2. Major Financial Instruments Business Schemes and Necessary Registration

There are four types of Financial Instruments Businesses: “Type I Financial Instruments Business”, “Type II Financial Instruments Business”, “Investment Management Business”, and “Investment Advisory and Agency Business”.

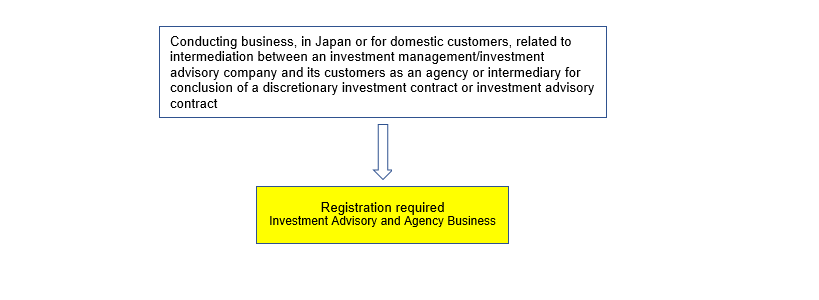

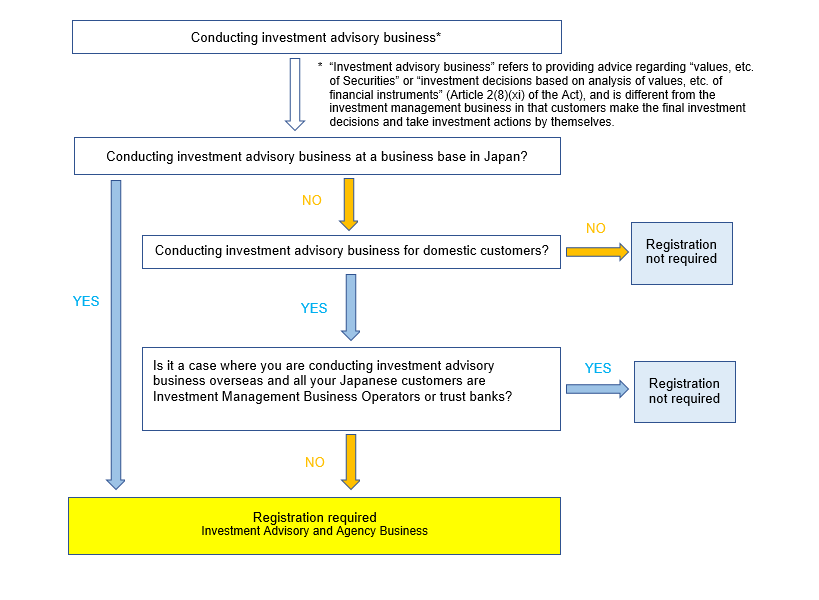

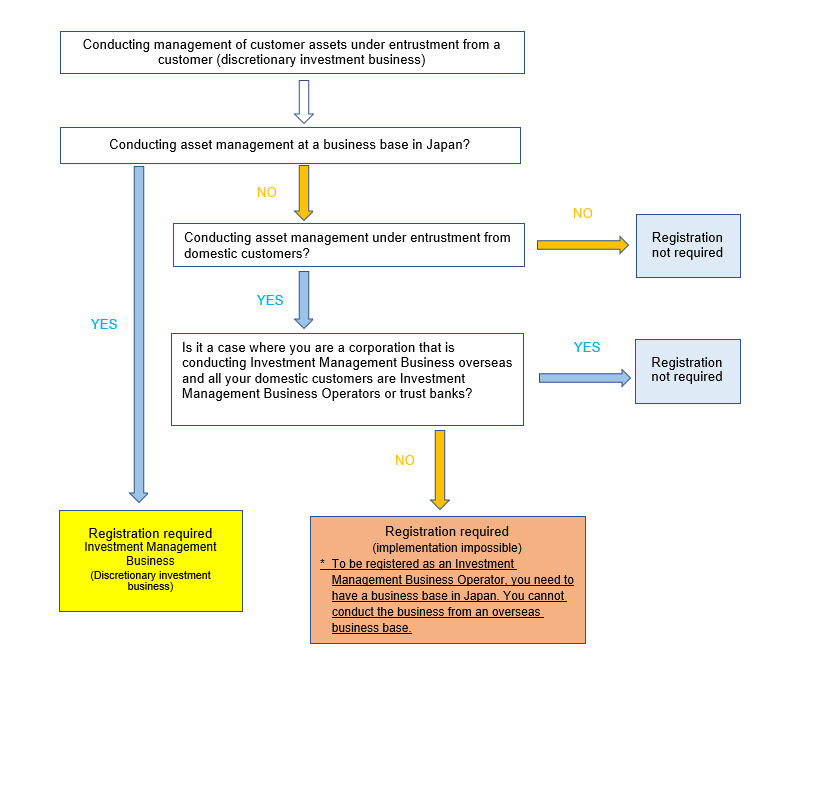

First, to manage customer assets or funds, registration of Investment Management Business is required. However, if your business will not include final investment decisions and investment authority but remain within the scope of providing advice regarding “values, etc. of Securities” or “investment decisions based on an analysis of values, etc. of Financial Instruments,” you may register for Investment Advisory and Agency Business, for which regulations are more relaxed than those applied to Investment Management Businesses. To conduct solicitation and sale of Securities, including the shares of the funds you manage, it is necessary to register for a Type I Financial Instruments Business/Type II Financial Instruments Business. To intermediate between an investment management or investment advisory company and its customers (as an agency or intermediary for conclusion of a discretionary investment contract or investment advisory contract), registration for Investment Advisory and Agency Business is required. (For more details, refer to (Reference 1) (1).)

The subsequent sections provide flowcharts ((1) below) and explanations ((2) below) about major business scheme cases to help you determine whether and what type of registration for Financial Instruments Business is necessary for your intended business, assuming the following business cases: 1) investment advisory business, 2) investment management business (including investment solicitation of funds you have established), 3) intermediation between an investment management/investment advisory company and its customers (as an agency or intermediary for conclusion of a discretionary investment contract or investment advisory contract), 4) solicitation or sales of funds established by other investment management companies, and 5) establishment of a foreign business operator’s representative office for collecting information in Japan.

Note that the flowcharts and business scheme cases below are provided for the purpose of helping you easily check whether/what type of registration is necessary only with regard to typical cases. They do not cover all the possible cases, options and requirements under relevant laws and regulations.

(1) Flowcharts to determine whether and what type of registration is necessary

The flowcharts to be presented on the subsequent pages are as outlined below. Please refer to the page that corresponds to the business you are planning to conduct.Please note that the following flowchart does not include the flow for the Specially Permitted Business during Transition Period.

2) Investment management business

(b) Establishment and management of funds (including investment solicitation for funds you have established)

