|

|

| Greeting by Minister for Financial Services Shozaburo Jimi at “Meeting to Exchange Views on the Facilitation of Finance for SMEs” (December 9) |

At “Meeting to Exchange Views with Ministry of Economic, Trade and Industry on SME Finance, ” Minister of Economy, Trade and Industry Yukio Edano (right) shakes hands with Minister for Financial Services Shozaburo Jimi (at Ministry of Economy, Trade and Industry) (December 28) |

[Topics]

Final extension of expiration of the Act concerning Temporary Measures to Facilitate Financing for SMEs, etc.

After the March 2011 extension of expiration of the Act concerning Temporary Measures to Facilitate Financing for SMEs, etc., the FSA has watched the results and effects of its execution situation. Considering the situation until now, basically, there seems to be solid implementation of initiatives for the Act concerning Temporary Measures to Facilitate Financing for SMEs, etc. On the other hand, problems are pointed out, such as an increase in loan condition changes.

Considering these points, there is a need to implement policies to ensure financial discipline (ensuring soundness and preventing moral hazards), while encouraging financial institutions to wield their consulting functions more, and strongly providing support which leads to true business improvement of small and medium enterprises (exit strategies).

To do this, comprehensive exit strategies must be created, including actions for inspection and supervision, in order to shift towards providing support for business revitalization of SMEs. This should be done in cooperation with external institutions and related parties. On the other hand, this shift must proceed smoothly (“soft landing”). Therefore, it was decided that it is appropriate to only extend the current Act concerning Temporary Measures to Facilitate Financing for SMEs, etc. until March 31, 2013, and take focused actions to provide business revitalization support for SMEs, etc.

Of these, the revision bill for re-extension of the Act concerning Temporary Measures to Facilitate Financing for SMEs, etc. was submitted to the Diet on January 27, 2012.

By promoting such policies, the FSA is working for facilitation of finance, and actively supporting the business improvement of SMEs etc., while paying attention to ensuring the sound and appropriate management of financial institutions.

* For details, please go to the FSA's web site and access “Statement by Minister for Financial Services - Final extension of expiration of the Act concerning Temporary Measures to Facilitate Financing for SMEs, etc. -” and ![]() “Final extension of expiration of the Act concerning Temporary Measures to Facilitate Financing for SMEs, etc.” (December 27) at the “Temporary Measures to Facilitate Financing for SMEs, etc.” section. (Available in Japanese only)

“Final extension of expiration of the Act concerning Temporary Measures to Facilitate Financing for SMEs, etc.” (December 27) at the “Temporary Measures to Facilitate Financing for SMEs, etc.” section. (Available in Japanese only)

Banks' Shareholdings Purchase Corporation and Life Insurance Policyholders Protection Corporation of Japan

1. With the aim of having it play a role as a safety net to ensure sound bank finances, there is a March 31, 2012 deadline for purchases by the Banks' Shareholdings Purchase Corporation* (established January 2002).

(Note) Subject to purchases

- Shares, preferred shares, preferred capital investments, ETFs and J-REITS held by banks, etc.

- Bank shares, preferred shares and preferred capital investment held by cross-shareholding operating companies

2. Regarding the source of funds for funding assistance to bankrupt life insurance companies from the Life Insurance Policyholders Protection Corporation (established in December 1998), government assistance can be provided for bankruptcies when the private sector alone is not sufficient until the same date: March 31, 2012.

(Note) The following are sources of funds for funding assistance by the Life Insurance Policyholders Protection Corporation, provided when a life insurance company becomes bankrupt:

(1) Funds accumulated in advance by life insurance companies which are members of the Life Insurance Policyholders Protection Corporation (limit: 400 billion yen, accumulated balance as at March 31, 2011: 16.2 billion yen)

(2) Government guaranteed borrowings by the Life Insurance Policyholders Protection Corporation (limit: 460 billion yen)

If allocation of (1) and (2) are not sufficient,

(3) Government assistance can be provided if certain requirements are met (time limit established in laws)

3. Japan's financial system is relatively stable. But considering effects of the Great East Japan Earthquake, and the ongoing global financial market turmoil sparked by Europe's debt crises, the following two matters continue to be important:

- To prevent a situation where economies and stock markets affect each other negatively and enter a downward spiral, the Banks' Shareholdings Purchase Corporation shall play roles as a share disposal receptacle, and as a safety net (Note)

- The Life Insurance Policyholders Protection Corporation continues to completely perform its functions as a safety net.

(Note) With implementation of Basel III, required capital will be raised in stages. Therefore, there are still great needs for disposals of shares held by banks, etc.

4. Therefore, it is appropriate to extend by five years the deadline for government assistance and purchases of shares etc. Thus the FSA intends to submit a bill for this to the next ordinary session of the Diet.

