4 Specially Permitted Business for Foreign Investors, etc. / Specially Permitted Business during Transition Period

In order for Japan's capital market to fulfill its function as an international financial center, an entry system with simplified procedures (only notification required) has been established for the following two cases (effective from November 22nd, 2021).

(i) Entry scheme for GP managers with overseas qualified clients (non-Japanese corporations and individuals domiciled abroad with a certain amount of assets)

(ii) Pre-registration entry scheme for those (managing only offshore funds) with authorization granted by regulatory bodies and having a proven track record in specified foreign jurisdictions (temporary measure for 5 years)

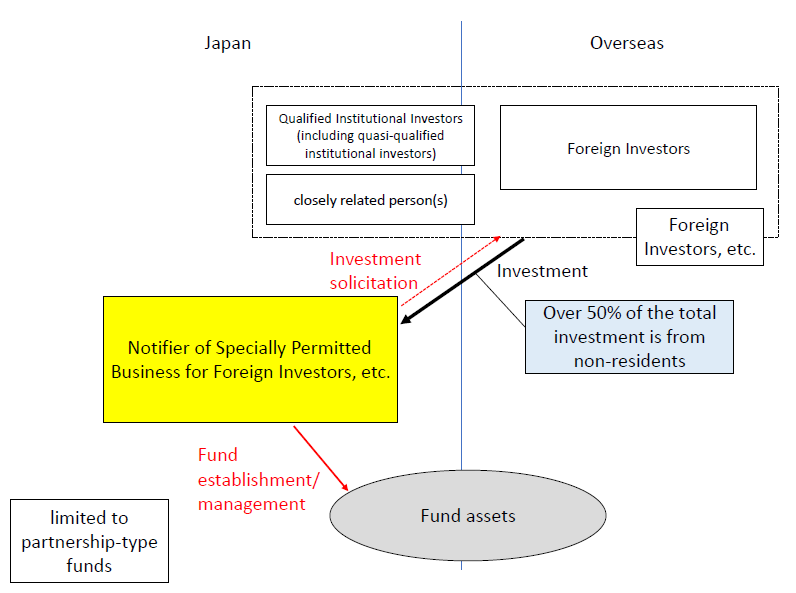

(1) Specially Permitted Business for Foreign Investors, etc.

Registration for Investment Management Business (fund management business) and Type II Financial Instruments Business (including private placement, etc.) is not required if notification of certain matters is made in advance, in the case of a partnership-type fund engaging in , (i) the act of managing money invested by Foreign Investors, etc.*1 (limited to the case where more than 50% of the money invested is invested by non-residents*2) and (ii) the offering or private placement*3 to Foreign Investors, etc. in relation to the above act prescribed in (i) that is conducted at business offices or offices in Japan. (Article 63-8, 63-9 of the Act)

*1 For the scope of "Foreign Investors, etc.," please refer to here.

*2 The term "non-resident" means a natural person or corporation other than a resident (Article 63-8(1)(i) of the Act, Article 6(1)(vi) of the FEFTA). The term "resident" means a natural person having a domicile or residence in Japan, or a corporation having its principal office in Japan; whereas a non-resident's office in Japan, such as a branch office and local office, is deemed to be a resident even if the non-resident's principal office is located in a foreign country, regardless of whether the office in Japan has the legal authority to represent the non-resident (Article 6(1)(v) of the FEFTA).

*3 A "public offering" of a partnership-type fund (collective investment scheme) refers to a solicitation for the acquisition of 500 or more investors who respond to the offering and acquire equity of the fund, and a "private placement" refers to a solicitation for the acquisition that does not constitute a public offering (Article 2(3)(iii) of the Act, Article 1-7-2 of the Order).

〇 Outline of Specially Permitted Business for Foreign Investors, etc.

