Recommendation for Administrative Monetary Penalty Payment Order for Market Manipulation of Shares of cocokara fine Inc. by Individual Investor Residing Abroad

Japanese version![]()

(Provisional Translation)

June 26, 2018

Securities and Exchange Surveillance Commission

1. Contents of the Recommendation

The Securities and Exchange Surveillance Commission today made a recommendation to the Prime Minister and the Commissioner of the Financial Services Agency that an administrative monetary penalty payment order be issued in regard to market manipulation of shares of cocokara fine Inc. by an individual investor residing abroad pursuant to Article 20(1) of the Act for Establishment of the Financial Services Agency. This recommendation is based on the findings of an investigation into the market manipulation, whereby the following violation of laws and ordinances was identified.

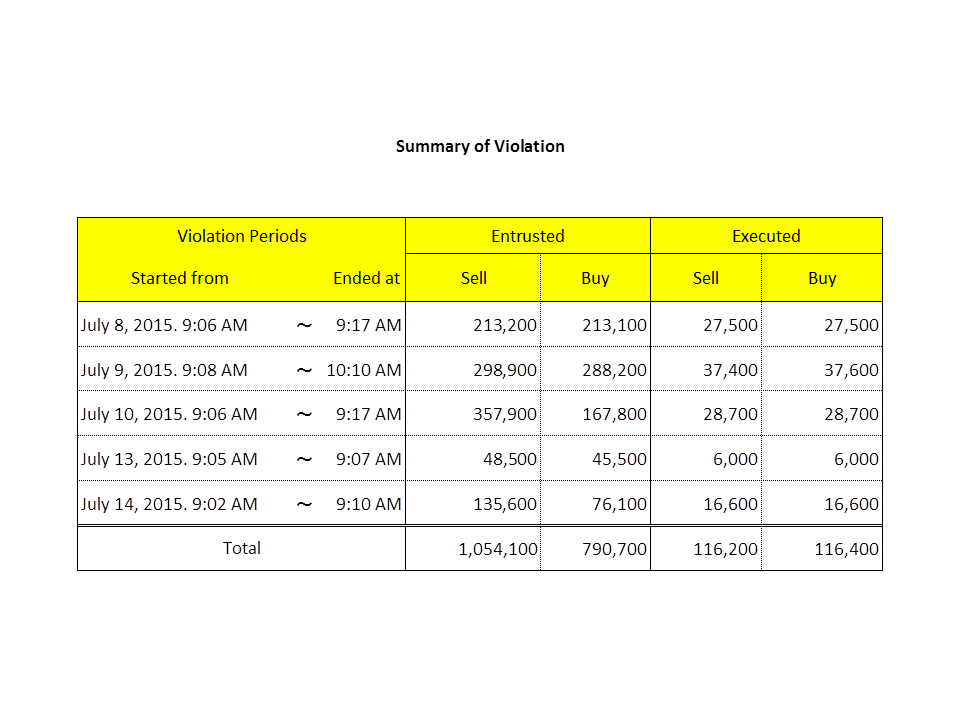

2. Summary of the Findings Regarding Violation of Laws and Ordinances

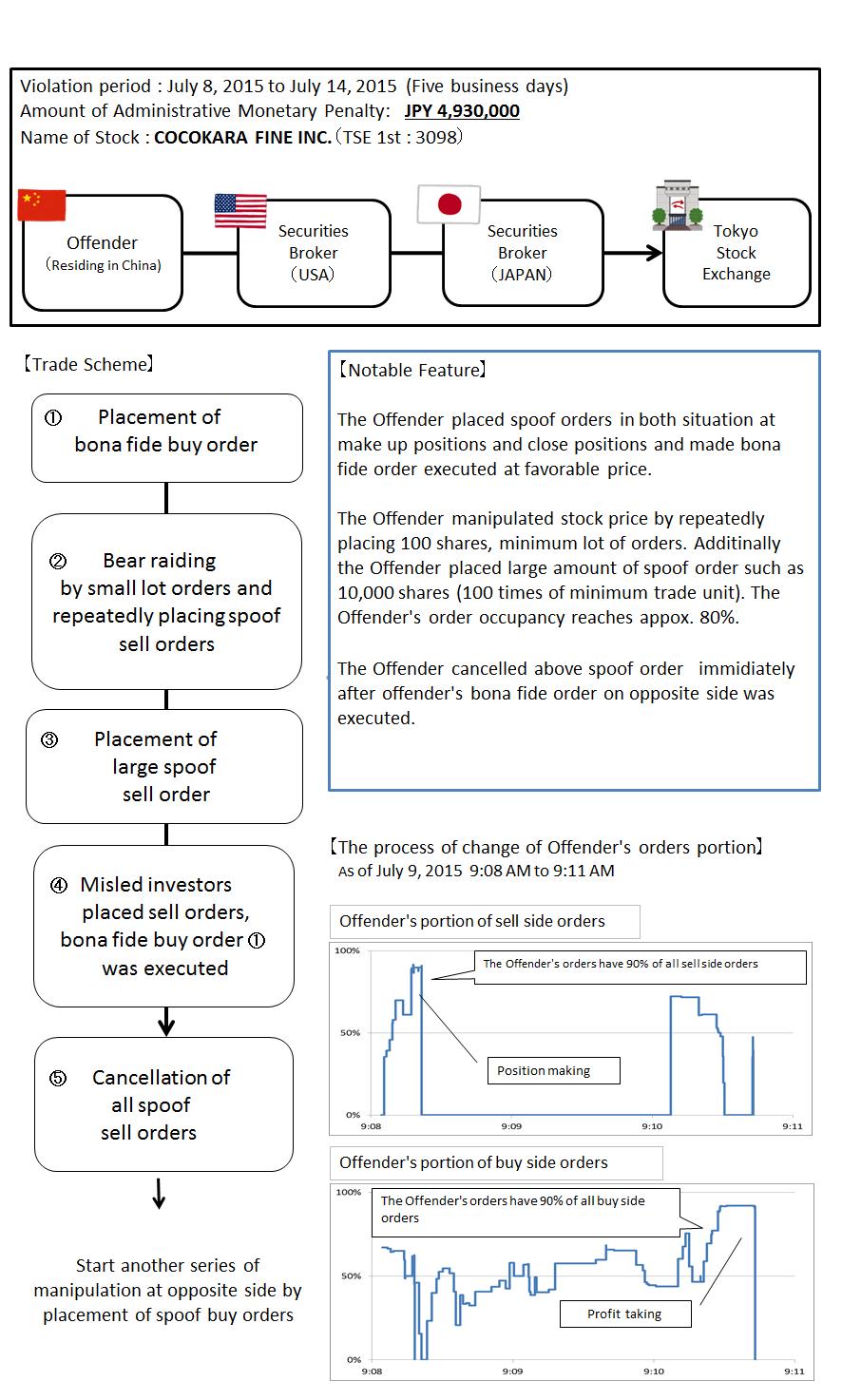

The person subject to the administrative monetary penalty order residing in China (“Offender”), regarding shares of cocokara fine Inc., whose shares are listed on the Tokyo Stock Exchange First Section Market, with the purpose of inducing sales and purchases of other market participants, during five trading days in total, from 9:06 AM on July 8, 2015, to 9:10 AM on July 14, 2015, as described in the Appendix, without intention to execute, conducted transactions by placing a number of purchase orders at prices equal to the best bid and below the best bid price , made entrustments of purchase orders of 790,700 shares and sold 116,200 shares, on the other hand, conducted transactions by placing a number of sell orders at prices equal to best offer and above the best offer price, made entrustments of sell orders of 1,054,100 shares and bought 116,400 shares on its own account. These constituted a series of sales and purchase of securities and entrustments that would mislead others into believing that sales and purchase of the shares were thriving and would cause fluctuations in prices of the shares.

Summaries of the findings regarding the violation of laws and ordinances are described in Attachment 1.

The actions mentioned above conducted by the Offender were recognized as “a series of Sales and Purchase of Securities, etc.” and “Entrustment, etc.” conducted “in violation of Article 159(2)(i)” as stipulated under Article 174-2(1) of the Financial Instruments and Exchange Act (“FIEA”).