(Note) For the Banks' Shareholdings Purchase Corporation, a 20 trillion yen government guarantee limit continues to be established for acquisition of share purchase funds.

* For details, please go to the FSA's web site and access “Banks' Shareholdings Purchase Corporation and Life Insurance Policyholders Protection Corporation of Japan (Press Conference by Shozaburo Jimi, Minister for Financial Services, December 27, 2011)” (December 27) in the Press Releases section. (Available in Japanese only)

The FY2012 tax reform outline was decided in the Cabinet on December 10, 2011.

It includes the following main items related to the FSA:

1. Exemption of registration and license tax imposed on the registration of trusts regarding certain lands and buildings belonging to land trusts, the settlers of which are certain local governments damaged by the Great East Japan Earthquake.

2. Addition of profit-linked bonds issued by corporations, such as public corporations, completely controlled by certain local governments damaged by the Great East Japan Earthquake to the Japanese Bond Income Tax Exemption Scheme.

3. For the FY2013 tax reform, the government is to study about changing the taxing methods for public and corporate bonds, and expanding the scope of profit/loss offset for financial instruments, considering that the tax rate for dividends and capital gains on listed shares will be raised to the statutory rate (20%) from 2014.

4. Enhance convenience and simplification of so-called Japanese ISA (tax exemption for small investments in listed shares)

5. The government is to study changing the principle of international taxation from the “force of attraction rule” to the “attribution rule.”

* For details, please go to the FSA's web site and access “Main items related to the FSA in the FY2012 tax reform outline” (December 12) in the Press Releases section. (Available in Japanese only)

In July 2008, the FSA found many large amounts of non-payment of insurance claims (the event where an accident covered by insurance occurred, and although the core insurance claim was paid, insurance companies have neglected their duty to pay other related claims in the event of an accident covered by insurance because the policyholder did not apply for the payment of such claims; the same hereinafter). The FSA issued business improvement orders to 10 insurance companies in which the FSA found needs for further improvements in management controls systems and business operation systems. The FSA also required improvement status reports.

http://www.fsa.go.jp/news/20/hoken/20080703-6.html (Administrative actions against 10 insurance companies)

On December 16, 2011, the FSA removed this obligation for periodic reporting on the improvement status, and published the improvement status.

In removing the periodic reporting obligation, the following explains (1) status of improvement in system developments, (2) status of non-payment claims, (3) future policies.

1. Status of Improvements in System Developments

(1) Causes of Occurrence

When the FSA issued its business improvement orders in 2008, it was found that in many cases, life insurance companies have failed to pay insurance claims that should have been paid in the event of an accident covered by insurance. These occurrences were due to the following deficiencies in system aspects.

- Top management and the entire company were insufficiently aware of the necessity of preventing occurrences of non-payment insurance claims, etc. There was especially insufficient awareness of the importance of providing guidance to policyholders with regard to how to make an insurance claim.

- Effective internal audits focusing on non-payments of insurance claims, etc. were not conducted.

- Deficiencies were seen in the development of systems to eliminate human error: development of a system needed to prevent non-payments of insurance claims from occurring, development of a clerical process to provide claims guidance without fail, mutual checking between payment assessors, etc.

- For staff working on payments, there were insufficient training program and education systems which should consider the characteristics of reasons for payments of insurance claims, etc.

- There was insufficient development of business systems to preserve insurance contracts: raising awareness of policyholders to request insurance claims to insurance companies to prevent non-payments, and providing information to policyholders on specific methods used to make an insurance claim.

(2) Specific Improvement Policies

At each insurance company which received a business improvement order, top management took the lead in taking the following actions for problematic systems.

- For events with a possibility of leading to payments, the previous passive stance of waiting for inquiries from insurance policyholders was changed to building an active stance, such as by providing claims guidance at the time of payment or immediately after payment

- At least each 6 months, execution of effective internal audits by specialized staff, which focus on non-payments of insurance claims

- Development of systems to prevent human error: Introduction of electronic assessment documents and mechanized assessment systems, verification after payment by parallel assessment systems and staff other than assessors, etc.

- Strengthen training programs and education systems for staff working on payments etc., by systematic training programs and e-learning systems

- Provision of information: Notices of past payment results, and checksheets for self-checks on whether there are other related claims that policyholders can claim when they claim insurance benefits

- Revision and elimination of insurance products, in order to make payment reasons easier to understand for insurance policyholders

etc.

In addition to these actions, the entire insurance industry is implementing initiatives. For example, The Life Insurance Association of Japan created the “Guidelines on Insurance Claims Guidance Clerical Work” (shows the basic approach for the content, methods and timing of claims guidance, and the method of explaining to ensure that insurance policyholders, etc. recognize when insured accidents occur).