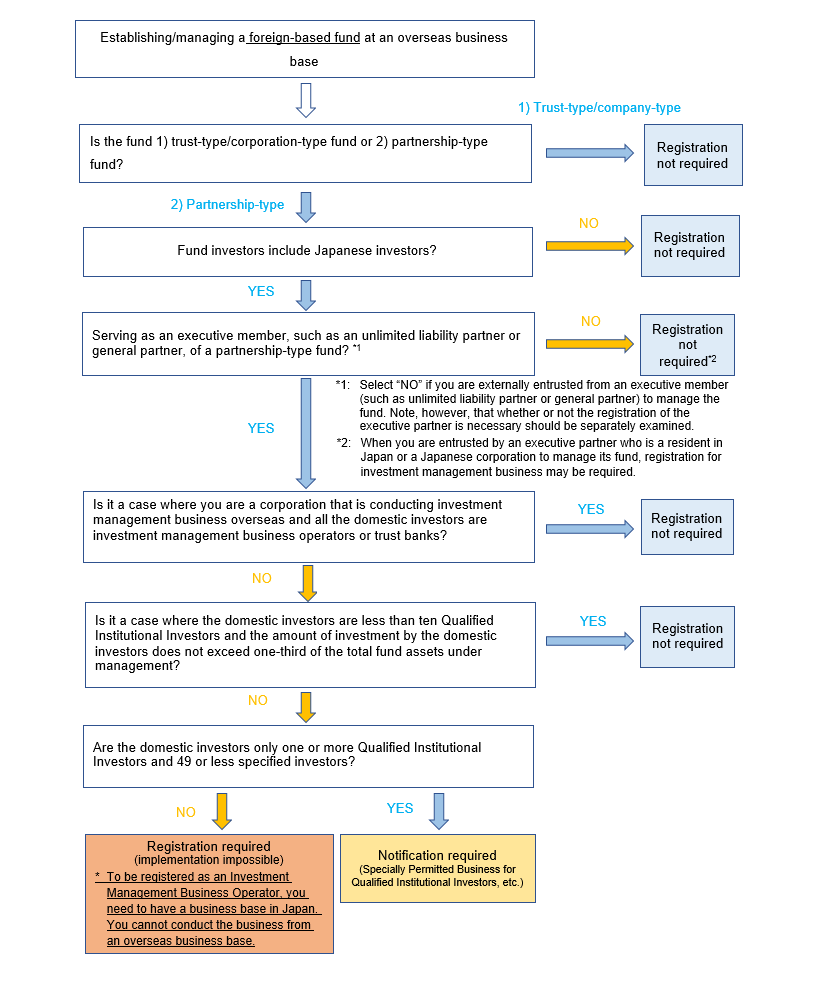

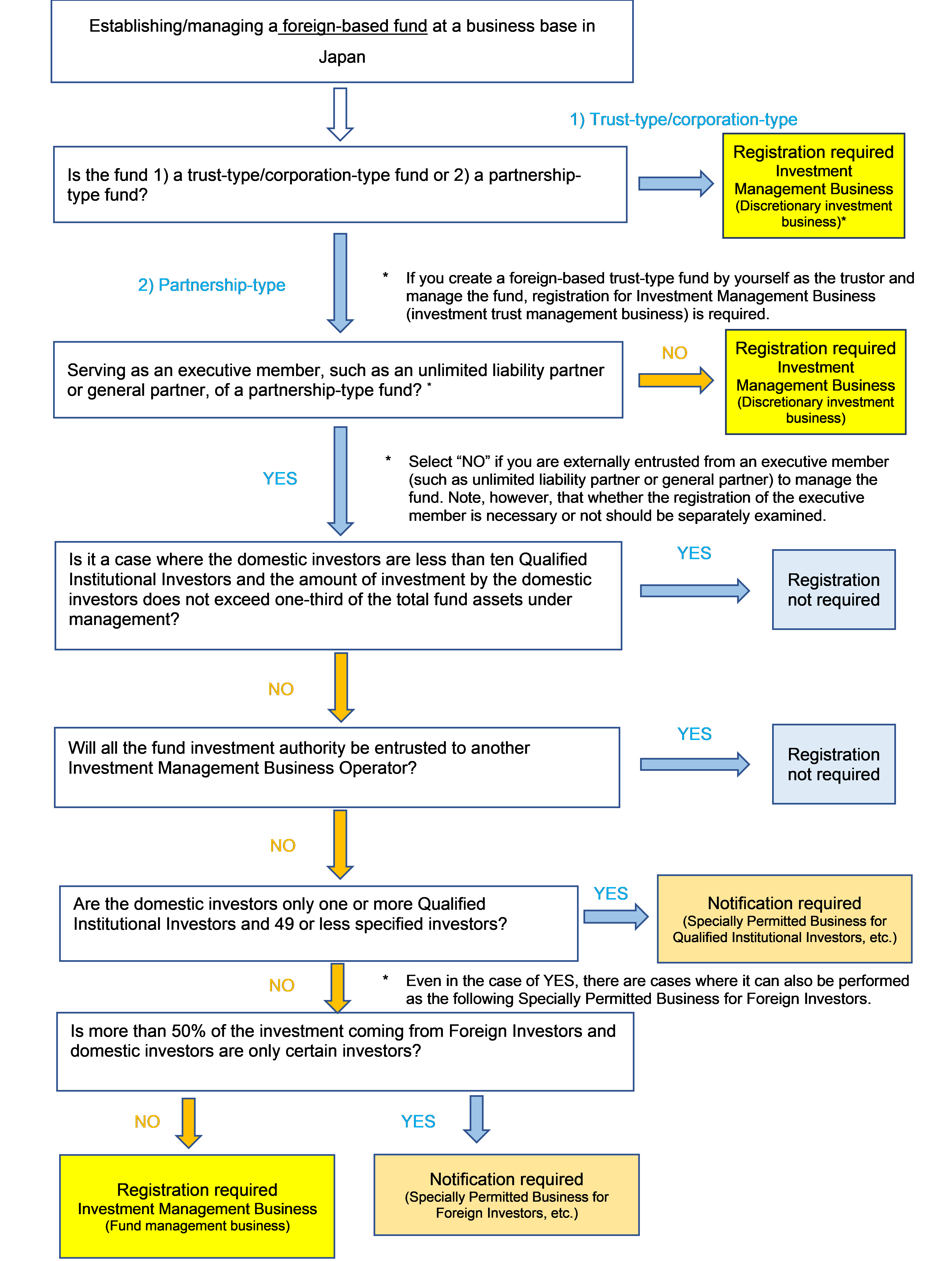

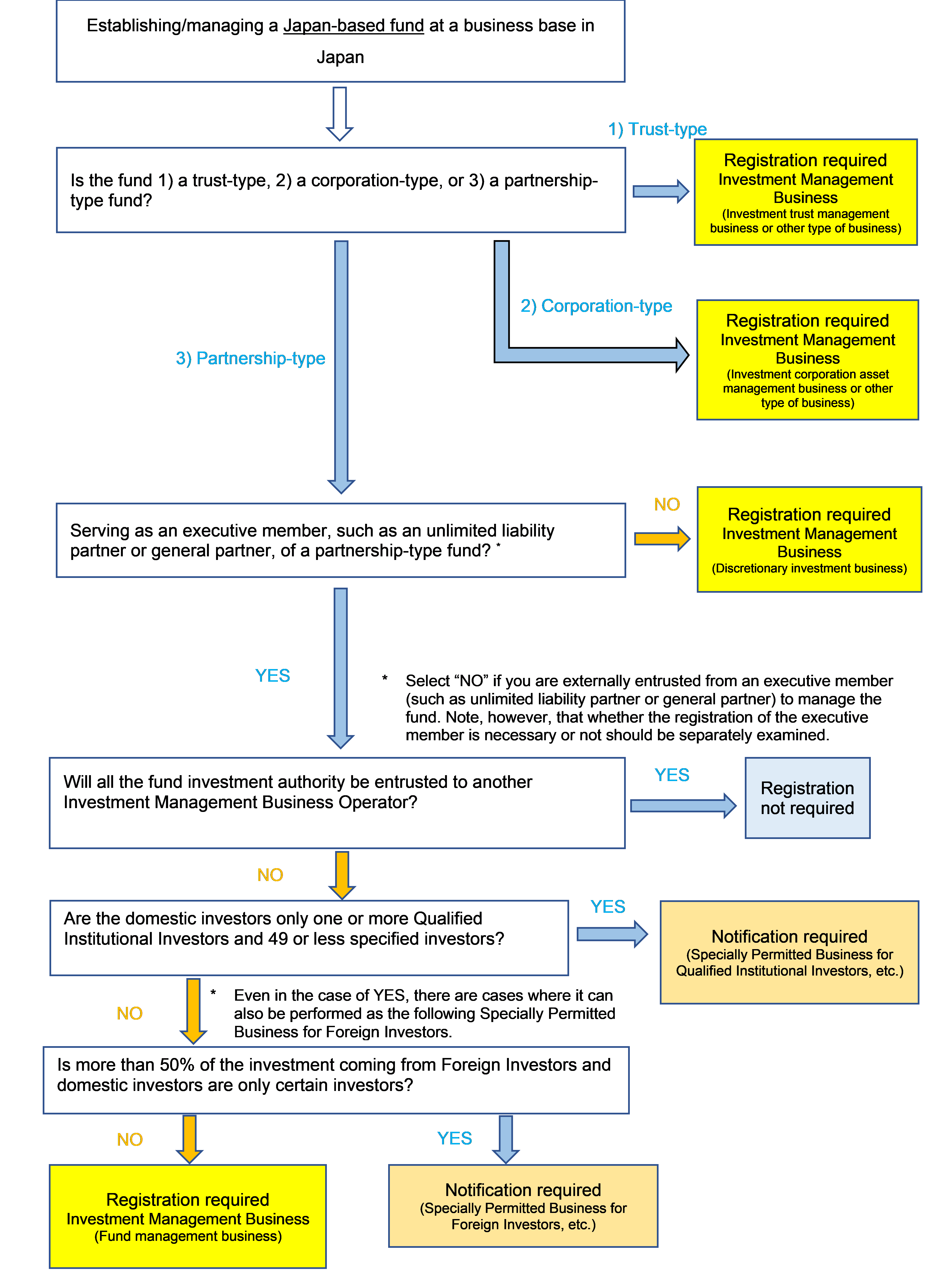

(i) Establishment/management of a fund

* A “foreign-based fund” shall refer to a fund established under the laws and regulations of a foreign country and a “Japan-based fund” shall refer to a fund established under the laws and regulations of Japan.

