June 14, 2022

(June 22,2022 Updated)

(July 7,2022 Updated)

Financial Services Agency

Summary of Results of the FSA-sponsored International Symposium

“Transition to Net-Zero: The Role of Finance and Pathway toward a Sustainable Future”

Climate change is an urgent issue that must be resolved globally. In order to achieve carbon neutrality, all industries need to make a transition that contributes to achieving the goals of the Paris Agreement. It is also important to properly evaluate these efforts and encourage the mobilization of capital.

On May 26, 2022, the Financial Services Agency (FSA) held an international symposium at the Toranomon Hills Forum and virtually to focus on "transition" and discuss transition pathways to net zero and the role of transition finance.

The symposium featured lively discussions among approximately 30 representatives from the financial and industrial sectors as well as government officials from not only Japan but also Singapore, the U.S., Canada and European countries. While the number of participants at the venue was capped to prevent infection, the symposium was held in a hybrid format to allow networking among participants, which is necessary to solve global issues. Approximately 850 people attended the event, including both on-site and online participants.

1.Objectives

- Seizing the momentum: Just as seen in the initiatives by G20 or in the private sector, a consensus has been made that transition is an imminent challenge to realize the contents of the Paris Agreement. We need to ride the momentum without losing any time.

- Call for collaboration: To resolve the global challenge, namely climate change, it is important to ensure collaboration among various stakeholders, such as industrial and financial leaders, and the public sector around the world. Therefore, we wanted to have the key representatives, domestic or overseas, get together at one place.

- Shedding a light on the role of finance: Given the rising importance of the role of the private financial sector to fund transition, we as a financial regulator thought it necessary to set a place for discussions on transition from the viewpoint of finance.