3. Calculation of the Amount of the Administrative Monetary Penalty

Pursuant to the FIEA, the amount of the administrative monetary penalty applicable to the above violation is 4,930,000 yen.

Details of the calculation are presented in Attachment 2.

4.Remarks

We appreciate the assistance of the China Securities Regulatory Commission in this matter.

appendix

Attachment 1

Attachment 2

●Method of Calculation of the Amount of the Administrative Monetary Penalty

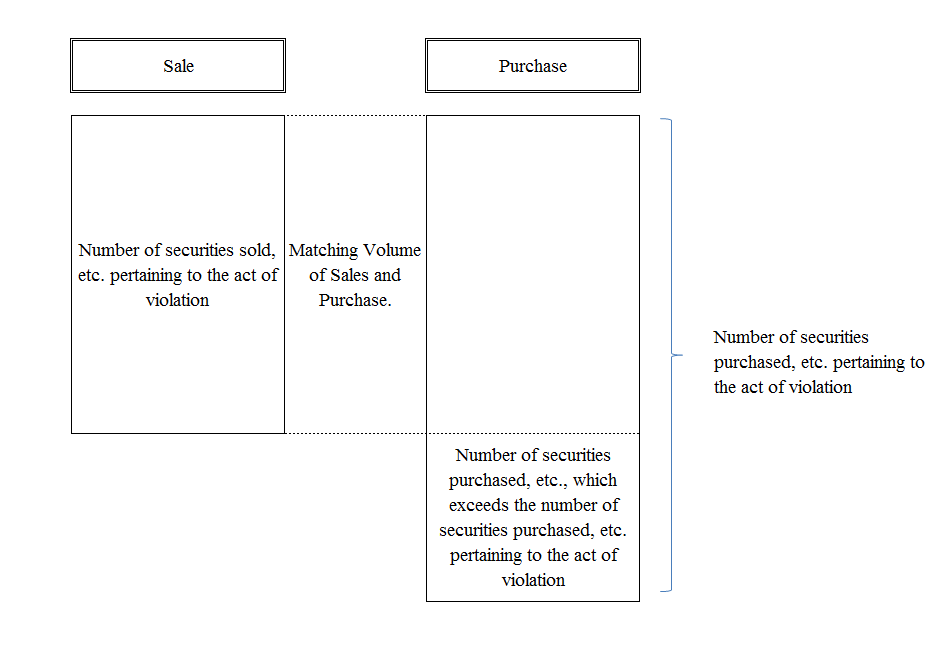

1. Pursuant to the provisions of Article 174-2(1) of the FIEA, the amount of the administrative monetary penalty shall be calculated as follows;

(1) The sum of following (a) and (b)

(a) Amount pertaining to a Matching Volume of Sales and Purchase (Note 1) pertaining to the violation: (Value pertaining to sales, etc. of securities on its own account) – (Value pertaining to purchase, etc. of securities on its own account)

(Note 1): Matching Volume of Sales and Purchase: The smaller of the number of securities sold, etc. and the number of securities purchased, etc. pertaining to the violation.

and

(b) Where the number of securities purchased, etc. on its own account pertaining to the violation exceeds the number of securities sold, etc. on its own account pertaining to the violation: (Highest price among the highest prices as designated under Article 67-19 or Article 130 of the FIEA of the securities on each day during a one-month period following the termination of acts of violation X the excess transaction volume) - (Value pertaining to purchase, etc. of securities with respect to the excess transaction volume)

(2) Pursuant to the provisions of Article 176(2) of the FIEA, any fraction less than ten thousand yen of a sum of the amounts calculated as in (1) above shall be rounded down.

(3) Count up each calculated amounts of (2) above, the total amount is the administrative monetary penalty in the Appendix.

2.In this case, the amount of the administrative monetary penalty is as follows;

(1)Violation period of July 8, 2015.

Because amount pertaining to the sale, etc. of the securities on its own account is 27,500 shares and amount pertaining to the purchase, etc. of the securities on its own account is 27,500 shares,

i. Amount pertaining to a Matching Volume of Sales and Purchase pertaining to the violation (27,500 shares): (Value pertaining to sales, etc. of securities on its own account. 114,531,200 yen) – (Value pertaining to purchase, etc. of securities on its own account. 113,224,950 yen) = 1,306,250 yen.

ii. As pursuant to the provisions of Article 176(2) of the FIEA, any fraction less than ten thousand yen of the amount calculated as in (i) above shall be rounded down, the amount of administrative monetary penalty is 1,300,000 yen.