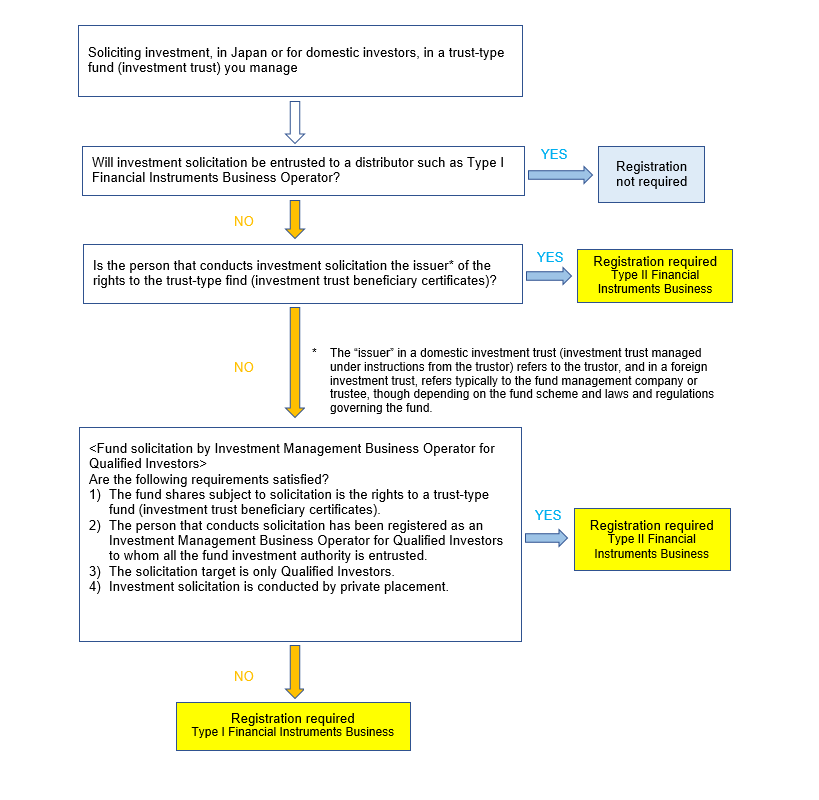

(ii) Investment solicitation for the funds you have established

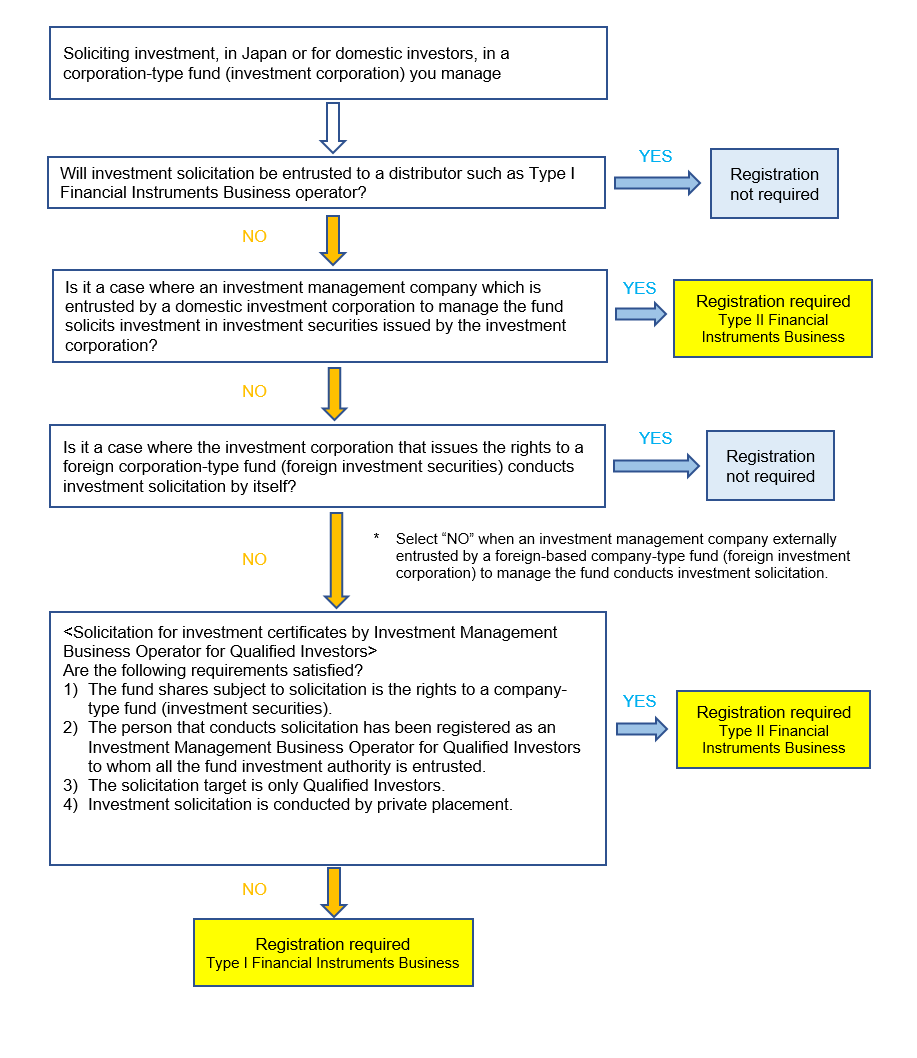

- In the case of a corporation-type fund

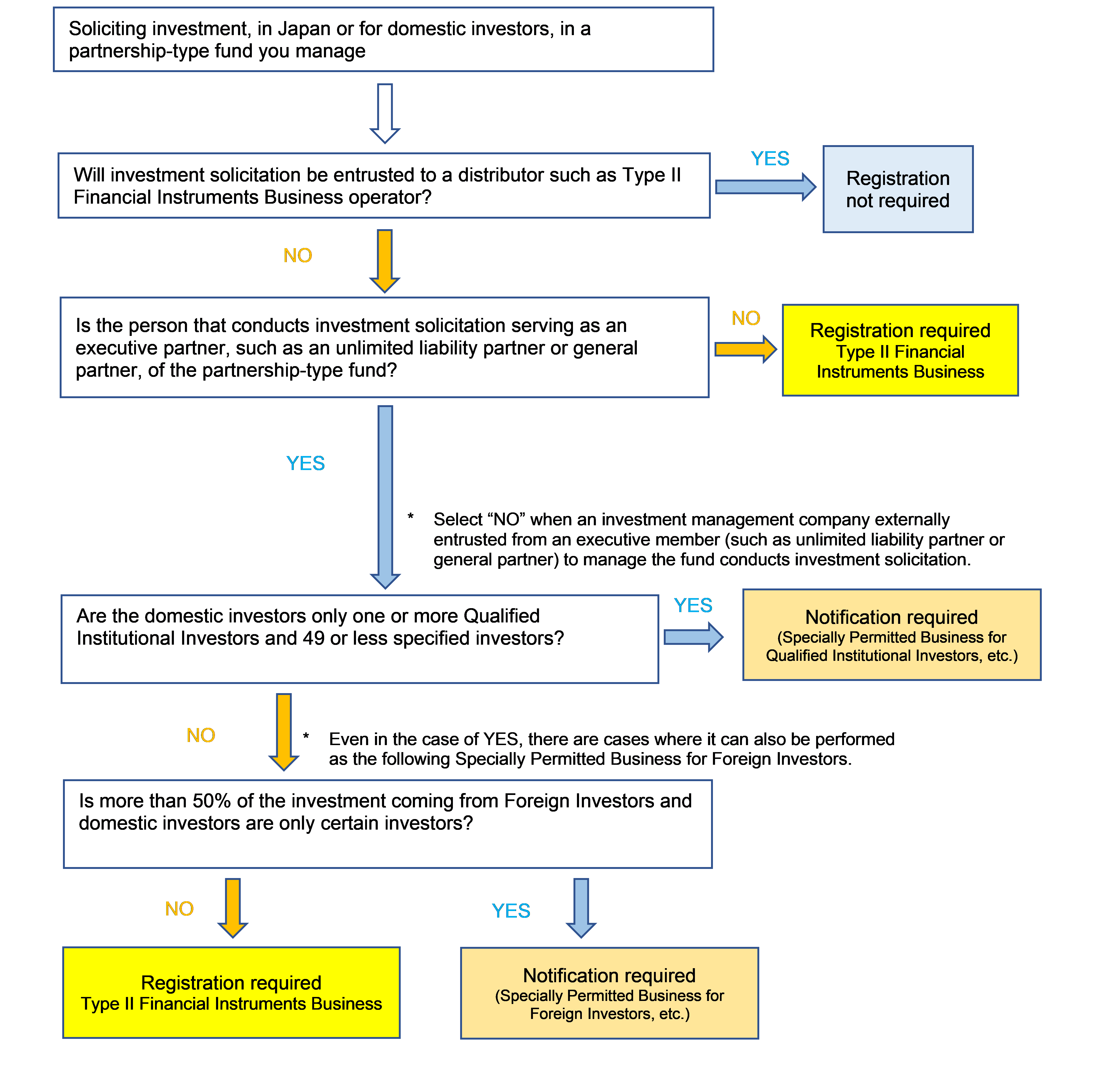

- In the case of a partnership-type fund

1) Investment advisory business

See business scheme case 2)(ⅴ) See business scheme case 1) (See (Reference1)(2)2)

2) Investment management business

(a) Management of customer assets on behalf of the customer

See business scheme case 2)(ⅴ) See business scheme case 2)(ⅰ),(ⅱ),(ⅲ),(ⅳ) (See (Reference1)(2)2)

(b) Establishment and management of funds

(i) establishing/managing a fund

See business scheme case 2)(ⅸ) See business scheme case 2)(ⅸ) See business scheme case 2)(ⅸ) (See (Reference1)(2)8) (See (Reference1)(2)7) (See (Reference1)(2)2)

See business scheme case 2)(ⅵ) (See (Reference1)(2)7) (See (Reference1)(2)5) (See (Reference1)(2)8)(See Section 4 (1))

See business scheme case 2)(ⅶ) See business scheme case 2)(ⅹ) See business scheme case 2)(ⅷ)(Investment management company(B)) See business scheme case 2)(ⅷ) See business scheme case 2)(ⅷ)See business scheme case 2)(ⅷ) (See (Reference1)(2)5) (See (Reference1)(2)8)(See Section 4 (1))

(ii) Investment solicitation for the funds you have established

〇 Trust-type fund

See business scheme case 2)(ⅵ),(ⅶ) (See "Investment Management Business for Qualified Investors" See business scheme case 2)(ⅶ) See business scheme case 2)(ⅵ) See business scheme case 2)(ⅵ)

〇 Corporation-type fund

See business scheme case 2)(ⅵ),(ⅹ) (See "Investment Management Business for Qualified Investors") See business scheme case 2)(ⅹ) See business scheme case 2)(ⅵ) See business scheme case 2)(ⅵ)

〇 Partnership-type fund

See business scheme case 2)(ⅷ),(ⅸ) See business scheme case 2) (viii)

(Investment Management Company (B)) See business scheme case 2)(ⅷ),(ⅸ) See business scheme case 2)(ⅷ),(ⅸ) (See (Reference1)(2)8)(See Section 4 (1))

3) Intermediation between an investment management/investment advisory company and its customers (as an agency or intermediary for conclusion of a discretionary investment contract or investment advisory contract)

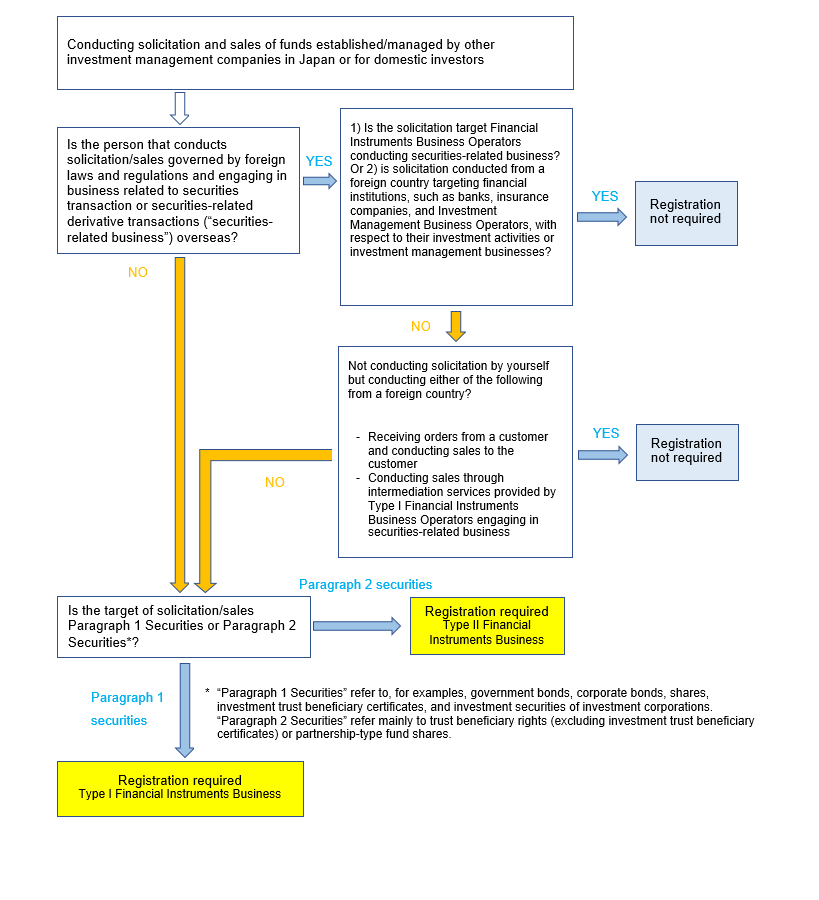

4) Solicitation or sales of funds established/managed by other investment management companies

See business scheme case 4)(ⅱ) See business scheme case 4)(ⅱ) See business scheme case 4)(ⅰ) See business scheme case 4)(ⅰ) (See (Reference1)(2)1) (See (Reference1)(2)1) (See (Reference1)(1)Note 2)

5) Establishment of a foreign business operator’s representative office for collecting information in Japan

(2) Major business scheme cases

The following mainly explains the type of registration required and the relevant exemptions for each of the major business schemes cases expected with respect to Financial Instruments Businesses.

< Business scheme cases presented in this Guidebook >

Based on an investment advisory contract, an investment advisory company with a business base in Japan provides its domestic or foreign customers with advice about the values, etc. of securities or investment decisions based on an analysis of the values, etc. of financial instruments

2) Investment management business (including investment solicitation for funds you have established)

An intermediary company with a business base in Japan conducts intermediation for the conclusion of a discretionary investment contract or investment advisory contract between tis foreign group company which is an investment management/advisory company and its domestic customers

4) Solicitation or sales of funds established by other investment management companies

(i) A distributor with a business base in Japan is entrusted by a foreign investment management company to conduct solicitation/sales of funds it manages for domestic investors

(ii) A securities company with a foreign business base sells funds and other financial instruments to domestic investors (the case where registration is not required)

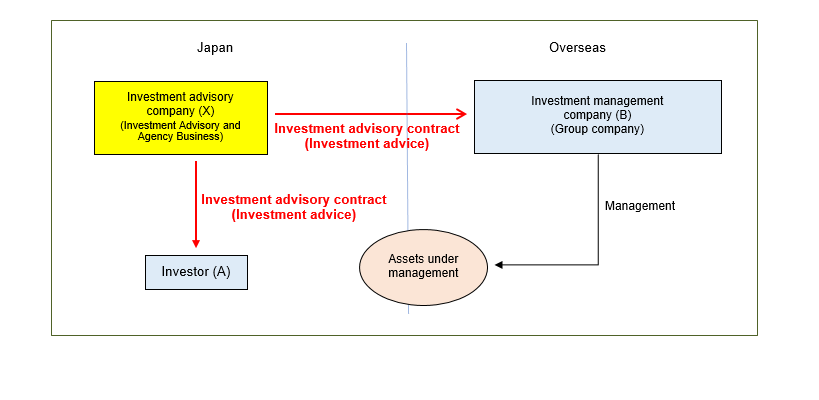

1) Investment advisory business

Based on an investment advisory contract, an investment advisory company based in Japan provides its domestic or foreign customers with advice regarding investment decisions made based on analysis of values of securities or values of financial instrumentsCase

Investment advisory company (X) with a business base in Japan provides domestic investors (A) or foreign investment management company (B) (a group company of the investment advisory company (X)) with advice regarding the values, etc. of securities or investment decisions based on an analysis of the values, etc. of financial instruments.