2. Status of Non-Payments of Insurance Claims

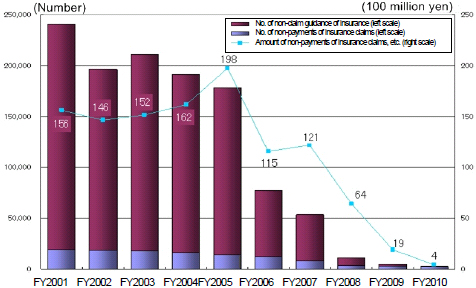

In FY2005, there were about 178,000 non-payments of a total of about 19.8 billion yen of insurance claims. The system developments implemented by insurance companies as described in 1. above reduced these to about 2,000 non-payments of a total of about 0.4 billion yen of insurance claims in FY2010.

Also, most non-payments of insurance claims in 2010 (about 80%) were discovered by insurance companies themselves, by verification after payment, internal audits, etc. as described in the above system developments.

However, although they are decreasing, non-payments still exist in FY2010. For non-payments, each company is clarifying the causes each time a non-payment occurs and is working to develop systems to take necessary countermeasures. The improvement status of specific actions for non-payment is described below.

- In the situation where there were multiple related terms for the same disease, non-payments were caused due to overlooking some terms. Therefore, systems were quickly improved, such as by adding key words.

- Non-payments (mistakes in amount paid per day of hospitalization) caused due to insurance contract changes. Therefore, when the contracts are changed, after payment of the benefits, priority is placed on their verification.

3. Future Policies

There is no end to improvements needed in insurance claim payment operations. In order to work on further improvements in insurance claim payment management systems, The Life Insurance Association of Japan and each life insurance company have been requested to do the following.

- Periodically announce the status of non-payments at each life insurance company

- In order to receive a wide range of consultations from policyholders regarding payments of insurance claims, enhance the content of distribution of insurance products and the contracts by solicitors, such as raising awareness information.

* For details, please go to the FSA's web site and access “Improvement status of 10 life insurance companies for which business improvement orders were issued” (December 16) in the Press Releases section. (Available in Japanese only)

In September 2009, the G20 Pittsburgh Summit Leaders' Declaration stated “All standardized OTC derivative contracts should be traded on exchanges or electronic trading platforms, where appropriate, and cleared through central counterparties by end-2012 at the latest. OTC derivative contracts should be reported to trade repositories.” For OTC derivative market regulations in Japan, the 2010 revised Financial Instruments and Exchange Act established a centralized settlement and transaction information storage and reporting system for standardized transactions.

On the other hand, standardized OTC derivative transactions are obligated to use electronic transactions infrastructure which meets certain requirements. Considering the moves toward development of foreign countries' systems and the status of progress in international discussions, it was decided to delay the creation of a system. But since then, Japan OTC derivative transactions have been on a growth trend, and international discussions and the development of a system in various countries are taking place.

Consequently, based on instructions by the FSA's top three politicians, the “Study Group on OTC Derivative Market Regulation” was established, comprised of members including financial institutions, settlement and transfer institutions and experts. This group performed the required study and met four times since November 2011. For centralized settlement, storage and reporting of transaction information, the direction for specifying items stipulated in the 2010 revised Financial Instruments and Exchange Act is also discussed. The group announced its results on December 26, 2011, as the “Summary of Discussions in the ‘Study Group on OTC Derivative Market Regulation’.”

The outline of the summary is as follows.

1. Use of Electronic Transaction Infrastructure in the OTC Derivative Market

(1) Aims of System Development in Japan

- The authorities' monitoring of actual transaction conditions, including fairness of price formation

- Conduct transactions using highly reliable methods based on previously established rules, to contribute to market stabilization during financial crises

- Enhancement of price transparency is expected to improve the efficiency of futuristic markets, and expand the number of market participants

- Encourage straight through processing with electronic processing for the series of clerical steps from contract agreement until settlement (reduce operational risks, boost efficiency of clerical work)

(2) Systematic Framework Approach

- Subject parties: Initially, among financial instruments business operators, those transactions between parties in a so-called dealer standpoint with a large volume (balance, frequency) of subject transactions. Expansion will be studied as needed.

- Subject transactions: Transactions with a certain level of standardization and liquidity, and which are traded via a settlement institution (initially, yen denominated interest rate swaps (plain vanilla type) are envisioned)

- Requirements of electronic trading infrastructure with obligatory use: Electronic trading infrastructure providers are required to register as type I financial instruments business operators. To achieve the system's intentions, they must store and publish transaction records, report to authorities, and develop fair trading rules.

- Handling of foreign countries' electronic trading infrastructure: Establish an exception to enable the provision of unregistered electronic trading infrastructure in Japan. This is under the condition that the foreign country's electronic trading infrastructure is subject to the supervision of overseas authorities, and that there is a cooperative supervision framework between authorities.