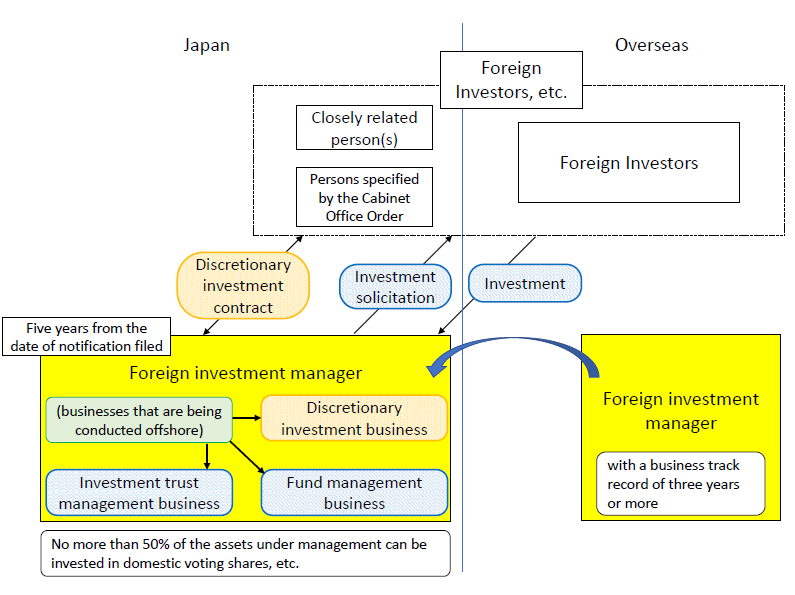

(2) Specially Permitted Business during Transition Period

1) When a foreign investment manager performs Specially Permitted Business during Transition Period

Registration for Type I Financial Instruments Business, Type II Financial Instruments Business, or Investment Management Business is not required if notification of certain matters has been given in advance, in the case that a foreign investment manager (with a business track record of three years or more) that has obtained a license or approval, etc. from a foreign authority engages in any of the following activities at business offices or offices in Japan (Article 3-3(1), (5) of the Supplementary Provisions of the Act).

(i) Any of the following acts performed in a foreign country in accordance with the laws and regulations of that country

・ discretionary investment management business for Foreign Investors, etc.*1

・ investment trust management business for foreign investment trusts with Foreign Investors, etc. as investors

・ fund management business for foreign partnership-type funds with Foreign Investors, etc. as investors

(ii) Offering or private placement of beneficiary securities of foreign investment trusts, foreign investment securities or interests in foreign partnership-type funds and/or handling thereof in connection with the investment management activities described in (i) above.

*1 For the scope of "Foreign Investors, etc.," please refer to here.

Please note that more than 50% of the assets under management cannot be invested in domestic stocks, etc. having voting rights when conducting the Specially Permitted Business during Transition Period (Article 3-3(3)(i)(f), of the Supplementary Provisions of the Act, Paragraph 6 of the Supplementary Provisions of the Order, and Article 38 of the Supplementary Provisions of the FIB Cabinet Office Order).

This Specially Permitted Business during Transition Period is a time-limited measure that will be in effect until November 21, 2026, and notifications regarding the Specially Permitted Business during Transition Period must be submitted by that date. Also, Specially Permitted Business during Transition Period can only be performed for a maximum of five years from the date of notification, and if you plan to continue operations after that, you will need to register or submit alternative notification (Article 3-3(3)(i), (ii) of the Supplementary Provisions of the Act).

Please note that even a foreign investment manager that engages in Specially Permitted Business during Transition Period is allowed to use an exemption for investment management and advisory services for domestic financial institutions (Article 61 of the Act and Article 17-11 of the Enforcement Order). However, it is not permitted to conduct business related to the said exemption in Japan, such as at a branch office in Japan.

〇 Outline of Specially Permitted Business during Transition Period

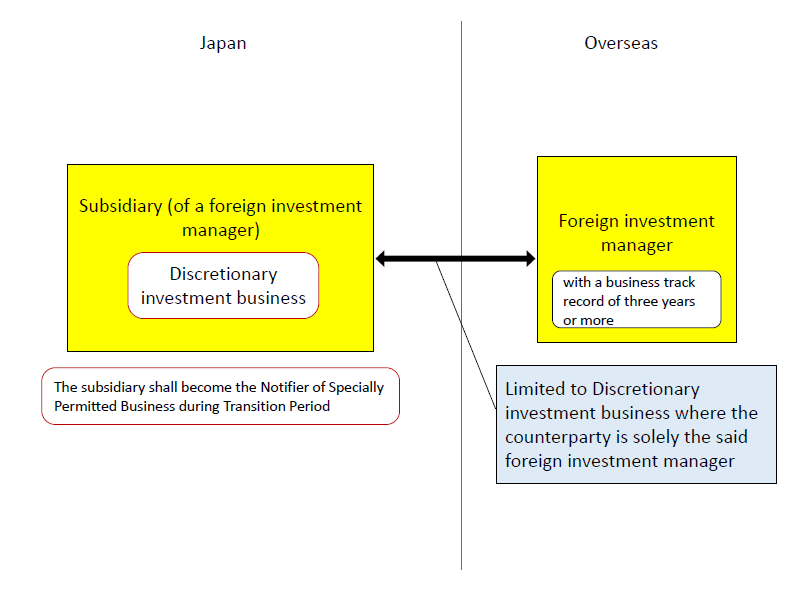

2) When a subsidiary of a foreign investment manager conducts Specially Permitted Business during Transition Period

Registration for Investment Management Business (discretionary investment management business) is not required if notification of certain matters has been given in advance, in the case where a subsidiary of a foreign investment manager (with a business track record of three years or more) that has obtained a license or approval, etc. from a foreign authority conducts discretionary investment management business with the foreign investment manager at a business office or office established in Japan (Article 3-3(7) and (1) of the Supplementary Provisions of the Act). In this case, it is not the foreign investment manager but its subsidiary that should submit the notification of the Specially Permitted Business during Transition Period.

