Recommendation for Administrative Monetary Penalty Payment Order for Market Manipulation of Shares of Evolable Asia Corp. by Asset Design Co., Ltd.

Japanese version![]()

(Provisional Translation)

January 16, 2018

Securities and Exchange Surveillance Commission

1. Contents of the Recommendation

The Securities and Exchange Surveillance Commission today made a recommendation to the Prime Minister and the Commissioner of the Financial Services Agency that an administrative monetary penalty payment order be issued in regard to market manipulation by Asset Design Co., Ltd. (Corporate Number: 5010001078625, “Asset Design”) pursuant to Article 20(1) of the Act for Establishment of the Financial Services Agency. This recommendation is based on the findings of an investigation into the market manipulation, whereby the following violation of laws and ordinances was identified.

2. Summary of the Findings Regarding Violation of Laws and Ordinances

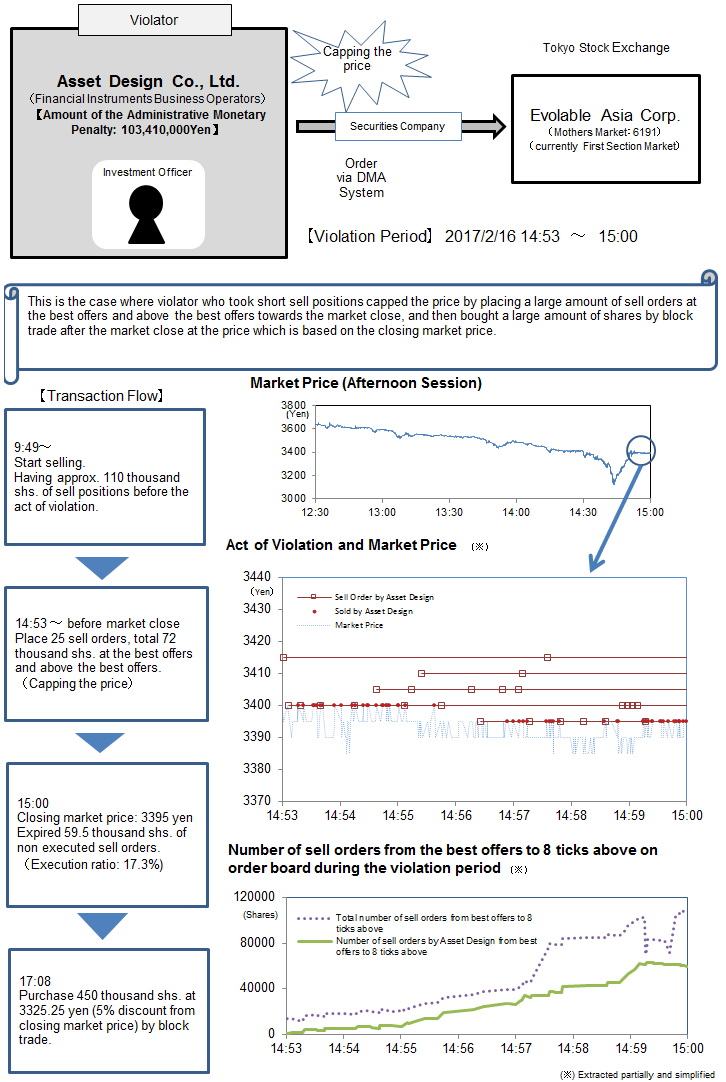

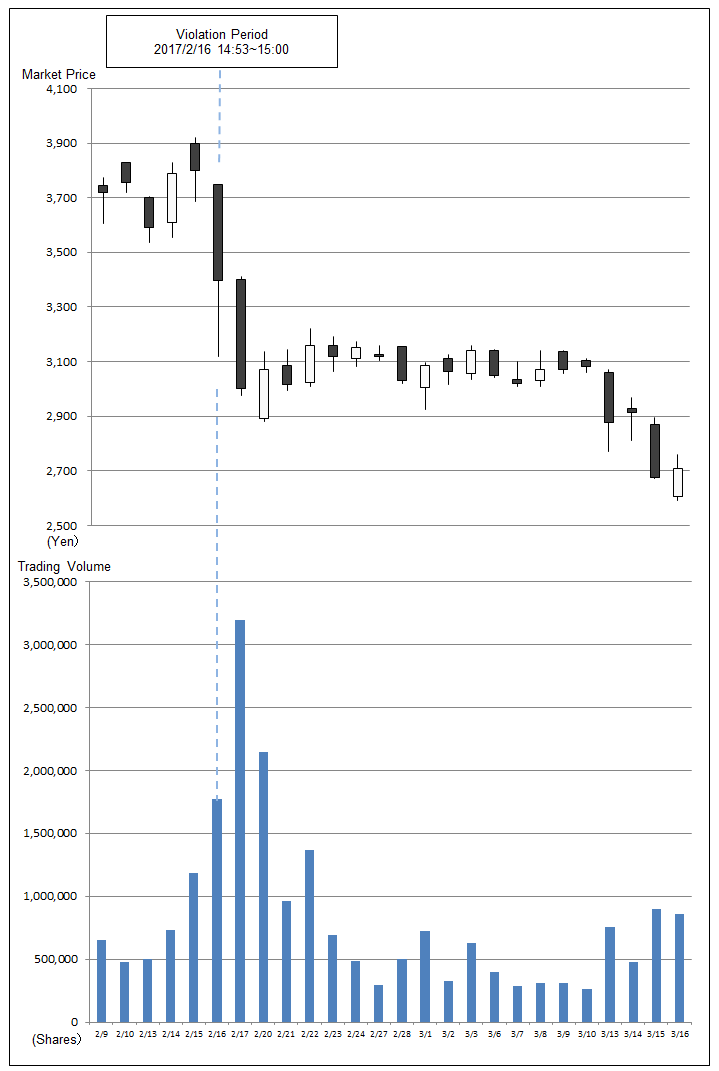

Asset Design is a stock company that is registered with the Commissioner of the Kanto Local Finance Bureau as an Investment Management Business and a Type II Financial Instruments Business Operator, and has the discretionary investment management right for the assets of Asset Design COPROS Fund (“COPROS Fund”), a unit trust registered in the Cayman Islands, pursuant to the investment management agreement entered into with Elian Trustee (Cayman) Limited as the trustee of COPROS Fund. Asset Design, through an employee who engaged in securities trading as an investment officer, in relation to its business, regarding shares of Evolable Asia Corp., whose shares were listed on the Tokyo Stock Exchange Mothers Market, from 2:53 pm to 3:00 pm on February 16, 2017 as described in the Appendix, with the purpose of inducing sales and purchase of other market participants, conducted transactions by placing a large amount of sell orders at prices equal to the best offer and above the best offer