Recommendation for Administrative Monetary Penalty Payment Order for Market Manipulation of 10-year Japanese Government Bond Futures by Mitsubishi UFJ Morgan Stanley Securities Co., Ltd.

Japanese version![]()

(Provisional Translation)

June 29, 2018

Securities and Exchange Surveillance Commission

1. Contents of the Recommendation

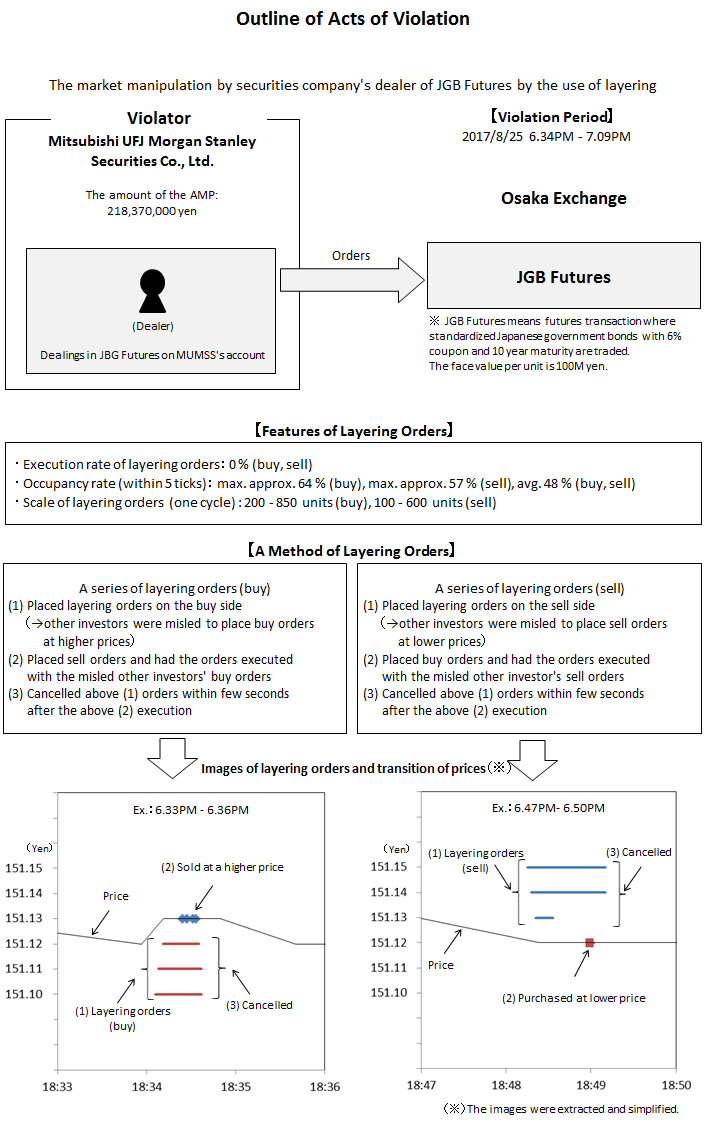

The Securities and Exchange Surveillance Commission today made a recommendation to the Prime Minister and the Commissioner of the Financial Services Agency that an administrative monetary penalty payment order be issued in regard to market manipulation by Mitsubishi UFJ Morgan Stanley Securities Co., Ltd. (Corporate Number: 4010001129098, “MUMSS”) pursuant to Article 20(1) of the Act for Establishment of the Financial Services Agency. This recommendation is based on the findings of an investigation into market manipulation, whereby the following violation of laws and ordinances was identified.

2. Summary of the Findings Regarding Violation of Laws and Ordinances

MUMSS is a stock company that is registered with the Commissioner of the Kanto Local Finance Bureau as a Type I Financial Instruments Business operator. MUMSS, through its employee who engaged in dealing, in relation to its business, regarding 10-year Japanese Government Bond Futures, September 2017 (“10-year JGB Futures”), which was listed on Osaka Exchange, Inc. (“Osaka Exchange”), from 6:34 PM to 7:09 PM on August 25, 2017 as described in the Appendix, with the purpose of inducing Market Transactions of Derivatives of other market participants, without intention to execute, placed buy orders for 6,253 units and sold 177 units by placing a large amount of buy orders at the best bid price and below, and placed sell orders for 1,844 units and bought 158 units by placing a large amount of sell orders at the best offer price and above, on the Osaka Exchange. These transactions constituted a series of Market Transactions of Derivatives and offers that would mislead other investors into believing that Market Transactions of Derivatives were thriving and would cause fluctuations in the market of 10-year JGB Futures.