Other than that, besides the provisions regarding grounds for disqualification also applying to the foreign investment manager (parent company) (Article 3-3(7) of the Supplementary Provisions of the Act), the basic requirements, etc. (see 1), (3) 3) ) are the same as the case where the foreign investment manager performs the Specially Permitted Business during Transition Period*1.

*1 With respect to the restriction on investing more than 50% of assets under management in domestic stocks, etc. with voting rights, whether or not the restriction is violated will be calculated based on the percentage of domestic stocks, etc. in the assets under management of the foreign investment manager (parent company), even if the subsidiary conducts Specially Permitted Business during Transition Period.

○ Outline of Specially Permitted Business during Transition Period (when a subsidiary of a foreign investment manager engages in Specially Permitted Business during Transition Period)

3) Foreign countries (countries or regions) subject to the Specially Permitted Business during Transition Period

When a foreign investment manager conducts Specially Permitted Business during Transition Period, the foreign investment manager must be registered under the same type of registration as that under Japanese law (including permission or other administrative disposition similar to registration) for conducting investment management business in the respective foreign countries in accordance with the provisions of any of the following applicable foreign laws and regulations (Article 3-3(3)(i)(a) of the Supplementary Provisions of the Act, Article 34 of the Supplementary Provisions of the FIB Cabinet Office Order, the Regulatory Notice Specifying Countries or Regions Based on the Provisions of Article 34 of the Supplementary Provisions of the FIB Cabinet Office Order (The FSA's Regulatory Notice No.101 of November 10, 2021)). Please note that even if a subsidiary of a foreign investment manager conducts Specially Permitted Business during Transition Period, it is the foreign investment manager that needs to be registered, not the subsidiary.

| ・ The United States of America ・ The United Kingdom ・ Australia ・ Singapore ・ Switzerland ・ Germany ・ France ・ Hong Kong

(Sorting by word order in Japanese)

|

■ The scope of "Foreign Investors, etc."

The scope of "Foreign Investors, etc." in Specially Permitted Business for Foreign Investors, etc. and Specially Permitted Business during Transition Period differ as follows.

| Specially Permitted Business for Foreign Investors, etc. (Article 63-8(2) of the Act) | Specially Permitted Business during Transition Period (Article 3-3(6) of the Supplementary Provisions of the Act) |

| A foreign corporation or an individual domiciled in a foreign state, which satisfies the requirements specified by a Cabinet Office Order in consideration of such individual's knowledge, experience and the state of its assets. | A foreign corporation or an individual domiciled in a foreign state. |

|

(FIB Cabinet Office Order)

(i) A foreign corporation (ii) An individual domiciled in a foreign state, who falls under any of the following (A) The fulfillment of all of the following (a) Net assets of 300 million yen or more (b) Investable financial assets of 300 million yen or more (c) One year has passed since the opening of a securities or derivatives account (B) The fulfillment of any of the following, and (A)(c) (a) Net assets of 500 million yen or more (b) Investable financial assets of 500 million yen or more (c) Income of 100 million yen or more in the previous year (C) The average number of trading contracts, etc. related to securities or derivatives per month during the previous one-year period is four or more, and falling under (A)(a) or (b), and falling under (A)(c) (D) A person with specific knowledge and experience,*1 who falls into one of the following categories and falls into (A)(c). (a) Net assets of 100 million yen or more (b) Investable financial assets of 100 million yen or more (c) Income of 10 million yen or more in the previous year (E) A person who is equivalent to a Professional Investor under the applicable laws and regulations of a foreign country |

― |

| Qualified Institutional Investors (including persons specified by a Cabinet Office Ordinance as being equivalent thereto, but excluding persons set forth in the preceding item). | Other than those listed in the preceding item, persons specified by an Order as having a close relationship with a foreign investment manager. |

| (FIB Cabinet Office Order)

(i) Professional Investors (ii) Employees' pension funds or corporate pension funds under applicable foreign laws (mainly for the purpose of retirement pension management and benefits) |

(Order)