2.Overview of the Symposium

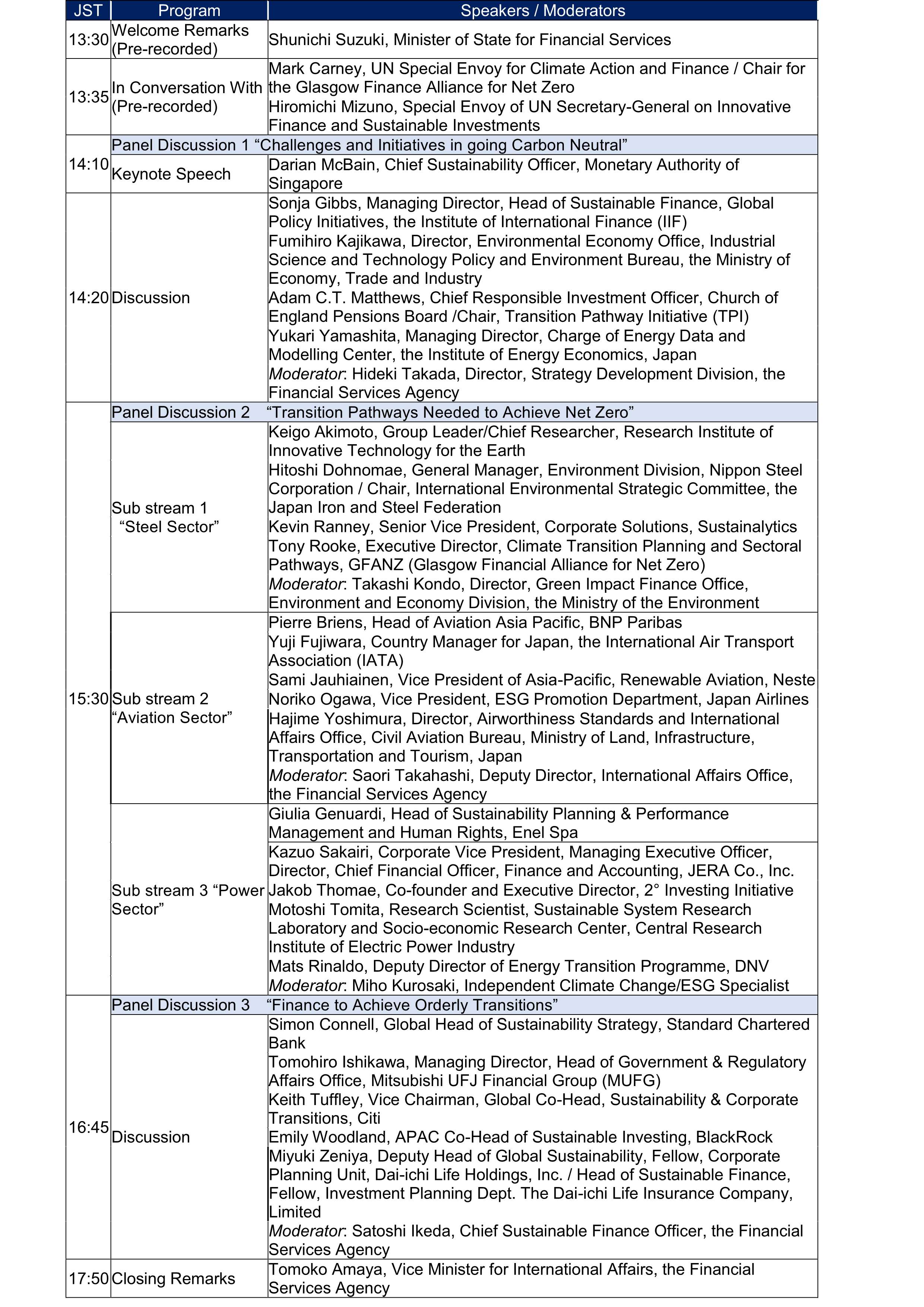

(1)Program/Speakers

(2)Discussions

◆Welcome Remarks

In his welcome remarks, Mr. Shunichi Suzuki, Minister of State for Financial Services, recalled the discussions that led to the entry into force of the Kyoto Protocol when he became Minister of Environment 20 years ago. He also introduced the Japanese government's pioneering efforts to emphasize the importance of "transition finance." He also introduced the efforts of the Japanese government and the FSA since the Carbon Neutrality 2050 declaration. In addition to the government's efforts, the private sector has also been active in transition finance, and the message was that it is important for the public and private sectors gathered at this symposium to cooperate with each other across borders to solve the problem of climate change.

English Video(YouTube)

English Video(YouTube)  Japanese Video(YouTube)

Japanese Video(YouTube) ◆In conversation with

On the occasion of the symposium, Mr. Mark Carney, UN Special Envoy for Climate Action and Finance / Chair for the Glasgow Finance Alliance for Net Zero (GFANZ), and Mr. Hiromichi Mizuno, Special Envoy of UN Secretary-General on Innovative Finance and Sustainable Investments, had a conversation in Los Angeles, USA. In addition to an introduction to the work of GFANZ, the two leaders spoke of the need to move further away from dependence on fossil fuels due to the recent surge in energy prices, and their expectations for Japan's role in supporting emerging economies and innovation toward decarbonization.

English Video(YouTube)

English Video(YouTube)  Japanese Video(YouTube)

Japanese Video(YouTube) ◆Panel Discussion 1 “Challenges and Initiatives in going Carbon Neutral”

- Keynote Speech

To kick off the discussion, Dr. Darian McBain, Chief Sustainability Officer of the Monetary Authority of Singapore (MAS), gave a keynote address on the challenges and opportunities for decarbonization in Asia. Making reference to a traditional Japanese painting by Katsushika Hokusai, she touched on the impact of climate change on sea surface temperature rise and biodiversity loss, and introduced the amount of investment and investment opportunities needed in the Asian region to achieve net zero.

![]() Presentation material of Dr. Darian McBain (MAS)

Presentation material of Dr. Darian McBain (MAS)

English Video(YouTube)

English Video(YouTube)  Japanese Video(YouTube)

Japanese Video(YouTube) - Discussion

English Video(YouTube)

English Video(YouTube)  Japanese Video(YouTube)

Japanese Video(YouTube) Panel Discussion 2 was divided into three sectoral breakout groups for more practical discussions: "Steel," "Aviation," and "Power," to discuss how credible pathways should be to achieve the goals of the Paris Agreement.