Necessary registration (investment advisory company (X))

Explanation

● When investment advisory company (X) is to provide advice about the “values, etc. of securities” or “investment decisions based on an analysis of the values, etc. of financial instruments” and receive remuneration for such investment advisory businesses under an investment advisory contract concluded with domestic investor (A), investment advisory company (X) is required to be registered as an Investment Advisory and Agency Business Operator.

● Even when providing investment advice for foreign investment management company (B) (a group company of investment advisory company (X)), investment advisory company (X) is required to be registered as an Investment Advisory and Agency Business Operator if it provides investment advice from its business base in Japan and receives remuneration for such investment advisory businesses.

● When investment advisory company (X) is delegated by its customers the investment decision/authority with regard to their assets and directly manages the customers’ assets, registration for Investment Management Business, not for Investment Advisory and Agency Business, is required.

● Registration for Investment Advisory and Agency Business may not be required in a case where the advice to be provided is limited to the provision of general information such as market situation or where no substantial remuneration is paid for the investment advisory service.

2) Investment management business (including investment solicitation for funds you have established)

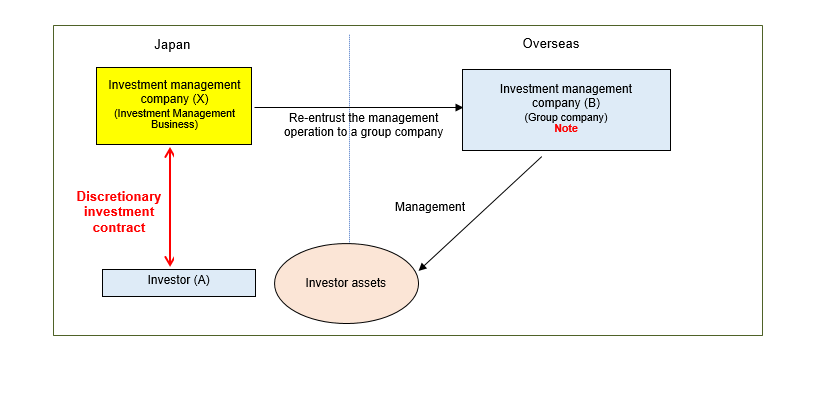

(i) An investment management company based in Japan is entrusted with asset management from domestic investors and re-entrusts the management operation to a foreign group company

Case

Investment management company (X) with a business base in Japan concludes a discretionary investment contract with domestic Investors (A) to manage their assets under the said contract. Then Investment management company (X) re-entrusts the management authority to foreign Investment management company (B), which is an overseas group company of Investment management company (X).

Necessary registration (Investment management company (X))

Registration required as: Investment Management Business (discretionary investment business)

Explanation

〇 Management business by Investment management company (X)

● When Investment management company (X) concludes a discretionary investment contract with Investors (A) to manage their assets under the said discretionary investment contract (discretionary investment businesses) (Article 2(8)(xii)(b) of the Act), Investment management company (X) is required to be registered as an Investment Management Business Operator (discretionary investment business) (Article 28(4)(i) and Article 29 of the Act).

● As a way to manage investor assets, Investment management company (X) may entrust the management authority (authority to instruct and execute investment) to Investment management company (B), which is its group company based in a foreign country. When entrusting the relevant authority, the entrustor (specializing in fund management) is required to decide the object and policies of investment and monitor the entrusted party (Article 42-3(2) of the Act).

Note

〇 Management business by investment management company (B)

● In principle, even an investment management company based in a foreign country is required to be registered as an Investment Management Business Operator with a business base in Japan when it is to conduct investment management under a discretionary investment contract for customers in Japan (Article 2(8)(xii)(b), Article 28(4)(i) and Article 29 of the Act). However, in a case where an investment management company engaged in discretionary investment business overseas is to conduct investment management business only for Investment Management Business Operators and trust banks conducting discretionary investment business in Japan, registration for investment management business is not necessary as an exception (Article 61(2) of the Act). For example, as long as Investment management company (X) is registered for Investment Management Business (discretionary investment business), Investment management company (B) is not required to be registered as Investment Management Business with regard to the asset management entrusted by Investment management company (X). For more details, please refer to business scheme case 2) (v).

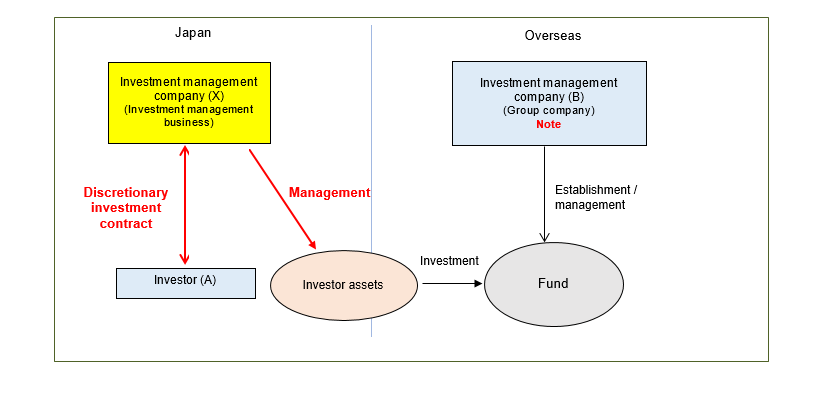

(ii) An investment management company based in Japan is entrusted with asset management from domestic investors, and performs

asset management by making investments in funds established by overseas group companies

Case

Investment management company (X) with a business base in Japan concludes a discretionary investment contract with domestic investors (A) and invests their assets under management in a fund managed by investment management company (B), which is an overseas group company of investment management company (X).

Necessary registration (investment management company (X))

Registration required as: Investment Management Business (discretionary investment business)

Explanation

〇 Management business by investment management company (X)

● When investment management company (X) concludes a discretionary investment contract with investors (A) to manage their assets under the said discretionary investment contract (discretionary investment businesses) (Article 2(8)(xii)(b) of the Act), investment management company (X) is required to be registered as an Investment Management Business Operator (discretionary investment business) (Article 28(4)(i) and Article 29 of the Act). In such case, investment management company (X) may invest the entrusted investor assets in funds established/managed by an overseas group company (investment management company (B)).

Note

○ Management business by investment management company (B)

● When investment management company (B) manages a partnership-type fund in a foreign country and accepts investments in the fund by Japanese investors, the executive member of the said partnership-type fund (referring to the person who directly manages the fund such as an unlimited liability partner or general partner) is required, in principle, to be registered as Investment Management Business Operator with a business base in Japan (Article 2(8)(xv), Article 28(4)(iii), Article 29, and Article 29-4(1)(iv)(b) of the Act). Provided, however, that registration is not required by laws in the cases below, for example. For more details, please refer to business scheme case 2) (ix).

a. When the said partnership-type fund is managed by a foreign investment management company and accepts investments in Japan only from Investment Management Business Operators and trust banks (Article 61(3) of the Act)

b. When the said partnership-type fund is a foreign-based fund and its Japanese investors are less than 10 Qualified Institutional Investors or notifiers of Specially Permitted Business for Qualified Institutional Investors, etc., and the amount of investment by Japanese investors does not exceed one-third of the total amount invested for the fund (Article 16(1)(xiii) of the Cabinet Office Ordinance on Definitions)

c. When the said partnership-type fund accepts investments in Japan only from one or more Qualified Institutional Investors and 49 or less specified investors, and the said executive member has notified the competent authority of the specified matters in advance (Article 63 of the Act)

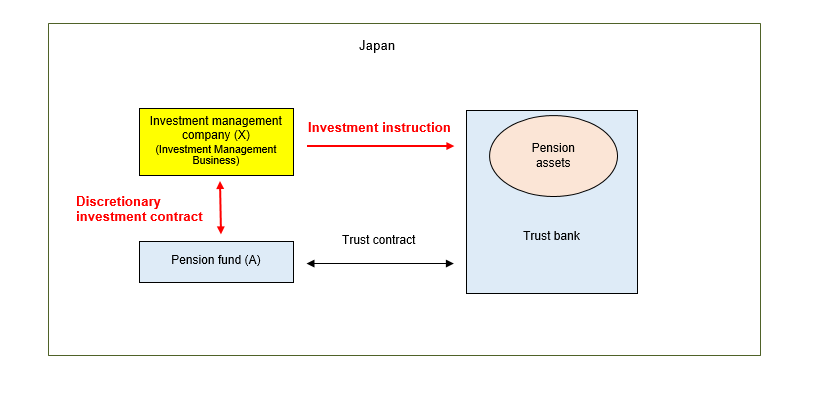

(iii) An investment management company based in Japan is entrusted by a domestic pension fund to manage its assets

Case

Investment management company (X) with a business base in Japan concludes a discretionary investment contract with pension fund (A) to manage the assets held by pension fund (A) under the said contract.

Necessary registration (investment management company (X))

Explanation

● When investment management company (X) concludes a discretionary investment contract with a domestic pension fund (A) to manage its assets under the said contract (discretionary investment businesses) (Article 2(8)(xii)(b) of the Act), investment management company (X) is required to be registered as an Investment Management Business Operator (discretionary investment business) (Article 28(4)(i) and Article 29 of the Act).

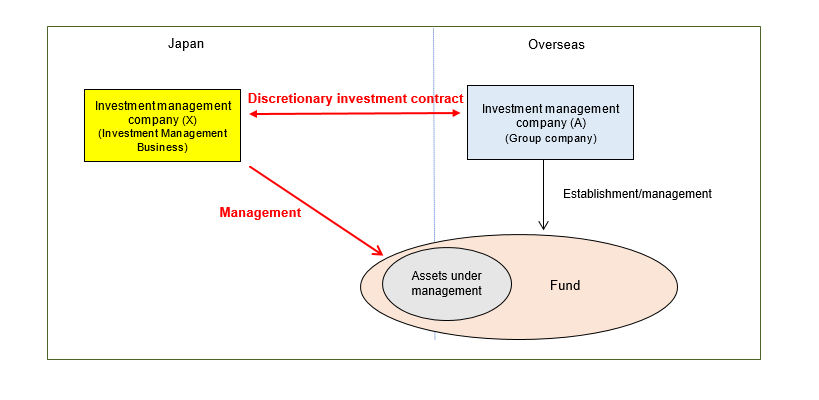

(iv) An investment management company based in Japan is entrusted by an overseas group company to manage the funds established by the said overseas group company

Case

Investment management company (X) with a business base in Japan concludes a discretionary investment contract with investment management company (A), which is an overseas group company, to be entrusted with the authority to manage the fund established by investment management company (A) and conducts the management operations from Japan.

Necessary registration (investment management company (X))

Registration required as: Investment Management Business (discretionary investment business)

○ Management business by investment management company (X)

● Even in a case where investment management company (X) manages the foreign-based fund established/managed by an investment management company based in a foreign country, investment management company (X) is required to be registered as an Investment Management Business Operator (discretionary investment business) if it conducts the management operations at its business base in Japan (Article 2(8)(xii)(b), Article 28(4)(i), and Article 29 of the Act).

● However, if the operations conducted by investment management company (X) involve, for example, only portfolio management not including investment decision and execution of investments, registration for Investment Management Business may be unnecessary as such operations don’t fall within the scope of Investment Management Business.