(i) Officers and employees of foreign investment managers (ii) Parent company, etc. of foreign investment manager (iii) Person(s) specified by a Cabinet Office Order |

| (FIB Cabinet Office Order)

(i) Subsidiaries of the foreign investment manager (ii) A person/entity entrusted with the investment management or investment advice by the foreign investment manager (iii) Officers or employees of a parent company, subsidiary, etc., or of a person/an entity entrusted with investment management or investment advice by the foreign investment manager (iv) Relative(s) within the third degree of kinship of the foreign investment manager, etc. |

|

| Other than those listed in the preceding two items, person(s) specified by a Cabinet Order as having a close relationship with the Notifier. | Persons specified by Cabinet Office Order as being equivalent to those listed in the preceding two items |

| (Cabinet Order)

(i) Officers and employees of the Notifier (ii) Parent company, etc. of the Notifier (iii) Persons specified by a Cabinet Office Order |

(FIB Cabinet Office Order)

(i) Financial instruments business operators, etc. conducting investment management business |

| (FIB Cabinet Office Order)

(i) Subsidiaries of a foreign investment manager (ii) A person/entity entrusted with investment management or investment advice by the Notifier (iii) Officers or employees of a parent company, subsidiary, etc., or of a person entrusted with investment management or investment advice by the Notifier (iv) A relative within the third degree of kinship of the Notifier," etc. |

*1 “A person with specific knowledge and experience“ is a person who falls under any of the following (Article 62(3) of FIB Cabinet Office Order).

(i) A person who has been engaged in the financial business for at least one year in total.

(ii) A person who has held a teaching or research position in economics or business administration for at least one year in total.

(iii) Securities analyst, 1st or 2nd grade Securities Broker Representative, 1st or 2nd grade Certified Skilled Professional of Financial Planning, or Small and Medium Enterprise Management Consultant, who has been engaged in the practice for at least one year in total.

(iv) A person such as one who has been engaged in the management consulting business for at least one year in total, with knowledge and experience equivalent or superior to those in (i) through (iii) above.

(3) Notification procedures and requirements

1) Flow of notification procedure

If you plan to conduct Specially Permitted Business for Foreign Investors, etc., and the Specially Permitted Business during Transition Period, please contact the Financial Market Entry Office. After the notification and attached documents have been checked and accepted, you may start your business.

If you have any questions or concerns regarding the Specially Permitted Business for Foreign Investors, etc. and the Specially Permitted Business during Transition Period, please contact Financial Market Entry Office.

・Reference

Financial Market Entry Office (The Financial Services Agency / Local Finance Bureaus)![]()

| Financial Market Entry Office | 103-0026 |

| 7th Floor, FinGATE TERRACE, 8-1 Nihonbashi-kabuto-cho, Chuo-ku, Tokyo |

E-mail: marketentry@fsa.go.jp Phone: +81-3-6667-0551 |

* Complex inquiries are best submitted in writing via e-mail with any relevant information attached whenever possible and appropriate, so that the Office can ensure a timely response.

2) Preparation of notification documents

A notification form for the Specially Permitted Business for Foreign Investors, etc. and the Specially Permitted Business during Transition Period must be prepared in accordance with the prescribed format. This notification form can be prepared in English in accordance with the Japanese format (Article 246-11(2) of the FIB Cabinet Office Order, Article 31(2) of the Supplementary Provisions of the FIB Cabinet Office Order).

Please refer to the following FSA web page for the format and examples of the notification form and some attached documents.

〇

| Documents to be attached*1 | Juridical person |

Individual

|

Remarks | Relevant provisions |

| Affidavit of the Notifier | ○ | ○ | Article 63-9(2)(i),(ii) of the Act | |

| Articles of incorporation | ○ | ― | Article 63-9(2)(i) of the Act | |

| Certificate of registered information | ○*2 | ― | Article 63-9(2)(i) of the Act | |

| Documents stating the Notifier's business execution system, such as its personnel structure and the organizational structure pertaining to the business | ○ | ○ | Article 63-9(2)(iii) of the Act, Article 246-15(1)(i) of FIB Cabinet Office Order | |

| Internal rules concerning Specially Permitted Business for Foreign Investors, etc. | ○ | ○ | Article 63-9(2)(iii) of the Act, Article 246-15(1)(ii) of FIB Cabinet Office Order | |

| Resumes of the officers and important (major) employees | ○ | ― | If the officer of the registration applicant is a juridical person, a document containing the background of such juridical person officer shall be filed. | Article 63-9(2)(iii) of the Act, Article 246-15(1)(iii)(a) of FIB Cabinet Office Order |

| Extracts of the certificates of residence of the officers and important (major) employees | ○ | ― | In cases where extracts from the certificate of residence are not available (such as where the applicant (individual) does not reside in Japan, or is a foreigner), any other document in lieu thereof (e.g. affidavit, etc.) shall be filed. If the officer of the Notifier is a juridical person, certificate of registered information or any other document in lieu thereof (affidavit, etc.) shall be filed. |

