- HOME

- Press Releases and Publications

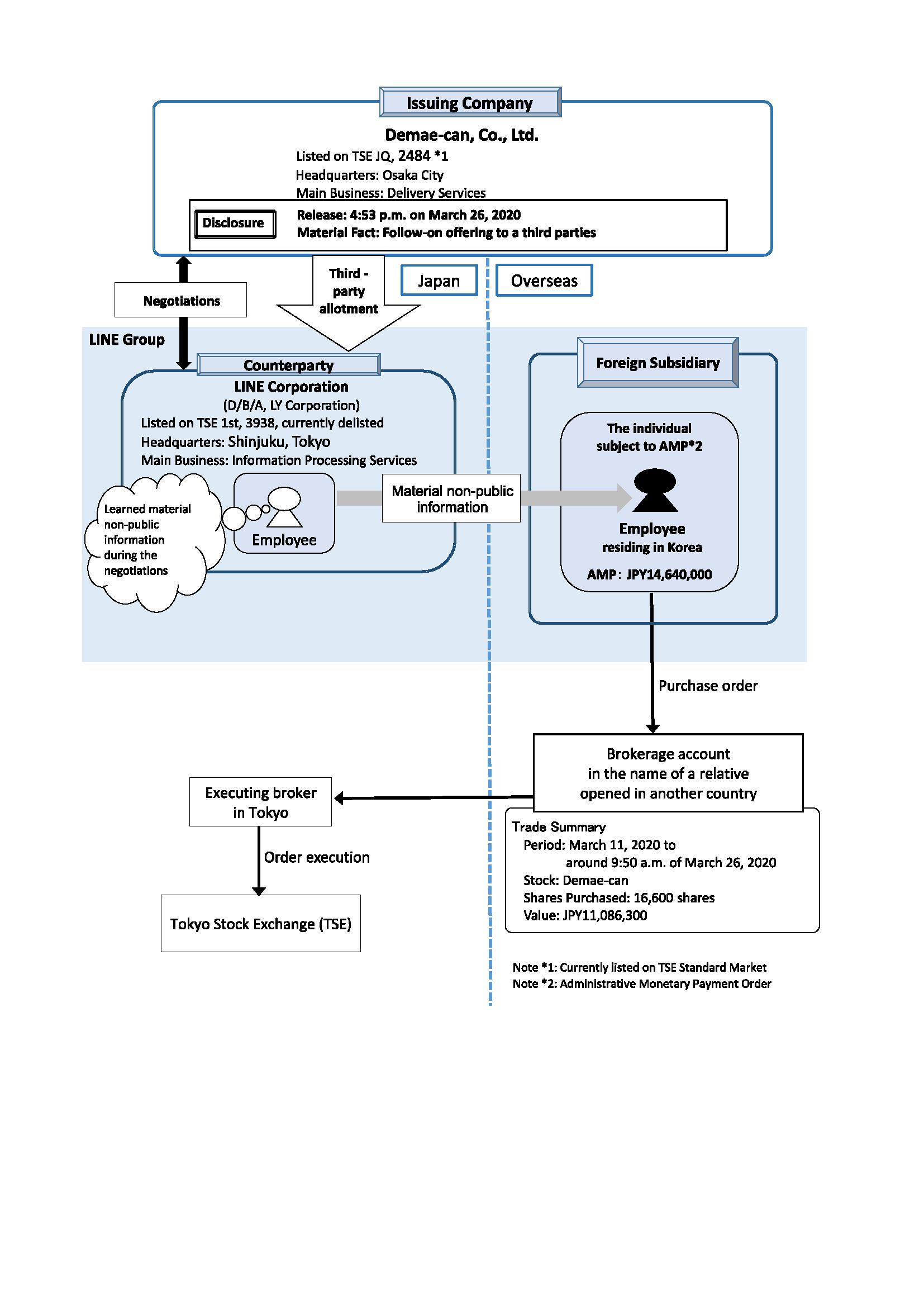

Recommendation for Administrative Monetary Penalty Payment Order for Insider Trading in Shares of Demae-can Co., Ltd. by an Individual Residing Abroad

1. Contents of the Recommendation

The Securities and Exchange Surveillance Commission today made a recommendation to the Prime Minister and the Commissioner of the Financial Services Agency that an administrative monetary penalty payment order be issued in regard to insider trading in the stock of Demae-can Co., Ltd. by an individual residing abroad pursuant to Article 20(1) of the Act for Establishment of the Financial Services Agency. This recommendation is based on the findings of an investigation into a suspected instance of insider trading, whereby the following violation of laws and ordinances was identified.

2. Summary of the Findings Regarding Violations of Laws and Ordinances

The individual residing in Korea subject to the administrative monetary payment order was informed by an employee working for LINE Corporation (“LINE”), which is currently reorganized as LY Corporation, of material nonpublic information about an offering of new shares of Demae-can Co., Ltd. (“Demae-can”) that its decision-making body had decided to make, which the employee of LINE learned of during the course of their duties to negotiate entering into a share subscription agreement with Demae-can.

A summary of the findings is shown in the  Chart.

Chart.

The individual’s aforesaid action was found to constitute “conduct[ing] Sales and Purchase, etc. set forth in Article 166(1) in violation of the provisions of Article 166(3)” as stipulated under Article 175(1) and 175(10) of the Financial Instruments and Exchange Act (“FIEA”).

Then, the individual purchased a total of 16,600 shares of Demae-can worth 11,086,300 yen with a relative’s brokerage account for their benefit during the period from March 11, 2020 to around 9:50 a.m. of March 26, 2020, ahead of the disclosure of the offering released at 4:53 p.m. on March 26, 2020.

The individual’s aforesaid action was found to constitute “conduct[ing] Sales and Purchase, etc. set forth in Article 166(1) in violation of the provisions of Article 166(3)” as stipulated under Article 175(1) and 175(10) of the Financial Instruments and Exchange Act (“FIEA”).

3. Calculation of the Amount of the Administrative Monetary Penalty

Pursuant to the FIEA, the amount of the administrative monetary penalty applicable to the above violation is 14,640,000 yen.

Details of the calculation are shown in the Attachment.

Attachment.

Details of the calculation are shown in the

4. Acknowledgements

We appreciate the assistance of the Hong Kong Securities and Futures Commission, the Financial Services Commission/Financial Supervisory Service of Korea, the Monetary Authority of Singapore, the Securities and Exchange Commission of Thailand, the United States Securities and Exchange Commission, and the Japan Exchange Regulation in this matter.

Search

Search