price on the Tokyo Stock Exchange. Thus, in total, Asset Design sold 12,500 shares while placing orders for the sales of 59,500 shares. Of those transactions, approximately 4.24%, which is equivalent to the contribution ratio to COPROS Fund of Asset Design and Persons who have special relationship with Asset Design, of which are on its own account and the rest of which are on the accounts of other investors of COPROS Fund. These constituted a series of sales and purchase of securities and entrustments that would mislead others into believing that sales and purchase of the shares were thriving and would cause fluctuations in prices of the shares.

Summaries of the findings regarding the violation of laws and ordinances are described in the Attachment 1 and the Attachment 2.

The actions mentioned above conducted by Asset Design were recognized as “a series of Sales and Purchase of Securities, etc.” and “Entrustment, etc.” conducted “in violation of Article 159(2)(i)” as stipulated under Article 174-2(1) of the Financial Instruments and Exchange Act (“FIEA”).

3. Calculation of the Amount of the Administrative Monetary Penalty

Pursuant to the FIEA, the amount of the administrative monetary penalty applicable to the above violation is 103,410,000 yen.

Details of the calculation are presented in the Attachment 3.

Attachment 1

Attachment 2

Attachment 3

● Method of Calculating the Amount of the Administrative Monetary Penalty

1. Pursuant to the provisions of Article 174-2(1) of the FIEA, the amount of the administrative monetary penalty shall be calculated as the sum of (1), (2) and (3) below:

(1) Amount pertaining to a Matching Volume of Sales and Purchase (Note 1) pertaining to the violation: (Value pertaining to sales, etc. of securities on its own account) –(Value pertaining to purchase, etc. of securities on its own account)

(Note 1) :Matching Volume of Sales and Purchase: The smaller of the number of securities sold, etc. and the number of securities purchased, etc. pertaining to the violation.