- Steel Sector: Panelists from policy makers, academia, steel manufacturers, and private financial organizations introduced their R&D efforts to solve the technical challenges of achieving net zero and implied that, as with the Net Zero states, the transition pathways are diverse and the way they are drawn is important. Given that steel has excellent workability and plays an important fundamental role for a wide-range of industries, such as automobiles and others, also heard was the importance of various stakeholders, such as industry and the financial sector cooperating and addressing together to achieve the structural reform of society needed for transition toward carbon neutrality.

English Video(YouTube)

English Video(YouTube)  Japanese Video(YouTube)

Japanese Video(YouTube) - Aviation Sector: Panelists from policy makers, industry associations, airlines, fuel producers, and the financial community discussed the need for cross-sector efforts to improve the effectiveness of multiple transition scenarios for decarbonizing the aviation industry and presented examples of collaboration. For example, the need for long-term target setting at the International Civil Aviation Organization (ICAO) and more rapid domestic efforts in Japan are discussed and the role of finance was highlighted through discussion of the challenges of increasing the supply of sustainable aviation fuel (SAF) to achieve net-zero aviation in 2050.

English Video(YouTube)

English Video(YouTube)  Japanese Video(YouTube)

Japanese Video(YouTube) - Power Sector: Panelists from domestic and foreign power companies, think tanks, academia, and third-party evaluation organizations discussed the power industry's efforts and challenges toward net zero, recent energy prices and energy security issues, as well as the role of finance and credible pathways to achieve the 1.5 degree goal. They also exchanged views on what Japan's power sector should do toward 2030.

English Video(YouTube)

English Video(YouTube)  Japanese Video(YouTube)

Japanese Video(YouTube) ◆Panel Discussion 3 “Finance to Achieve Orderly Transitions”

The final panel discussed the role of finance in supporting transitions in the real economy and the financial sector's own transitions from the perspective of banks, asset managers, and institutional investors. Discussions covered topics such as the perspective of financial institutions to evaluate corporate transitions in a forward looking manner, the evaluation of Japanese companies at this point in time, how to promote technological innovation and client engagement, and solutions to regional differences and possible gaps between the industry and financial sectors.

English Video(YouTube)

English Video(YouTube)  Japanese Video(YouTube)

Japanese Video(YouTube) ◆Closing Remarks

Ms. Tomoko Amaya, Vice Minister for International Affairs, the FSA, thanked the speakers, moderators and participants, and explained that Japan's entity-based transition finance approach to high-emitting sectors and companies is currently valuable from three perspectives: Dynamic, Flexible, and Interactive. In addition, she states that, for the further development of a reliable transition finance market, Japan would (1) continue public sector efforts in cooperation with the private sector, (2) improve the quality and credibility of efforts by external evaluators and financial institutions, and (3) strengthen the efforts of companies themselves. She expressed her hope that this symposium will serve as a cornerstone of the long journey toward the realization of the Paris Agreement.

See more details on the FSA's relevant policies:

・

・

English Video(YouTube)

English Video(YouTube)  Japanese Video(YouTube)

Japanese Video(YouTube) Contact

Financial Services Agency

Tel +81-(0)3-3506-6000

International Affairs Office

Strategy Development and Management Bureau (ext.2550)

Site Map

- Press Releases & Public Relations

- Press Releases

- Press Conferences

- Official Statements

- FSA Weekly Review & ACCESS FSA

- Speeches

- For Financial Users

- Others

- Archives

- Laws & Regulations

- Name of Laws and Regulations(PDF)

- Recent Changes (Legislation, Ordinances, Guidelines)

- Guidelines

- Financial Instruments and Exchange Act

- Financial Monitoring Policy

- Public Comment

- No-Action Letter System

- Procedures concerning Foreign Account Management Institutions

Search

Search