Article 63-9(2)(iii) of the Act, Article 246-15(1)(iii)(b) of FIB Cabinet Office Order |

| Certification that officers and important (major) employees are not bankrupt | ○ | ― | Certificates to be issued by the respective municipalities where the applicants' domiciles are located. In cases where the applicants are foreigners, any other document in lieu thereof shall be filed (e.g. affidavit, etc.) |

Article 63-9(2)(iii) of the Act, Article 246-15(1)(iii)(d) of FIB Cabinet Office Order |

| Affidavits of officers and important (major) employees | ○ | ― | Article 63-9(2)(iii) of the Act, Article 246-15(1)(iii)(e) of FIB Cabinet Office Order | |

| Documents stating the number of the Subject Voting Rights held by the Major Shareholders | ○ | ― | Article 63-9(2)(iii) of the Act, Article 246-15(1)(iii)(f) of FIB Cabinet Office Order | |

| Resumes of the Notifier and important (major) employees | ― | ○ | Article 63-9(2)(iii) of the Act, Article 246-15(1)(iv)(a) of FIB Cabinet Office Order | |

| Extracts of the certificates of residence of the Notifier and important (major) employees | ― | ○ | Extracts of the certificates, or any other document in lieu thereof, in cases where the individual (applicant) is a foreigner, or does not reside in Japan. |

Article 63-9(2)(iii) of the Act, Article 246-15(1)(iv)(b) of FIB Cabinet Office Order |

| Certification that the Notifier and important (major) employees are not bankrupt | ― | ○ | Certificate to be issued by the municipalities of their registered domiciles. Or any other document in lieu thereof (e.g. affidavit, or etc.) in the case where the registration applicants are foreigners. |

Article 63-9(2)(iii) of the Act, Article 246-15(1)(iv)(d) of FIB Cabinet Office Order |

| Affidavits of important (major) employees | ― | 〇 | Article 63-9(2)(iii) of the Act, Article 246-15(1)(iv)(e) of FIB Cabinet Office Order | |

| Documents stating the following matters

・Type of investors ・If there are any residents among the investors, the total amount of planned investment by resident and non-resident among the investors. ・If an investor falls under the category of a Professional Investor under applicable foreign laws and regulations, a summary of such foreign laws and regulations |

〇 | 〇 | Article 63-9(2)(iii) of the Act, Article 246-15(1)(v) of FIB Cabinet Office Order |

*1 The above attachments can be prepared in English (Article 246-15(2) of the FIB Cabinet Office Order).

*2 The certificate of registered information of the Notifier, which is required by law to be submitted as an attachment (Article 63-9(2)(i) of the Act), is obtained by the authorities and does not need to be submitted as an attachment.

| Documents to be attached*1 | Juridical person |

Individual

|

Remarks | Relevant provisions |

| Affidavit of the Notifier | ○ | ○ | Article 3-3(4), of the Supplementary Provisions of the Act, Article 63-9(2)(i), (ii) of the Act | |

| Articles of incorporation | ○ | ― | Article 3-3(4), of the Supplementary Provisions of the Act, Article 63-9(2)(i) of the Act | |

| Certificate of registered information | ○*2 | ― | Article 3-3(4), of the Supplementary Provisions of the Act, Article 63-9(2)(i) of the Act | |

| Certificate proving that the foreign investment manager has obtained registration, etc. in the foreign country | ○ | ○ | Article 3-3(4), of the Supplementary Provisions of the Act, Article 44(1)(i) of the Supplementary Provisions of the FIB Cabinet Office Order | |

| Documents stating the outline of the investment management business conducted by a foreign investment manager in the foreign country | ○ | ○ | Article 3-3(4), of the Supplementary Provisions of the Act, Article 44(1)(ii) of the Supplementary Provisions of the FIB Cabinet Office Order | |

| Certificate proving that three years have passed since the foreign investment manager started investment management business in the foreign country | ○ | ○ | Article 3-3(4), of the Supplementary Provisions of the Act, Article 44(1)(iii) of the Supplementary Provisions of the FIB Cabinet Office Order | |

| Copy of the latest business report submitted by the foreign investment manager to the foreign authority | ○ | ○ | Article 3-3(4), of the Supplementary Provisions of the Act, Article 44(1)(iv) of the Supplementary Provisions of the FIB Cabinet Office Order | |