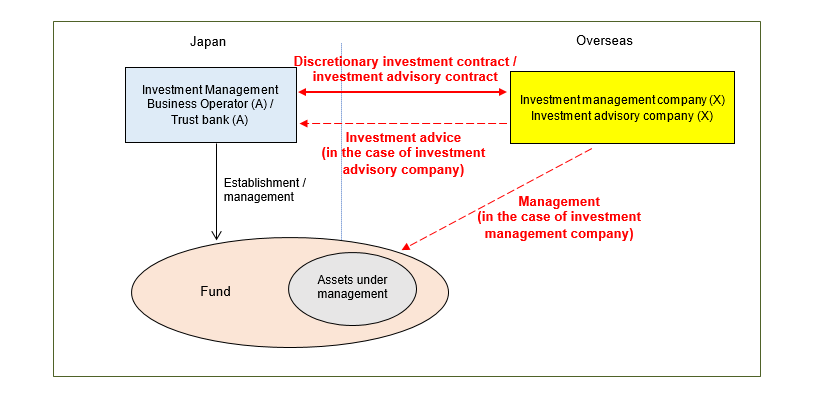

(v) An investment management company/investment advisory company based in a foreign country conducts investment management/advisory business for domestic investment management companies (registration not required)

Case

Investment management company (X) engaged in discretionary investment business overseas or investment advisory company (X) engaged in investment advisory business overseas provides domestic Investment Management Business Operator (A) or trust bank (A) with discretionary investment/investment advisory operations.

Necessary registration (investment management company (X))

Explanation

○ Management business by investment management company (X), and investment advisory business by investment advisory company (X)

● When conducting discretionary investment business or investment advisory business for domestic customers, registration for Investment Management Business or Investment Advisory and Agency Business (including setting up a business base in Japan in the case of Investment Management Business) is required in principle (Article 2(8)(xii)(b) and (xi), Article 28(4)(i) and (3)(i), Article 29, and Article 29-4(1)(iv)(b) of the Act). However, when an entity engaged in discretionary investment business or investment advisory business overseas (investment management company (X) or investment advisory company (X)) conducts business that targets in Japan only Investment Management Business Operators and trust banks, registration for Investment Management Business or Investment Advisory and Agency Business is unnecessary as an exception (Article 61(1) and (2) of the Act). For details, see (Reference 1) (2) 2).

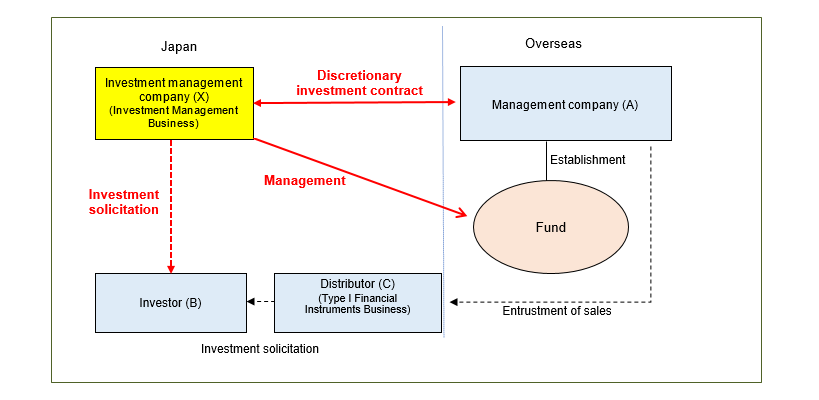

(vi) An investment management company based in Japan establishes a foreign-based trust-type or company-type fund, and conducts management and investment solicitation for the fund

Case

Investment management company (X) concludes a discretionary investment contract with the management company of a foreign-based trust-type fund (foreign investment trust) or a corporation-type fund (foreign investment corporation) established in a foreign country to manage the fund and solicit investments in the fund from domestic investors (B).

Necessary registration (investment management company (X))

Registration required as: Investment Management Business (discretionary investment business)

Registration required as: Type I Financial Instruments Business or Type II Financial Instruments Business (see Explanation below); provided, however, that registration is not required when entrusting investment solicitation to distributor (C) which is a Type I Financial Instruments Business Operator.

Explanation● Even in a case where investment management company (X) manages a foreign-based fund established in a foreign country, investment management company (X) is required to be registered as an Investment Management Business Operator (discretionary investment business) (Article 28(4) (i) and Article 29) if it manages the fund at its business base in Japan under entrustment from the fund management company (A) (Article 2(8)(xii)(b) of the Act).

● When investment management company (X) conducts investment solicitations (handling of a public offering or a private placement (Article 2 (8)(iv) of the Act)) for shares of a foreign-based trust-type or corporation-type fund (beneficiary certificates of a foreign investment trust (Article 2(1)(x) of the Act), or foreign investment securities (Article 2(1)(xi) of the Act)) that the investment management company (X) manages under entrustment from the fund management company (A), investment management company (X) is required to be registered as a Type I Financial Instruments Business Operator in principle (Article 28(1)(i) and Article 29).

● However, where investment management company (X) is registered as an Investment Management Business Operator for Qualified Investors, and when it solicits investments from Qualified Investors by means of private placement for the fund it manages under entrustment of entire management authority from the fund management company (A), company (X) may register for Type II Financial Instruments Business (Deemed Type II Financial Instruments Business). For details, see “Investment Management Business for Qualified Investors”.

● If investment management company (X) entrusts investment solicitation for the fund (handling of a public offering or a private placement (Article 2(8)(ix) of the Act)) to distributor (C) which is a domestic Type I Financial Instruments Business Operator and will not conduct solicitation by itself, investment management company (X) (and the fund management company (A)) are not required to register for investment solicitation.

Note

○ Notification of foreign investment trust or foreign investment corporation

● To conduct investment solicitation for shares of a foreign-based trust-type or corporation-type fund (foreign investment trust beneficiary certificates or foreign investment securities) in Japan, the issuer thereof is required to notify the competent authorities of specified matters in advance (Article 58(1) and Article 220(1) of the Investment Trust Act).

○ Specially Permitted Intermediary Service Provider for Unlisted Securities

● To conduct only Specially Permitted Intermediary Service for Unlisted Securities, out of the Type I Financial Instruments Business, requirements for registration, such as capital requirement and capital adequacy ratio, are relaxed. See here for the details regarding Specially Permitted Intermediary Service for Unlisted Securities.

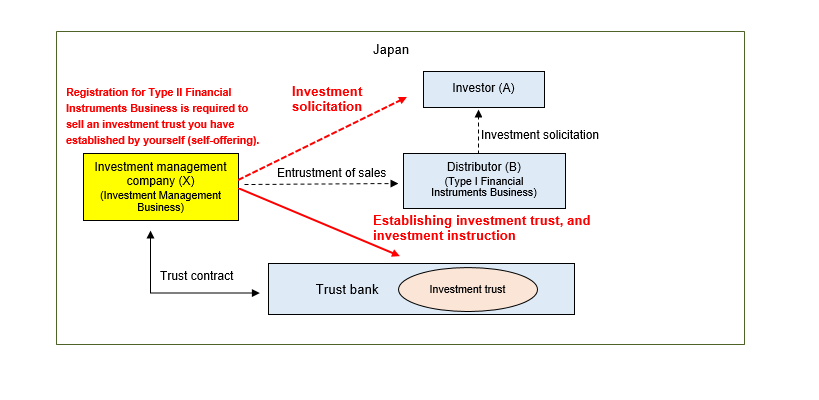

(vii) An investment management company based in Japan establishes a domestic trust-type fund, and conducts management an investment solicitation for the fund

Case

Investment management company (X) with a business base in Japan establishes and manages an investment trust in Japan, and also solicits investments for the investment trust from investors (A).

Necessary registration (investment management company (X))

Explanation

○ Management business by investment management company (X)

● When investment management company (X) establishes/manages an investment trust as a trustor thereof (Article 2(8)(xiv)), registration for Investment Management Business (investment trust management business) is required (Article 28(4)(ii) and Article 29 of the Act).

○ Investment solicitation by investment management company (X)

● When investment management company (X) is to solicit investments from investors (A) for an investment trust established and managed by itself (Article 2(1)(x) of the Act) (self-offering (Article 2(8)(vii)(a) of the Act)), registration for Type II Financial Instruments Business is required (Article 28(2)(i) and Article 29 of the Act). When investment management company (X) entrusts investment solicitation of the said investment trust (handling of a public offering or private placement (Article 2(8)(ix))) to distributor (B) which is a Type I Financial Instruments Business Operator and will not conduct solicitation by itself, registration related to investment solicitation is not required. For more details of self-offering and handling of public offering/private statement, see also (Reference 1) (1) (Note 3).

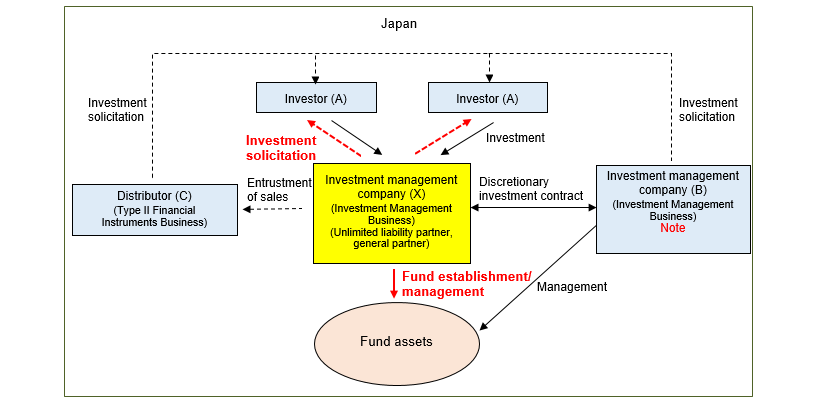

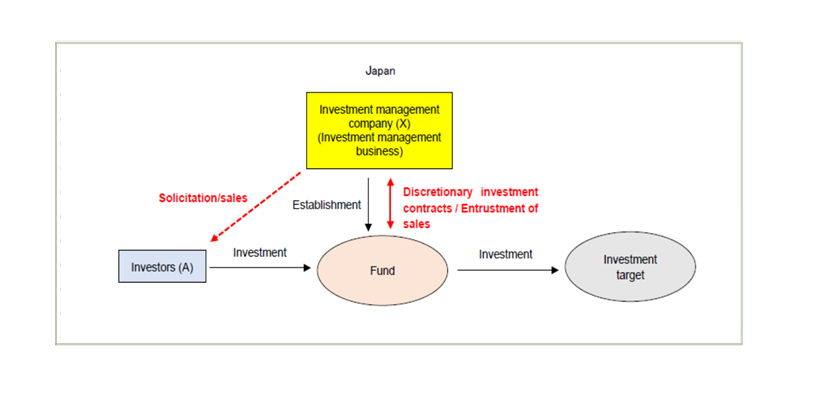

(viii) An investment management company based in Japan establishes a domestic partnership-type fund, and conducts management and investment solicitation for the fund

Case

Investment management company (X) with a business base in Japan establishes a partnership-type fund in Japan to manage the money contributed by investors (A) (self-management), and also solicits investments for the fund from investor (A).

