(Provisional Translation in English)

December 17, 2021

Securities and Exchange Surveillance Commission

Recommendation for Administrative Monetary Penalty Payment Order for Insider Trading in Remixpoint, inc. Stock by an Individual Residing Abroad

1. Contents of the Recommendation

The Securities and Exchange Surveillance Commission today made a recommendation to the Prime Minister and the Commissioner of the Financial Services Agency that an administrative monetary penalty payment order be issued in regard to insider trading in the stock of Remixpoint, inc. (“Remixpoint”) by an individual pursuant to Article 20(1) of the Act for Establishment of the Financial Services Agency. This recommendation is based on the findings of an investigation into a suspected instance of insider trading, whereby the following violation of laws and ordinances was identified.

2. Summary of the Findings Regarding Violations of Laws and Ordinances

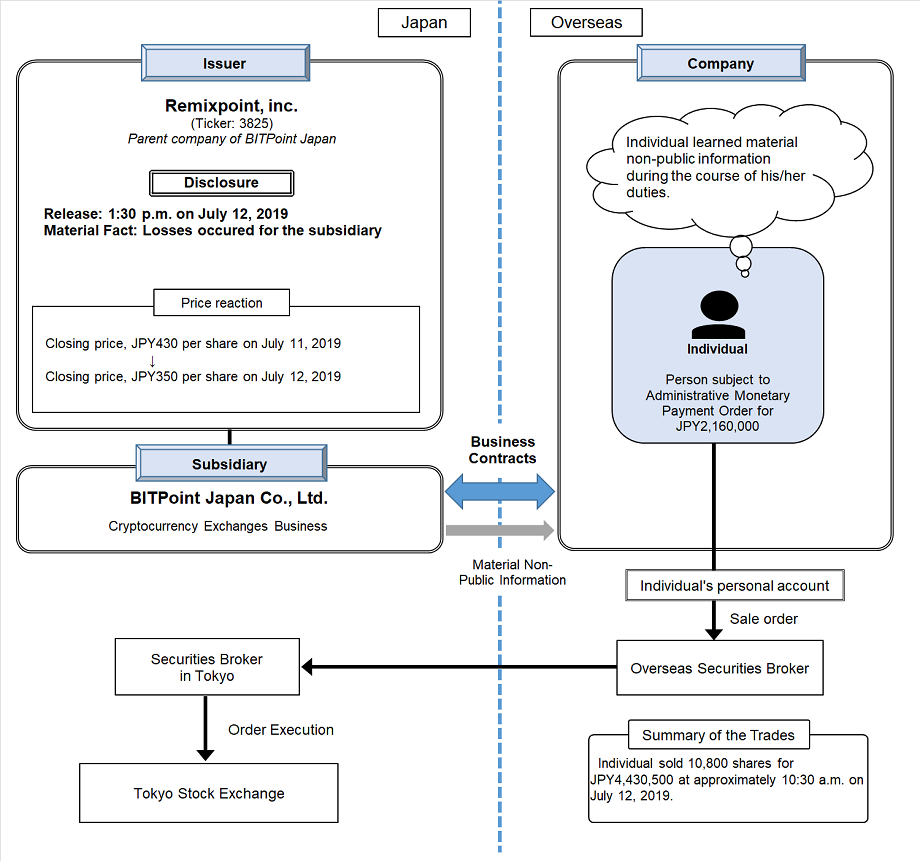

The person subject to administrative monetary payment order is an individual who resided abroad and worked for a company having business contracts with BITPoint Japan Co., Ltd. (“BPJ”), a subsidiary of Remixpoint.

The individual learned, during the course of his/her duties, material non-public information (“MNI”) that the cryptocurrency management system operated by BPJ was hacked and that the cryptocurrencies were stolen, which resulted in losses for BPJ.

Then, the individual sold 10,800 shares of Remixpoint stock for 4,430,500 yen at approximately 10:30 a.m. on July 12, 2019 in advance of the disclosure about the MNI released at 1:30 p.m. on the same day.

The summary of the findings is shown in the Chart.

The individual’s aforesaid action was found to be “conduct[ing] Sales and Purchase, etc. set forth in Article 166(1) in violation of the provisions of Article 166(1)” as stipulated under Article 175(1) of the Financial Instruments and Exchange Act (“FIEA”).

3. Calculation of the Amount of the Administrative Monetary Penalty

Pursuant to the FIEA, the amount of the administrative monetary penalty applicable to the above violation is a total of 2,160,000 yen. (Note: Details of the calculation is shown in the Attachment.)

4. Acknowledgements

We appreciate the assistance of the Financial Supervisory Commission of Taiwan and the Japan Exchange Regulation in this matter.

Chart

(Click to Enlarge Image)

Attachment

Calculation of the Amount of the Administrative Monetary Penalty

- Pursuant to Article 175(1)(i) of the FIEA, the amount of the administrative monetary penalty is calculated as the value of item (a) minus item (b) as follows:

(a) The number of shares sold multiplied by the actual sale price per share

(b) The number of shares sold multiplied by the lowest price per share in the markets during the two weeks after the disclosure about the MNI

2,160,340 yen = (a)[8,300 shares × 410 yen + 2,500 shares × 411 yen] - (b)[10,800 shares × 210.2 yen]

- Pursuant to Article 176(2) of the FIEA, the amount of the administrative monetary penalty shall be 2,160,000 yen, as the amount of less than ten thousand yen is rounded down.

Search

Search