- Execution period: To enable sufficient preparation by both electronic trading infrastructure providers and users, quickly develop the system, and set a certain period until execution (maximum of about three years).

2. Specification of Centralized Settlement System and Storage and Reporting of Transaction Information

(1) Write specific directions as stipulated by Cabinet Office Ordinances, etc., for both systems developed by the 2010 revised Financial Instruments and Exchange Act.

(2) Introduce both systems in stages. Initially, these mainly apply to financial instruments business operators with high frequency and large balances of OTC derivative transactions.

While considering the content of this summary, the FSA will quickly make required system improvements.

* For details, please go to the FSA's web site and access “Summary of Discussions in ‘Study Group on OTC Derivative Market Regulation’ ” (December 26) in the Press Releases section. (Available in Japanese only)

Currently, considering that the Great East Japan Earthquake created a disaster which exceeded previously imagined levels, the FSA is sorting out that experience and its lessons. To boost the effectiveness of its business continuity system, the FSA revised its “FSA Business Continuity Plan (Earthquake Directly below Tokyo Edition).” An outline of this plan is explained below.

1. Emergency Priority Operations

When an envisioned disaster strikes, the minimum imaginable operations which the FSA must perform and execute (“Emergency Priority Operations”) are as follows.

(1) Establish and operate a Disaster Countermeasures Headquarters (Headquarters Manager: Minister)

- Communication and coordination with the government's Disaster Countermeasures Headquarters, the Ministry of Finance, and Bank of Japan

- Comprehensive coordination for gathering and assigning staff

Check the status of financial markets and financial institutions, etc.

Provide information to the people, financial institutions, overseas authorities, etc.

Manage and operate FSA's IT system (EDINET)

Request financial institutions to support disaster victims

etc.

2. Main Points of Revision

(1) System for Gathering Staff

- For gathering the key staff for execution and continuation of priority operations in an emergency, even if public transit is interrupted, to enable staff to reliably gather at the FSA Head Office, designate staff who can gather by walking from their homes to the Head Office.

- Newly establish a reserve staff group comprised of staff who live near the FSA Head Office, and who work in sections and offices which do not have priority operations in an emergency.

(2) Priority Operations Checklist

- To clearly understand what should be done by the staff gathered at the FSA Head Office, newly create a checklist for priority operations in emergencies. Top officials would use this list to comprehensively coordinate priority operations of each section and office.

(3) Authority Delegation

- For authority delegation, establish the order of succession up to the seventh person if the Disaster Countermeasures Headquarters Manager (Minister) cannot command. Also register the succession order up to about the fifth person, for the person with authority for each emergency priority operation.

(4) Ensuring the Work Execution Environment

- More specifically stipulate the status of system development, such as information provision means, communication means and stored reserves, for execution and continuation of priority operations.

(5) Education and Drills

- Disaster prevention drills and training have been provided. Unceasingly revise these to keep their content highly effective, considering changes in the environment faced by the financial system.

3. Future Issues

(1) Strengthening Means of Communication with Financial Institutions and Other Related Parties

- To enable smooth emergency priority operations by each section and office, continue working to strengthen the means of communication with financial institutions and other related parties. For example by increasing the number of satellite mobile phones.

(2) Strengthen the Continuity Activities for Publicity Activities when an Envisioned Disaster Strikes

- To prepare for a broad disaster in the Kanto Region when the internet becomes unusable for a long time, investigate establishing an FSA web site backup center, and publicity activities utilizing another institution's web site.

(3) Study a Business Continuity System for a Broad Disaster in Tokyo

- To prepare for a broad disaster in Tokyo and enable smooth continuation of operations at alternative locations, the FSA will proceed with further study considering the status of study by the entire government.

Unceasing efforts are required to strengthen the business continuity system for earthquakes, etc. The FSA will continue to work on further initiatives for a stronger business continuity system. At the same time, the FSA will also require financial institutions to study business continuity systems, and continue to cooperate closely with related institutions. It thus aims to build a flexible and durable business continuity system for the entire financial system against risks of earthquakes, etc.

* For details, please go to the FSA's web site and access Revision of “FSA Business Continuity Plan” (December 14) in the Press Releases section. (Available in Japanese only)

Site Map

- Press Releases & Public Relations

- Press Releases

- Press Conferences

- Official Statements

- FSA Weekly Review & ACCESS FSA

- Speeches

- For Financial Users

- Others

- Archives

- Laws & Regulations

- Name of Laws and Regulations(PDF)

- Recent Changes (Legislation, Ordinances, Guidelines)

- Guidelines

- Financial Instruments and Exchange Act

- Financial Monitoring Policy

- Public Comment

- No-Action Letter System

- Procedures concerning Foreign Account Management Institutions

Search

Search