Necessary registration (investment management company (X))

Explanation

○ Management business by investment management company (X)

● When investment management company (X) establishes a partnership-type fund by concluding a partnership contract with investors (A) (Article 2(2)(v) of the Act) and manages the fund by investing over 50% of the money contributed by investors (A) in securities or rights in derivative transaction (Article 2(8)(xv) of the Act), investment management company (X) is required to be registered as an Investment Management Business Operator (fund management business) in principle (Article 28(4)(iii) and Article 29).

● However, registration for Investment Management Business is not necessary in the any of the cases below:

(i) domestic investors (A) consist only of one or more Qualified Institutional Investors and 49 or less specified investors, and investment management company (X) has notified the competent authorities of the specified matters in advance (Specially Permitted Business for Qualified Institutional Investors, etc.) (Article 63 of the Act). For details, see (Reference 1) (2) 8).

(ii) the whole of the fund management authority is entrusted to investment management company (B) which is an Investment Management Business Operator, and investment management company (B) has notified the competent authorities of the specified matters in advance (Article 16(1)(x) of the Cabinet Office Ordinance on Definitions). For details, see (Reference 1) (2) 5).

(iii) the fund is a baby fund of two-tiered fund based on a silent partnership (anonymous partnership) contract for investment in beneficial interest in real property trust, and the business operator of the mother fund is an Investment Management Business Operator or a notifier of Specially Permitted Business for Qualified Institutional Investor, etc., and the said Investment Management Business Operator or the notifier of Specially Permitted Business for Qualified Institutional Investor, etc., has notified the competent authority of the specified matters in advance (Article 16(1)(xi) of the Cabinet Office Ordinance on Definitions). For details, see (Reference 1) (2) 6).

(iv) notification of certain matters is made in advance, in the case of partnership-type fund, the act of managing money invested by Foreign Investors, etc. (limited to the case where more than 50% of the money invested is invested by non-residents) (Specially Permitted Business for Foreign Investors, etc.)(Article 63-8 of the Act) For details, see Section 4 (1).

○ Investment solicitation by investment management company (X)

● When investment management company (X) is to solicit investments from investors (A) for shares of a partnership-type fund (Article 2(2)(v) of the Act) (self-offering), registration for Type II Financial Instruments Business is required (Article 2(8)(vii)(f), Article 28(2)(i), and Article 29 of the Act). However, when investment management company (X) entrusts investment solicitation of the said fund (handling of a public offering or private placement (Article 2(8)(ix))) to distributor (C) which is a Type II Financial Instruments Business Operator and will not conduct solicitation by itself, registration related to investment solicitation is not required. For more details of self-offering and handling of public offering/private placement, see also (Reference 1) (1) (Note 3).

● As in the case of management business, when domestic investors (A) consist only of one or more Qualified Institutional Investors and 49 or less specified investors and investment management company (X) has notified the competent authority of the specified matters in advance, registration related to investment solicitation is not required (Specially Permitted Business for Qualified Institutional Investors, etc.) (Article 63 of the Act). For details, see (Reference 1) (2) 8).

● In addition, in the case of an offering or private placement to foreign investors, etc. in relation to the act of managing money invested by foreign investors, etc. (limited to the case where more than 50% of the money invested is invested by non-residents), and where the investment management company (X) has notified the competent authorities of specified matters in advance, registration related to investment solicitation is not required. (Specially Permitted Business for Foreign Investors, etc.) (Article 63-8 of the Act) For details, see Section 4 (1) .

Note

○ Necessity of registration for investment management company (B)

● When investment management company (B) is to manage the fund under entrustment of investment decisions and investment authority from investment management company (X) as an executive member (such as unlimited liability partner or general partner) of the fund, investment management company (B) is required to be registered as the Investment Management Business Operator (discretionary investment business) (Article 2(8)(xii)(b), Article 28(4)(i), and Article 29 of the Act).

● When investment management company (B) is to conduct investment solicitation for the fund from investors (A) (handling of a public offering or private placement (Article 2(8)(ix) of the Act)), registration for Type II Financial Instruments Business is required. (Article 28(2) (ii) and Article 29 of the Act)

(ix) An investment management company based in a foreign country accepts investments from domestic investors for a partnership-type fund established overseas (registration not required)

Case

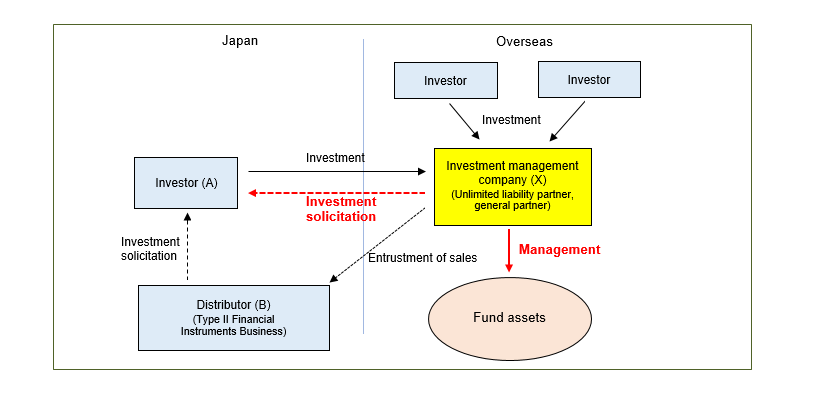

Investment management company (X) engaged in asset management business in a foreign country solicits investments from domestic investors (A) for a partnership-type fund established overseas, and manages the money contributed by investors (A) for the said partnership-type fund.

Necessary registration (investment management company (X))

Explanation

○ Management business by investment management company (X)

● When investment management company (X) engaged in management business overseas establishes/manages a foreign-based partnership-type fund (Article 2(2)(vi) of the Act) as an executive member (such as unlimited liability partner or general partner) of the fund and accepts investments for the fund from domestic investors (A), investment management company (X) is required to be registered for Investment Management Business (including setting up of a business base in Japan) in principle (Article 2(8)(xv), Article 28(4)(iii), Article 29, and Article 29-4(1)(iv)(b) of the Act). However, such registration is not necessary in any of the cases below:

(a) Domestic investors (A) consist only of Investment Management Business Operators and trust banks (Article 61(3) of the Act). For details, see (Reference 1) (2) 2).

(b) Domestic investors (A) are less than 10 Qualified Institutional Investors or notifier of Specially Permitted Business for Qualified Institutional Investors, etc., and the amount of investments by domestic investors does not exceed one-third of the total amount invested for the fund (Article 16(1)(xiii) of the Cabinet Office Ordinance on Definitions). For details, see (Reference 1) (2) 7).

(c) Domestic investors (A) consist only of one or more Qualified Institutional Investors and 49 or less specified investors, and investment management company (X) has notified the competent authorities of the specified matters in advance (Article 63 of the Act). For details, see (Reference 1) (2) 8).

○ Investment solicitation by investment management company (X)

● When investment management company (X) solicits investments for a foreign-based partnership-type fund (Article 2(2)(vi) of the Act) established and managed by itself from domestic investors (A) (self-offering), investment management company (X) is required to be registered for Type II Financial Instruments Business (including setting up of a business base in Japan) in principle (Article 2(8)(vii)(f), Article 28(2)(i), Article 29, and Article 29-4(1)(iv)(b) of the Act). However, such registration is not necessary in any of the cases below:

(a) Investment management company (X) entrusts investment solicitation (handling of public offering or private placement (Article 2(8)(ix) of the Act)) to a distributor (B) which is a Type II Financial Instruments Business Operator, and will not conduct solicitation by itself.

(b) Domestic investors (A) consist only of one or more Qualified Institutional Investors and 49 or less specified investors, and investment management company (X) has notified the competent authority of the specified matters in advance (Article 63 of the Act). For details, see (Reference 1) (2) 8).

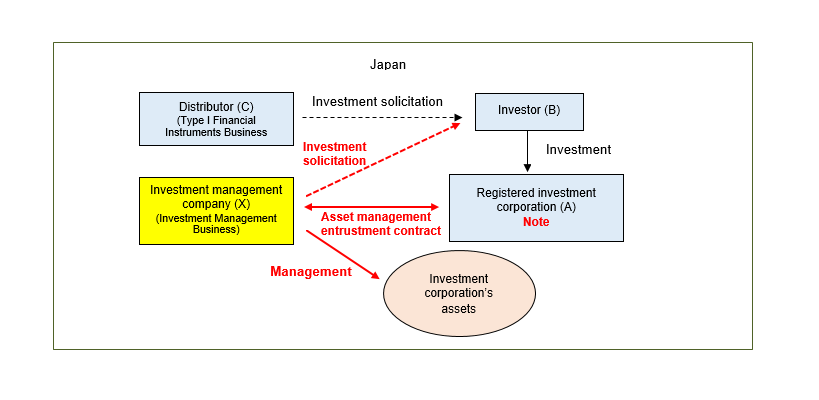

(x) An investment management company based in Japan establishes a domestic company-type fund, and conducts management and investment solicitation for the fund

Case

Investment management company (X) with a business base in Japan concludes an asset management contract with domestic registered investment corporation (A) established in accordance with the Investment Trust Act and manages its assets, and also solicits investments from investors (B) for investment securities issued by the registered investment corporation (A).

Necessary registration (investment management company (X))

Explanation

○ Management business by investment management company (X)

● To manage the assets held by registered investment corporation (A) (Article 2(8)(xii)(a)) under an asset management contract (Article 198 of the Investment Trust Act) concluded with the registered investment corporation (A), investment management company (X) is required to be registered as an Investment Management Business Operator (investment corporation asset management business) (Article 28(4)(i) and Article 29 of the Act).

○ Investment solicitation by investment management company (X)

● When investment management company (X) is to conduct investment solicitation for investment securities issued by registered investment corporation (A) it conducts asset management for, registration for Type II Financial Instruments Business is required (Article 196(2) of the Investment Trust Act, Article 29 of the Act).

● When investment management company (X) entrusts investment solicitation (handling of a public offering or private placement (Article 2(8) (ix))) to distributor (C) which is a Type I Financial Instruments Business Operator and will not conduct solicitation by itself, registration related to investment solicitation is not required.

Note

○ Notification related to establishment of an investment corporation in Japan and commencement of management operations

● To establish an investment corporation in Japan, the project planner is required to notify the competent authority of specified matters in advance (Article 69(1) of the Investment Trust Act), and the said investment corporation is required to be registered to conduct operations related to asset management (Article 187 of the Investment Trust Act).

(xi) An investment management company based in Japan establishes a domestic partnership-type fund and conducts investment solicitation solely for the fund

Case

Investment management company (X) with a business base in Japan establishes, for the purpose of unifying shareholders, a fund that has the rights set forth in Article 2(2)(v) and (vi) of the Act, that invests in unlisted stocks, etc. newly issued by a stock company, and that has an economic nature equivalent to equity-based crowdfunding.

Necessary registration (investment management company (X))

Explanation

○ Management business by investment management company (X)

● When investment management company (X) concludes a discretionary investment contract with a fund to manage the fund's assets under the discretionary investment contract (discretionary investment business) (Article 2 (8) (xii) (b) of the Act), the investment management company (X) is required to be registered as an Investment Management Business Operator (discretionary investment business) (Article 28 (4) (I) and Article 29 of the Act).

● To manage the fund on its own, the investment management company (X) is required to be registered for Investment Management Business (fund management business) (Article 2 (8) (xv) of the Act) (Article 28 (4)(iii) and Article 29 of the Act).