(2) Where the number of securities sold, etc. on its own account pertaining to the violation exceeds the number of securities purchased, etc. on its own account pertaining to the violation: (Value pertaining to sales, etc. of securities with respect to the excess transaction volume) – (The lowest price as designated under Article 67-19 or Article 130 of the FIEA of the securities during a one-month period following the end of the violation X the excess transaction volume)

(3) Where the violator conducted the violation or sales, etc. of securities or purchase, etc. of securities on the account of others during the period from the commencement of the violation until a one-month period has elapsed since it ended:

(The amount of money or the value of other property paid or payable to the Violator (Note 2) , as consideration for the investment of the property for the month in which the Transactions Subject to Calculation (Note 3) were performed (“the Investment Fee”)) X 3

(Note 2): If a period serving as the basis of calculation of the investment fee (the “Investment Fee(the “Investment Fee Calculation Period”) exceeds one month, the amount will be calculated: by dividing the investment fee by the number of the months in the Investment Fee Calculation Period; based on the investment performance of the month including the day when the Transactions Subject to Calculation were performed where the investment fee is calculated based on the investment performance in relation to the Investment Fee Calculation Period or by any other reasonable method (the Cabinet Office Ordinance on Administrative Monetary Penalty Provided for in Chapter VI-II of the Financial Instruments and Exchange Act (the “COOAMP”)).

(Note 3): “Transactions Subject to Calculation” means transactions related to the violation pursuant to Article 174-2(1)(ii)(d) of the FIEA or the Sales, etc. of Securities or Purchase, etc. of Securities pertaining to the violation (Article 1-16(1)(i) of the COOAMP).

and

(4) Pursuant to the provisions of Article 176(2) of the FIEA, any fraction less than ten thousand yen of a sum of the amounts calculated as in (1), (2) and (3) above shall be rounded down.

2. In this case, the amount of the administrative monetary penalty is 103,410,000 yen. This amount is based on 103,410,178.665 yen (Note 4), a sum of the amounts calculated as in (1), (2) and (3) below, for which the sum has been rounded down for the amount less than ten thousand yen pursuant to (4) above.

(Note 4): Although the amount described here rounding to three decimal places, the actual calculation was done without any rounding; the same shall apply hereinafter.

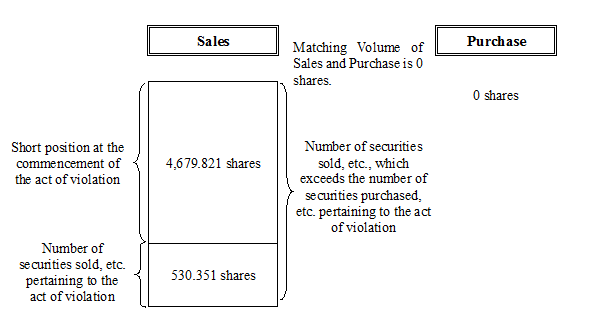

(1) The amount of the administrative monetary penalty regarding the amount pertaining to a Matching Volume of Sales and Purchase (Note 5) is 0 yen.

(Note 5): Amount pertaining to a Matching Volume of Sales and Purchase is 0 shares as described below:

(i) Amount pertaining to the sales of the securities on its own account is 5,210.173 shares (Note 6).

(ii) Amount pertaining to the purchase of the securities is 0 shares.

(Note 6): 530.351 shares (12,500 shares of the actual amount of the sales of the shares X 4.243%, the contribution ratio of Asset Design’s officers to COPROS Fund) + 4,679.821 shares (110,300 shares in Asset Design’s possession at the time of the commencement of the violation, and these shares are deemed to be sold on its own account at the price of 3,395 yen at the time of the commencement of the violation pursuant to Article 174-2(7) of the FIEA X 4.243%).

(2) The amount of the administrative monetary penalty regarding the excess transaction volume where the amount pertaining to the sales of the securities exceeds the amount pertaining to the purchase of the securities as described in (1) above is 4,184,829.455 yen (Note 7).

(Note 7): The amount is calculated as below:

(Value pertaining to sales, etc. of Securities with respect to the excess transaction volume) - (The lowest price as designated under Article 67-19 or Article 130 of the FIEA of the Securities during a one-month period following the end of the violation (2,592 yen) X the excess transaction volume (5,210.173 shares)

{(42,462,500 yen (Note 8) X 4.243%, which is the value pertaining to sales, etc. of securities prorated according to the contribution ratio of Asset Design’s officers to COPROS Fund) + (3,395 yen X 110,300 shares X 4.243%, which is the value pertaining to sales, etc. of securities held at the commencement of the violation prorated according to the contribution ratio of Asset Design’s officers to COPROS Fund, deemed to be sold at the commencement of the violation)} – (2,592 yen X 5,210.173 shares)

(Note 8): The calculation is as below:

(3,395 yen X 7,500 shares + 3,400 yen X 5,000 shares)

(3) The amount of the administrative monetary penalty based on the Investment Fee payable to the violator is calculated to be 99,225,349.209 yen (Note 9).

(Note 9): The amount is calculated by multiplying 33,075,116.403 yen, the Investment Fee payable to the Violator X 3

[Reference: Examples of how to calculate the administrative monetary penalty]

Search

Search