(2) Violation period of July 9, 2015.

Because amount pertaining to the sale, etc. of the securities on its own account is 37,400 shares and amount pertaining to the purchase, etc. of the securities on its own account is 37,600 shares,

i. Amount pertaining to a Matching Volume of Sales and Purchase pertaining to the violation (37,400 shares): (Value pertaining to sales, etc. of securities on its own account. 149,440,550 yen) – (Value pertaining to purchase, etc. of securities on its own account. 147,684,900 yen) = 1,755,650 yen.

and

ii. As the number of securities purchased, etc. on its own account pertaining to the violation (37,600 shares) exceeds the number of securities sold, etc. on its own account pertaining to the violation (37,400 shares) :

(Highest price among the highest prices designated under Article 67-19 or Article 130 of the FIEA of the securities on each day during a one-month period following the termination of acts of violation as (6,220 yen) X the excess transaction volume) – (Value pertaining to purchase, etc. of securities with respect to the excess transaction volume)

(6,220 yen x 200 shares) – (3,985 yen x 200 shares) = 447,000 yen

Total amount is, i + ii = 2,202,650 yen

iii. As pursuant to the provisions of Article 176(2) of the FIEA, any fraction less than ten thousand yen of a sum of the amounts calculated as in (i) and (ii) above shall be rounded down, the amount of administrative monetary penalty is 2,200,000 yen.

(3) Violation period of July 10, 2015.

Because amount pertaining to the sale, etc. of the securities on its own account is 28,700 shares and amount pertaining to the purchase, etc. of the securities on its own account is 28,700 shares,

i. Amount pertaining to a Matching Volume of Sales and Purchase pertaining to the violation (28,700 shares): (Value pertaining to sales, etc. of securities on its own account. 116,725,010 yen) – (Value pertaining to purchase, etc. of securities on its own account. 115,719,650 yen) = 1,005,360 yen.

ii. As pursuant to the provisions of Article 176(2) of the FIEA, any fraction less than ten thousand yen of the amount calculated as in (i) above shall be rounded down, the amount of administrative monetary penalty is 1,000,000 yen.

(4) Violation period of July 13, 2015.

Because amount pertaining to the sale, etc. of the securities on its own account is 6,000 shares and amount pertaining to the purchase, etc. of the securities on its own account is 6,000 shares,

i. Amount pertaining to a Matching Volume of Sales and Purchase pertaining to the violation (6,000 shares): (Value pertaining to sales, etc. of securities on its own account. 24,352,000 yen) – (Value pertaining to purchase, etc. of securities on its own account. 24,246,500 yen) = 105,500 yen.

ii. As pursuant to the provisions of Article 176(2) of the FIEA, any fraction less than ten thousand yen of the amount calculated as in (i) above shall be rounded down, the amount of administrative monetary penalty is 100,000 yen.

(5) Violation period of July 14, 2015.

Because amount pertaining to the sale, etc. of the securities on its own account is 16,600 shares and amount pertaining to the purchase, etc. of the securities on its own account is 16,600 shares,

i. Amount pertaining to a Matching Volume of Sales and Purchase pertaining to the violation (16,600 shares): (Value pertaining to sales, etc. of securities on its own account. 69,439,000 yen) – (Value pertaining to purchase, etc. of securities on its own account. 69,106,200 yen) = 332,800 yen.

ii. As pursuant to the provisions of Article 176(2) of the FIEA, any fraction less than ten thousand yen of the amount calculated as in (i) above shall be rounded down, the amount of administrative monetary penalty is 330,000 yen.

※ Details of transaction amounts of sales and purchases during violation period, refer to Attachment 3.

3. Total amount of administrative monetary penalty is

Sum of above mentioned (1) to (5),

1,300,000 yen + 2,200,000 yen + 1,000,000 yen + 100,000 yen + 330,000 yen = 4,930,000 yen

Search

Search