○ Investment solicitation by investment management company (X)

● When investment management company (X) is to conduct investment solicitation (handling of public offering or private placement (Article 2 (8) (ix) of the Act)) for the fund it has established, registration for Type II Financial Instruments Business is required (Article 28 (2) (ii), and Article 29 of the Act).

Note

○ A fund that has an economic nature equivalent to equity-based crowdfunding

● “Fund that has an economic nature equivalent to equity-based crowdfunding” refers to a fund that has the purpose of avoiding having a large number of individual shareholders in the fund-raising company (in which the fund invests), and its actual operation has characteristics equivalent to those of direct acquisition of the stocks in which the fund invests by investors. Whether or not the fund has characteristics equivalent to those of direct acquisition is examined with comprehensive consideration given to the number of the issues to be acquired by the fund, the investment policy for the stocks held by the fund, the way in which shareholders' rights are exercised, etc."

● In the case where investment management company (X) with a business base in Japan establishes, for the purpose of unifying shareholders, a fund that has the rights set forth in Article 2(2)(v) and (vi) of the Act, that invests in unlisted stocks, etc. newly issued by a stock company, and that has an economic nature equivalent to equity-based crowdfunding, an appropriate system suited to the actual situation will suffice, such as having personnel with work experience at a Type I Financial Instruments Business Operator and equivalent knowledge, even if they do not necessarily have operational experience at an investment management business, with regard to the requirements for investment managers, in the personnel structure. “Unlisted stocks, etc.” refers to stocks and subscription warrant securities issued in Japan by domestic stock companies that are not listed on a financial instruments exchange.

● In addition, please note that if the business of the Investment Management Business is not deemed to have an economic nature equivalent to that of an equity-based crowdfunding business due to a change in the document describing the business and business methods after registration, the business operator will need to satisfy requirements equivalent to those for the personnel structure of other investment management business (discretionary investment business) schemes.

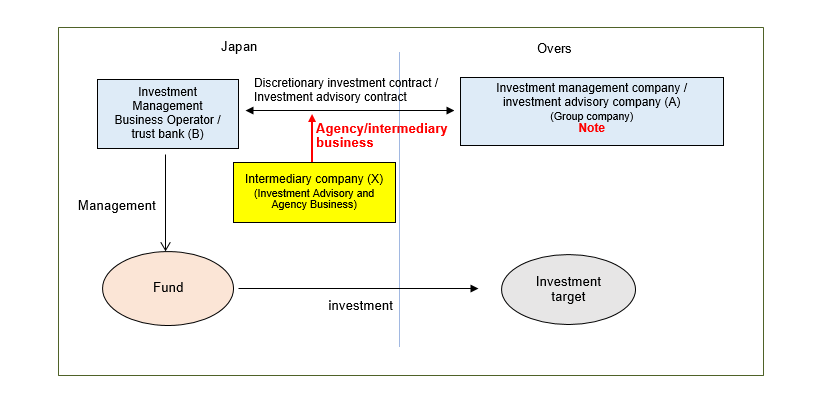

3) Intermediation between an investment management/investment advisory company and its customers (as an agency or intermediary for conclusion of a discretionary investment contract or investment advisory contract)

An intermediary company based in Japan conducts intermediation for an investment management/advisory company which is a foreign group company with respect to the conclusion of a discretionary investment contract or investment advisory contract with its domestic customers

Case

Intermediary company (X) with a business base in Japan conducts intermediation (as an agency or intermediary) for conclusion of a discretionary investment contract/investment advisory contract between foreign investment management company/foreign investment advisory company (A) (a group company of intermediary company (X)) and its customer, which is domestic Investment Management Business Operator or trust bank (B).

Necessary registration (intermediary company (X))

Explanation

○ Intermediary business by the intermediary company (X)

● To intermediate between investment management company or investment advisory company (A) and its customers as an agency or intermediary for conclusion of a discretionary investment contract or investment advisory contract, intermediary company (X) is required to be registered for Investment Advisory and Agency Business (Article 2(8)(xiii), Article 28(3)(ii), and Article 29).

Note

○ Necessity of registration for investment management/investment advisory company (A)

● In principle, even an investment management company or investment advisory company based in a foreign country is required to be registered for Investment Management Business or Investment Advisory and Agency Business when it is to conduct investment management businesses under a discretionary investment contract or investment advisory businesses under an investment advisory contract for customers in Japan (Article 2(8)(xii)(b) and (xi), Article 28(4)(i) and (3)(i), and Article 29 of the Act). However, in a case where an investment management company engaged in discretionary investment business overseas or an investment advisory company engaged in investment advisory business overseas is to conduct business only for domestic Investment Management Business Operators and trust banks, registration for Investment Management Business or Investment Advisory and Agency Business is not necessary as an exception (Article 61(1) and (2) of the Act). Therefore, in this case, as customers are Investment Management Business Operators or trust banks, investment management company/investment advisory company (A) is not required to be registered. For more details, please refer to the business scheme case 2) (v).

4) Solicitation or sales of funds established by other investment management companies

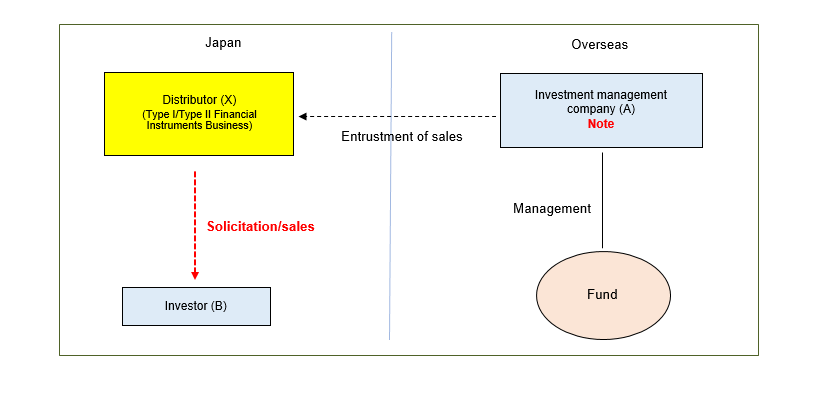

(i) A distributor based in Japan is entrusted by an investment management company based in a foreign country to conduct solicitation/sales of funds it operates for domestic investors

Case

Distributor with a business base in Japan (X) is entrusted by investment management company (A) based in a foreign country to conduct solicitation/sales of funds managed thereby for domestic investors (B)

Necessary registration (Distributor (X))

Explanation

● When the distributor (X) is entrusted by investment management company (A) to solicit domestic investors (B) for a fund, registration for Type I Financial Instruments Business is required if shares of the fund are Paragraph 1 Securities, or registration for Type II Financial Instruments Business is required if they are Paragraph 2 Securities (Article 2(8)(ix), and Article 28(1)(i) and (2)(ii) of the Act). For details of Paragraph 1 Securities and Paragraph 2 Securities, see (Reference 1) (1) (Note 2).

Note

○ Management business by investment management company (A)

● When investment management company (A) manages a partnership-type fund in a foreign country and accepts investments in the fund by Japanese investors, the executive member of the said partnership-type fund (referring to the person who directly manages the fund such as an unlimited liability partner or general partner) is required, in principle, to be registered as Investment Management Business Operator with a business base in Japan (Article 2(8)(xv), Article 28(4)(iii), Article 29, and Article 29-4(1)(iv)(b) of the Act). Provided, however, that registration is not required by laws in the cases below, for example. For more details, please refer to business scheme case 2) (ix).

a. When the said partnership-type fund is managed by a foreign investment management company and accepts investments in Japan only from Investment Management Business Operators and trust banks (Article 61(3) of the Act)

b. When the said partnership-type fund is a foreign-based fund and its Japanese investors are less than 10 Qualified Institutional Investors or notifiers of Specially Permitted Business for Qualified Institutional Investors, etc., and the amount of investment by Japanese investors accounts for less than one-third of the total amount invested for the fund (Article 16(1)(xiii) of the Cabinet Office Ordinance on Definitions)

c. When the said partnership-type fund accepts investments in Japan only from one or more Qualified Institutional Investors and 49 or less specified investors, and the said executive member has notified the competent authority of the specified matters in advance (Article 63 of the Act)

For details, see (Reference 1) (2) 8).

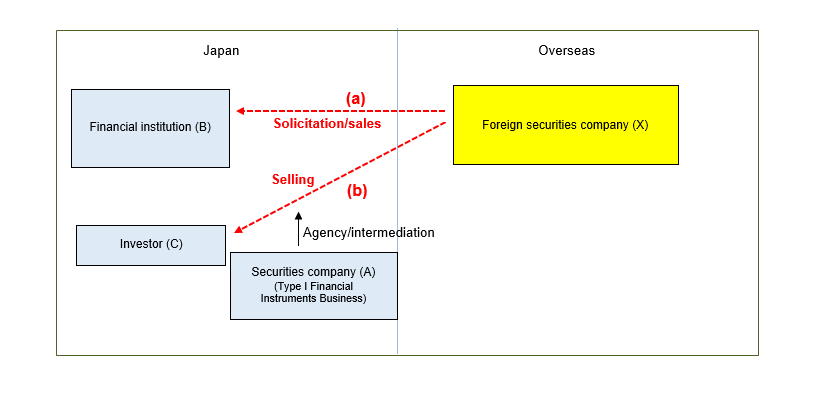

(ii) A securities company based in a foreign country sells funds and other financial instruments to domestic investors (registration not required)

Case

Foreign securities company (X) engaging in businesses pertaining to securities transactions or securities-related derivatives transactions (securities-related business) (a) conducts solicitation/sales of funds or other financial instruments for domestic securities companies, investment management companies, banks, insurance companies and other specified financial institutions (B), or (b) conducts sales of funds or other financial instruments by agency or intermediation by domestic securities company (A), which is a Type I Financial Instruments Business Operator, without conducting solicitation by itself.

Necessary registration (Foreign securities company (X))

Explanation

● When foreign securities company (X) is to solicit/sell funds or other financial instruments for domestic investors, registration for Type I Financial Instruments Business or Type II Financial Instruments Business is required in principle; provided, however, that registration is not necessary in either of the cases below:

(a) The foreign securities company (X) (i) conducts solicitation for financial institutions (B) that are Financial Instruments Business Operators engaged in securities-related business in Japan (Article 58-2 proviso of the Act) or (ii) conducts solicitation from overseas for financial institutions (B) such as banks, insurance companies and Investment Management Business Operators, with regard to their investment activities or investment management businesses (Article 17-3(i) of the Order). For details, see (Reference 1) (2) 1).

(b) The foreign securities company (X) conducts sales from overseas for Japanese investors (C) by agency or intermediation by the securities company (A) which is a Type I Financial Instruments Business operator engaged in securities-related business, without conducting solicitation by itself (Article 17-3(ii)(b) of the Order). For details, see (Reference 1) (2) 1).

