider trading by one person and also an employee providing insider information about their company, which was negotiating to enter into an agreement with Stream Media Corporation (“SMC”), pursuant to Article 20 (1) of the Act for Establishment of the Financial Services Agency. This recommendation is based on the findings of an investigation into a suspected instance of insider trading and providing insider information whereby the following violations of laws and ordinances were identified.2. A Summary of the Findings Regarding Violations of Laws and Ordinances

(i) Offender (1)

Offender (1), who is subject to an administrative monetary payment order, was informed by an employee of S.M.ENTERTAINMENT JAPAN. (“SM JAPAN”) about material non-public information (hereinafter “MNPI”) regarding the decision maker of SMC, who had decided that it would merge with SMEJ, a subsidiary newly established by SM JAPAN. The employee, who is Offender (2) described below, learned about the MNPI regarding the merger during the course of negotiations for the merger agreement between SMEJ and SMC.

Offender (1) purchased a total of 39,720 shares of SMC for 5,247,410 yen from April 1 to May 12, 2020 in advance of the disclosure of the MNPI on May 29, 2020.

A summary of the findings is shown in  the Chart.

the Chart.

Offender (1) was found to be “effecting sales and purchases, etc. set forth in Article 166 (1) in violation of the provisions of Article 166 (3),” as stipulated under Article 175 (1) of the Financial Instruments and Exchange Act (“FIEA”).

(ii) Offender (2)

Offender (2), who is subject to an administrative monetary payment order, was an employee of SM JAPAN, which was negotiating to enter into a merger agreement between SMC and SMEJ, a subsidiary newly established by SM JAPAN. Offender (2) informed Offender (1) about the decision of SMC to merge with SMEJ. Offender (2) did this for the purpose of having Offender (1) profit by purchasing SMC shares in advance of the disclosure of the MNPI. Offender (2) learned of the MNPI about the merger during the course of their work negotiating the agreement.

Offender (1) purchased a total of 39,720 shares of SMC for 5,247,410 yen from April 1 to May 12, 2020 in advance of the disclosure of the MNPI released on May 29, 2020.

A summary of the findings is shown in  the Chart.

the Chart.

Offender (2) was found to be “providing information on the material facts, etc. set forth in Article 167-2 (1) in violation of the provisions of Article 167-2 (1),” as stipulated under Article 175-2 (1) of the Financial Instruments and Exchange Act (“FIEA”).

3. Calculation of the Amount of the Administrative Monetary Penalty

Pursuant to the FIEA, each amount of the administrative monetary penalty that is applicable to the above violations is described as follows:9,120,000 yen penalty against Offender (1)

4,560,000 yen penalty against Offender (2)

Note: Details of the calculation are shown in

Search

Search