| Documents related to administrative disposition(s) which the foreign investment manager has received in a foreign country | ○ | ○ | Documents shall be filed in a case where the Notifier has been subject to an adverse disposition under applicable foreign laws and regulations equivalent to the Act within three years prior to the date of notification. | Article 3-3(4), of the Supplementary Provisions of the Act, Article 44(1)(v) of the Supplementary Provisions of the FIB Cabinet Office Order |

| Documents stating the Notifier's business execution system, such as its personnel structure and the organizational structure pertaining to the business | ○ | ○ | Article 3-3(4), of the Supplementary Provisions of the Act, Article 44(1)(vi) of the Supplementary Provisions of the FIB Cabinet Office Order | |

| Internal rules concerning Specially Permitted Business during Transition Period | ○ | ○ | Article 3-3(4), of the Supplementary Provisions of the Act, Article 44(1)(vii) of the Supplementary Provisions of the FIB Cabinet Office Order | |

| Document stating the changes in investment ratio in domestic stocks with voting rights, etc. for the latest business year | ○ | ○ | Article 3-3(4), of the Supplementary Provisions of the Act, Article 44(1)(viii) of the Supplementary Provisions of the FIB Cabinet Office Order | |

| Resumes of officers and important (major) employees | ○ | ― | If an officer of the registration applicant is a juridical person, a document containing the background of such juridical person officer shall be filed. | Article 3-3(4), of the Supplementary Provisions of the Act, Article 44(1)(ix)(a) of the Supplementary Provisions of the FIB Cabinet Office Order |

| Extracts of the certificates of residence of officers and important employees | ○ | ― | In cases where extracts from the certificate of residence are not available (such as where the applicant (individual) does not reside in Japan, or is a foreigner), any other document in lieu thereof (e.g. affidavit, etc.) shall be filed. If the officer of the Notifier is a juridical person, certificate of registered information or any other document in lieu thereof (e.g. affidavit, etc.) shall be filed. |

Article 3-3(4), of the Supplementary Provisions of the Act, Article 44(1)(ix)(b) of the Supplementary Provisions of the FIB Cabinet Office Order |

| Certification that officers and important employees are not bankrupt | ○ | ― | Certificate to be issued by the municipalities of their registered domiciles. In the case where the officers and important (major) employees are foreigners, any other document in lieu thereof (e.g. affidavit, etc.) shall be filed. |

Article 3-3(4), of the Supplementary Provisions of the Act, Article 44(1)(ix)(d) of the Supplementary Provisions of the FIB Cabinet Office Order |

| Affidavits of officers and important employees | 〇 | ― | Article 3-3(4), of the Supplementary Provisions of the Act, Article 44(1)(ix)(e) of the Supplementary Provisions of the FIB Cabinet Office Order | |

| Documents stating the number of the Subject Voting Rights held by the Major Shareholders | 〇 | ― | Article 3-3(4), of the Supplementary Provisions of the Act, Article 44(1)(ix)(f) of the Supplementary Provisions of the FIB Cabinet Office Order | |

| Resumes of the Notifier and important (major) employees | ― | 〇 | Article 3-3(4), of the Supplementary Provisions of the Act, Article 44(1)(x)(a) of the Supplementary Provisions of the FIB Cabinet Office Order | |

| Extracts of the certificates of residence of the Notifier and important (major) employees | ― | 〇 | Extracts of certificates of residence, or any other document in lieu thereof (affidavit, etc.), if the individual is a foreigner, or does not reside in Japan. | Article 3-3(4), of the Supplementary Provisions of the Act, Article 44(1)(x)(b) of the Supplementary Provisions of the FIB Cabinet Office Order |

| Certification that the Notifier and important (major) employees are not bankrupt | ― | 〇 | Certificate to be issued by the municipalities of their registered domiciles. In the case where the officers and important (major) employees are foreigners, any other document in lieu thereof (e.g. affidavit, etc.) shall be filed. |