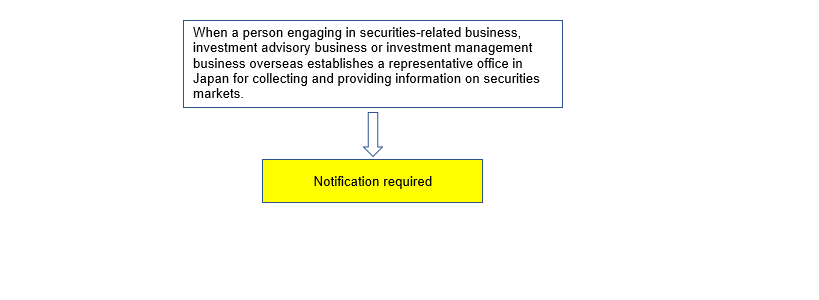

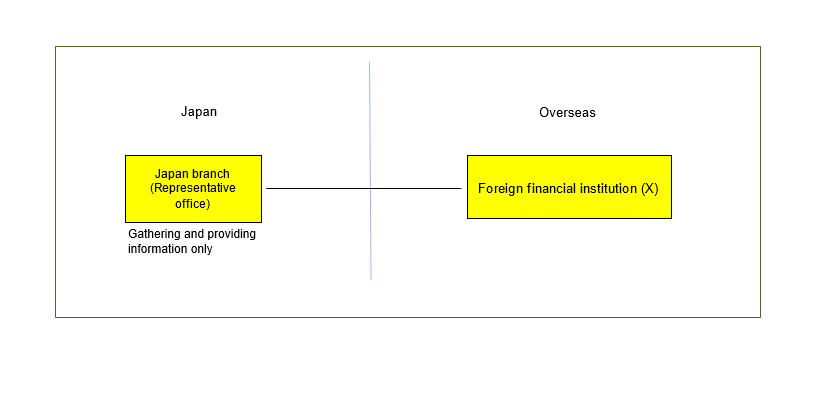

5) Establishment of a foreign business operator’s representative office for collecting information in Japan

Case

Foreign financial institution (X) conducting securities-related business, investment management business or investment advisory business overseas is to establish a representative office or other facility in Japan to collect and provide information on securities markets.

Necessary registration (Foreign financial institution (X))

Explanation

● When a foreign financial institution (X) engaged in securities-related business, investment management business or investment advisory business overseas is to set up a representative office or other facility in Japan to collect or provide information on securities markets (including provision of information through such means as marketing or holding seminars that will not constitute investment advisory services or solicitation of specific financial instrument), prior notification is required (Article 62 of the Act).

- Investment Management Business for Qualified Investors -

“Investment Management Business for Qualified Investors” was introduced aiming to promote entry of Investment Management Business Operators by relaxing registration requirements for Investment Management Business under the following conditions: (i) Rights Holders (referring to, in the case of discretionary investment business, the counterparties of discretionary investment contracts in principle) are limited to “Qualified Investors” (for definition of the scope of “Qualified Investors,” see (Reference 1)(3)) and (ii) the total amount of the investment assets is limited to 20 billion yen at maximum. Specifically, registration requirements are relaxed as follows (Article 29-5(1) of the Act):

1) A board of directors is not required (regular Investment Management Business Operator is required to be a company with a board of directors or a foreign company of a type equivalent to a company with a board of directors).

2) Minimum capital required is 10 million yen (50 million yen for an general Investment Management Business).

In addition, the Guidelines for Supervision IV-2-7 and VI-3-1-2 provides viewpoints of registration screening concerning control environment for business execution and personnel structure necessary for Investment Management Business for Qualified Investors. For more details, see Section 3 (2).

Moreover, for business operators that have registered for Investment Management Business for Qualified Investors, some exceptions are applied concerning investment solicitation for several types of securities including fund shares of investment trusts or investment corporations, for which registration for Type I Financial Instruments Business is required in principle. Specifically, when a registered Investment Management Business Operator for Qualified Investors is to solicit investments exclusively from Qualified Investors by way of private placement* (handling of private placement) for beneficiary certificates of investment trust or investment securities of investment corporation that it manages under entrustment of the whole of the management authority under a discretionary investment contract, the business operator is allowed to conduct such solicitation with registration for Type II Financial Instruments Business (Deemed Type II Financial Instruments Business) (Article 29-5(2) of the Act).

* The term “private placement” related to beneficiary certificates of an investment trust or investment securities of an investment corporation (Paragraph 1 Securities) means newly issuing securities for which solicitation target is limited to (i) 49 or less investors or (ii) Qualified Institutional Investors or Professional Investors (Article 2(3) of the Act).

(Note 1) It is not allowed to be registered for both the general Investment Management Business and the Investment Management Business for Qualified Investors at the same time. Therefore, please note that if you change the status of your registration from Investment Management Business for Qualified Investors to general Investment Management Business, the exceptions applied to Investment Management Business for Qualified Investors (including treatment as Deemed Type II Financial Instruments Business) will not be applied.

(Note 2) In conducting Investment Management Business for Qualified Investors, it is necessary to implement necessary and appropriate measures to prevent the total amount of investment assets from exceeding 20 billion yen and prevent any person other than Qualified Investors from becoming a rights holder (See VI-3-1-2 (3) of the Guidelines for Supervision).

- Investment Management-Related Service Entrusted Business -

A voluntary registration system was introduced to ensure the appropriate quality of services provided by Investment Management-Related Service Entrusted Business Operators, who conduct the Investment Management-Related Service ([i] fund’s NAV calculation service and [ii]regulatory compliance service) as entrusted by Investment Management Business Operators, etc., from the perspective of facilitating entries of Investment Management Business Operators. The details of the Investment Management-Related Service covered by the registration are as follows:

[i] Fund’s NAV calculation service: The service related to the evaluation of the property subject to investment (meaning money or other properties invested by a person that is allowed to engage in the Investment Management Business, etc. pursuant to the provisions of the FIEA on behalf of the rights holders prescribed in Article 42(1) of the FIEA; the same applies below) on the basis of the securities and other assets that constitute the property subject to investment, interest and dividends arising from those assets, and remuneration and other fees for the investment of the property subject to investment; and

[ii] Regulatory compliance service: The service related to guidance for ensuring compliance with laws and regulations (meaning laws and regulations, dispositions by government agencies which are based on laws and regulations, the articles of incorporation and other rules)

If an Investment Management Business Operator outsources the Investment Management-Related Service to an Investment Management-Related Service Entrusted Business Operator, the Investment Management Business Operator is eligible for the relaxation of registration requirements for Investment Management Business in terms of the development of a personnel structure: they are only required to secure staff with the ability to properly supervise and give appropriate instructions to the outsourcee as necessary, in place of a person who executes the said business outsourced.

An Investment Management Business Operator that outsources Investment Management-Related Service to external service provider (including outsourcing to non-registered service provider) needs to state the intention to outsource its Investment Management-Related Service, the tradename or name of the service provider, and the details of the Investment Management-Related Service outsourced to the service provider, and other particulars in a registration application form (Article 29-2(1)(xii) of the FIEA). Among these, as concrete details of the outsourced Investment Management-Related Service, the Investment Management Business Operator needs to clearly indicate which of the following services are outsourced.

(a) Evaluation of the investment trust asset and verification thereof (including calculation of the constant value of the investment trust property, tabulation of the establishment and cancellation of investment trust for the relevant calculation, checking of asset execution, recording of interest and dividends, etc.) ;

(b) In addition to (a) above, evaluation of the property subject to investment and verification thereof

⇒ If an Investment Management Business Operator outsources any of the businesses stated in (a) or (b) to an Investment Management-Related Service Entrusted Business Operator, it suffices for the Investment Management Business Operator to secure staff with the ability to properly supervise and give appropriate instructions to the outsourcee as necessary, in place of a person who executes the said fund’s NAV calculation business outsourced.

[ii] Details of the regulatory compliance service

(b) Drafting and managing internal rules and other manuals related to compliance; and

(c) Planning and implementing periodic compliance training and providing information on compliance.

⇒ If an Investment Management Business Operator outsources all of the services stated in (a) to (c) above to an Investment Management-Related Service Entrusted Business Operator, it suffices for the Investment Management Business Operator to secure staff with the ability to properly supervise and give appropriate instructions to the outsourcee as necessary, in place of a person who executes the said regulatory compliance business. (in the case of the entrustment of any of the services stated in (a) to (c) above, the Investment Management Business Operator may be eligible for the relaxation of personnel requirements within the scope of the outsourced business).

The Comprehensive Guidelines for Supervision of Investment Management-Related Service Entrusted Business Operators describe supervisory viewpoints regarding the control environment for business execution and the personnel structure, etc. required for Investment Management-Related Service Entrusted Business Operators.

-Specially Permitted Intermediary Service for Unlisted Securities -

From the perspective of promoting new entries to intermediary service for unlisted securities issued by startups, etc. and activating their distribution, requirements for registration for the Type 1 Financial Instruments Business are relaxed for business operators that intend to conduct specific acts regarding unlisted securities. More specifically, conducting any of the following acts on a regular basis fall under the category of Specially Permitted Intermediary Service for Unlisted Securities.

1) The following acts for Securities (limited to Securities that are not listed on financial instruments exchanges and excluding over-the-counter traded securities):

(i) intermediation of sale or acts set forth in Article 2(8)(ix) of the FIEA (excluding those conducted with general investors as a counterparty and acts conducted for general investors based on solicitation for the relevant general investors);

(ii) intermediation of purchase (excluding that conducted for general investors and intermediation conducted with general investors as a counterparty based on solicitation for the relevant general investors)

2) Acceptance of deposits of money from a customer in connection with any of the acts set forth in 1) above (limited to acceptance of money deposits necessary for the settlement of transactions by any of the acts set forth in 1) for which the period of deposit does not exceed one week)

Registration requirements to be relaxed for business operators that conduct only Specially Permitted Intermediary Service for Unlisted Securities, out of the Type I Financial Instruments Business, include the reduction of required amounts of stated capital and net assets and the elimination of the capital adequacy ratio. For the details of the registration requirements, see Section 3 (2).

Emergency Registration Exemption for Foreign Financial Institutions / Asset Managers

(Temporary relief to address overseas business disruptions due to disaster or other reasons)

On July 22, 2020, the Financial Services Agency of Japan (hereinafter the “FSA”) amended the Cabinet Office Order on Definitions under Article 2 of the Financial Instruments and Exchange Act. This amended order introduced a scheme for foreign financial services providers, including asset management companies to be exempted from registration requirements by obtaining confirmation by the FSA, which enables them to conduct their business operations in Japan for a certain period of time when they have difficulty in continuing their financial instruments business in their home jurisdiction due to disaster or other reasons.

Registration as a Financial Instruments Business Operator is not required if a person who is engaged in Type I financial instruments business or investment management business in a foreign state in accordance with the laws and regulations of the foreign state, and faces or is likely to face difficulties in continuing that business in the foreign state due to a disaster or other reasons, carries out that business in Japan for business-continuity's sake by obtaining approval from the Commissioner of the FSA with a given operational period (up to three months). (Article 16(1)(xvii) of the Cabinet Office Order on Definitions) For details, see (Reference 1) (2) 9).

Site Map

- Press Releases & Public Relations

- Press Releases

- Press Conferences

- Official Statements

- FSA Weekly Review & ACCESS FSA

- Speeches

- For Financial Users

- Others

- Archives

- Laws & Regulations

- Name of Laws and Regulations(PDF)

- Recent Changes (Legislation, Ordinances, Guidelines)

- Guidelines

- Financial Instruments and Exchange Act

- Financial Monitoring Policy

- Public Comment

- No-Action Letter System

- Procedures concerning Foreign Account Management Institutions

Search

Search