Article 3-3(4), of the Supplementary Provisions of the Act, Article 44(1)(x)(d) of the Supplementary Provisions of the FIB Cabinet Office Order |

| Affidavits of important (major) employees | ― | 〇 | Article 3-3(4), of the Supplementary Provisions of the Act, Article 44(1)(x)(e) of the Supplementary Provisions of the FIB Cabinet Office Order | |

| Affidavit (of the foreign investment manager) | 〇 | ― | If the subsidiary of a foreign investment manager conducts Specially Permitted Business during Transition Period (the same below). | Article 3-3(7) and (4), of the Supplementary Provisions of the Act, Article 44(1)(xi)(a) of the Supplementary Provisions of the FIB Cabinet Office Order |

| Articles of incorporation (of the foreign investment manager) | 〇 | ― | Article 3-3(7) and (4), of the Supplementary Provisions of the Act, Article 44(1)(xi)(a) of the Supplementary Provisions of the FIB Cabinet Office Order | |

| Certificate of registered information (of the foreign investment manager) | ○*2 | ― | Article 3-3(7) and (4), of the Supplementary Provisions of the Act, Article 44(1)(xi)(a) of the Supplementary Provisions of the FIB Cabinet Office Order | |

| Documents stating the Notifier's business execution system, such as its personnel structure and the organizational structure pertaining to the business (of the foreign investment manager) | 〇 | ― | Article 3-3(7) and (4), of the Supplementary Provisions of the Act, Article 44(1)(xi)(b) of the Supplementary Provisions of the FIB Cabinet Office Order | |

| Resumes of officers and important (major) employees (of the foreign investment manager) | 〇 | ― | Article 3-3(7) and (4), of the Supplementary Provisions of the Act, Article 44(1)(xi)(c) of the Supplementary Provisions of the FIB Cabinet Office Order | |

| Extracts of the certificates of residence of officers and important (major) employees (of the foreign investment manager) | 〇 | ― | Extracts of certificates of residence, or any other document in lieu thereof (affidavit, etc.), in the case where an individual is a foreigner, or does not reside in Japan. If the officer of the Notifier is a juridical person, certificate of registered information or any other document in lieu thereof (affidavit, etc. shall be filed). |

Article 3-3(7) and (4), of the Supplementary Provisions of the Act, Article 44(1)(xi)(d) of the Supplementary Provisions of the FIB Cabinet Office Order |

| Certification that officers and important employees are not bankrupt (of the foreign investment manager) | 〇 | ― | Certificate to be issued by the municipalities of their registered domiciles. In the case where the officers and important (major) employees are foreigners, any other document in lieu thereof (e.g. affidavit, etc.) shall be filed. |

Article 3-3(7) and (4), of the Supplementary Provisions of the Act, Article 44(1)(xi)(f) of the Supplementary Provisions of the FIB Cabinet Office Order |

| Affidavits of officers and important (major) employees (of the foreign investment manager) | 〇 | ― | If an officer of the foreign investment manager is a juridical person, a document containing the background of such juridical person officer shall be filed. | Article 3-3(7) and (4), of the Supplementary Provisions of the Act, Article 44(1)(xi)(g) of the Supplementary Provisions of the FIB Cabinet Office Order |

| Documents stating the number of the Subject Voting Rights held by the Major Shareholders (of the foreign investment manager) | 〇 | ― | Article 3-3(7) and (4), of the Supplementary Provisions of the Act, Article 44(1)(xi)(h) of the Supplementary Provisions of the FIB Cabinet Office Order |

*1 The above attachments can be prepared in English (Article 44(2) of the Supplementary Provisions of the FIB Cabinet Office Order).

*2 The certificate of registered information of the Notifier (Article 3-3(4) of the Supplementary Provisions of the Act, Article 63-9(2)(i) of the Act) is obtained by the authorities and do not need to be submitted as attachments.

3) Notification requirements specified in the FIEA

| SPBFI |

SPBTP

|

SPBQII*1

|

Relevant provisions | |

| The Notifier or its officers and important (major) employees have not received a certain administrative penalty, punishment or any other sanction in the past. | ○ | ○ | ○ | Article 63-9(6)(i)(a), (2)(a), (3)(a) of the Act |

| Article 3-3(3)(i)(c), (ii)(a), (iii)(a) of the Supplementary Provisions of the Act | ||||

| Article 63(7)(i)(a), (b), (ii)(a), (b) of the Act | ||||

| Having a sufficient personnel structure to conduct Specially permitted business in an appropriate manner | ○ | ○ | ―*2 | Article 63-9(6)(i)(b)(2) of the Act |

| Article 3-3(3)(i)(d)(2) of the Supplementary Provisions of the Act | ||||

| No member, etc. of an organized crime group is among the officers or important (major) employees. | ○ | ○ | ○ | Article 63-9(6)(i)(b)(1) of the Act |

| Article 3-3(3)(i)(d)(1) of the Supplementary Provisions of the Act | ||||

| Article 63(7)(i)(c), (ii)(c) of the Act | ||||

| Having a necessary system in place for conducting Specially Permitted Business in an appropriate manner | ○ | ○ | ―*2 | Article 63-9(6)(i)(c) of the Act, Article 246-19 of the FIB Cabinet Office Order |

| Article 3-3(3)(i)(e) of the Supplementary Provisions of the Act, Article 37 of the Supplementary Provisions of the FIB Cabinet Office Order | ||||

| (In the case of a judicial person) Business office, etc. in Japan |

○ | ○ | ― | Article 63-9(6)(ii)(b) of the Act |

| Article 3-3(3)(ii)(b) of the Supplementary Provisions of the Act | ||||

| (In the case of a foreign judicial person) Representative, etc. in Japan |

○ | ○ | ○ (including an individual domiciled in a foreign country) |

Article 63-9(6)(ii)(c) of the Act |

| Article 3-3(3)(ii)(c) of the Supplementary Provisions of the Act | ||||

| Article 63(7)(i)(d), (ii)(d) of the Act | ||||

| (In the case of a foreign judicial person) Guarantee by the foreign authority where the principal place of business, etc. is located, to the effect that it will respond to a request for cooperation in an investigation |

○ | ○ | ○ (including an individual domiciled in a foreign country) |

Article 63-9(6)(ii)(d) of the Act |

| Article 3-3(3)(ii)(d) of the Supplementary Provisions of the Act | ||||

| Article 63(7)(i)(e), (ii)(e) of the Act | ||||

| (In the case of a judicial person) No non-qualified Major Shareholders |

○ | ○ | ― | Article 63-9(6)(ii)(e), (f) of the Act |

| Article 3-3(3)(ii)(e), (f) of the Supplementary Provisions of the Act | ||||

| (In the case of a judicial person) Securing officers or employees with sufficient knowledge and experience required for conducting Specially Permitted Business |

○ | ○ | ― | Article 63-9(6)(ii)(g) of the Act |

| Article 3-3(3)(ii)(g) of the Supplementary Provisions of the Act | ||||

| (In the case of individual) Address in Japan (the individual shall be domiciled in Japan) |

○ | ○ | ― | Article 63-9(6)(iii)(b) of the Act |

| Article 3-3(3)(iii)(b) of the Supplementary Provisions of the Act | ||||

| (In the case of individual) Having sufficient knowledge and experience required for conducting Specially Permitted Business |

○ | ○ | ― | Article 63-9(6)(iii)(c) of the Act |

| Article 3-3(3)(iii)(c) of the Supplementary Provisions of the Act | ||||

| More than 50% of the money invested or contributed must come from non-residents. | ○ | ― | ― | Article 63-8(1)(i) of the Act |

| Registered to engage in investment management business in a foreign country | ― | ○ | ― | Article 3-3(3)(i)(a) of the Supplementary Provisions of the Act |

| Three years have passed since the commencement of the investment management business in a foreign country | ― | ○ | ― | Article 3-3(3)(i)(b) of the Supplementary Provisions of the Act, Paragraph 4 of the Supplementary Provisions of the Order |

| No more than 50% of the assets under management are invested in domestic stocks with voting rights | ― | ○ | ― | Article 3-3(3)(i)(f) of the Supplementary Provisions of the Act |

| The investor must be Foreign Investors*3 | ○ | ○ | ― | Article 63-8 of the Act, Article 3-3(5) of the Supplementary Provisions of the Act |

| One or more Qualified Institutional Investors and 49 or fewer Investors Subject to Specially Permitted Business*4 | ― | ― | ○ | Article 63(1)(i) of the Act, Article 17-12(1), (3) of the Order |

*1 “Specially Permitted Business for Qualified Institutional Investors, etc.” For details, see (Reference 1) (2) 8).

*2 In accordance with the scale of Specially Permitted Business for Qualified Institutional Investors, etc., it is necessary to ensure appropriate business operations in light of the Guidelines for Supervision (see IX).

*3 The scope of "Foreign Investors, etc." in Specially Permitted Business for Foreign Investors, etc. and Specially Permitted Business during Transition Period differ. For details, see here.

*4 For the scope of "Qualified Institutional Investors" and "Investors Subject to Specially Permitted Business," please refer to (Reference 1) (3) "Classification of investors".

Site Map

- Press Releases & Public Relations

- Press Releases

- Press Conferences

- Official Statements

- FSA Weekly Review & ACCESS FSA

- Speeches

- For Financial Users

- Others

- Archives

- Laws & Regulations

- Name of Laws and Regulations(PDF)

- Recent Changes (Legislation, Ordinances, Guidelines)

- Guidelines

- Financial Instruments and Exchange Act

- Financial Monitoring Policy

- Public Comment

- No-Action Letter System

- Procedures concerning Foreign Account Management Institutions

Search

Search