Summaries of the findings regarding the violation of laws and ordinances are described in Attachment 1.

The actions mentioned above conducted by MUMSS were recognized as “a series of Sales and Purchase of Securities, etc.” and “offers” conducted “in violation of Article 159(2)(i)” as stipulated under Article 174-2(1) of the Financial Instruments and Exchange Act (“FIEA”).

3. Calculation of the Amount of the Administrative Monetary Penalty

Pursuant to the FIEA, the amount of the administrative monetary penalty applicable to the above violation is 218,370,000 yen.

Details of the calculation are presented in Attachment 2.

4. Others

We have investigated this matter based on information provided by the Japan Exchange Regulation (JPX-R).

Attachment 1

Attachment 2

● Method of Calculation of the Amount of the Administrative Monetary Penalty

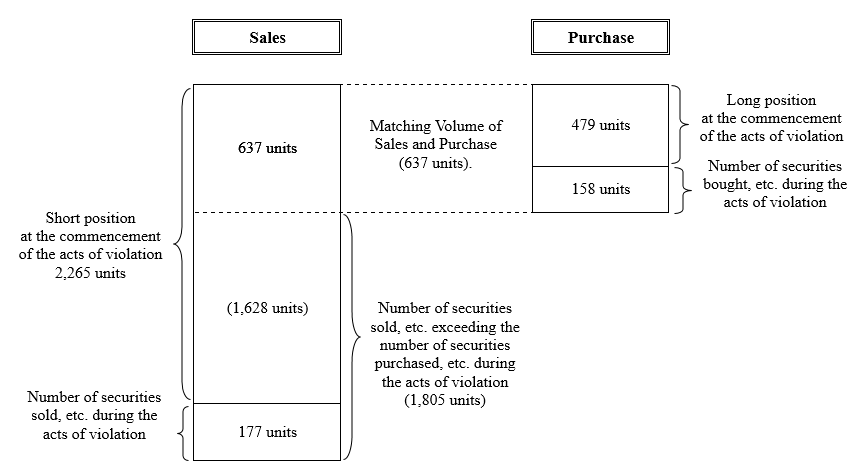

1. Pursuant to the provisions of Article 174-2(1) of the FIEA, the amount of the administrative monetary penalty shall be calculated as the sum of (1) and (2) below:

(1) Amount pertaining to a Matching Volume of Sales and Purchase (Note 1) pertaining to the acts of violation: (Value pertaining to sales, etc. of securities on its own account) – (Value pertaining to purchase, etc. of securities on its own account)

(Note 1) :Matching Volume of Sales and Purchase: The smaller of the number of securities sold, etc. and the number of securities purchased, etc. pertaining to the acts of violation

(2) Where the number of securities sold, etc. on its own account pertaining to the acts of violation exceeds the number of securities purchased, etc. on its own account pertaining to the acts of violation: (Value pertaining to the exceeding volume) – (The lowest price as designated under Article 67-19 or Article 130 of the FIEA during a one-month period following the end of the acts of violation X the exceeding volume)

2. In this case, the amount of the administrative monetary penalty is 218,370,000 yen. This amount is based on the sum of the amounts calculated as in (1) and (2) below.

(1) The amount of the administrative monetary penalty regarding the amount pertaining to a Matching Volume of Sales and Purchase (Note 2) is 0 yen.

(Note 2): Matching Volume of Sales and Purchase is 637 units as described below:

(i) Amount pertaining to the sale, etc. of the securities on its own account is 2,442 units, which includes 177 units that were sold, etc. during the acts of violation and 2,265 units that were sold short on its account by the time of the commencement of the acts of violation and are deemed to have been sold at the nominal price of 151.12 yen per unit, which was the price of 10-year JGB Futures at the time of the commencement of the acts of violation, pursuant to Article 174-2 (7) of the FIEA and Article 33-12(i) of the Order for Enforcement of the FIEA.

(ii) Amount pertaining to the purchase, etc. of the securities on its own account is 637 units, which includes 158 units that were purchased, etc. during the acts of violation and 479 units that were in its own possession at the time of the commencement of the acts of violation and are deemed to have been purchased at the nominal price of 151.12 yen per unit, which was the price of 10-year JGB Futures at the time of the commencement of the acts of violation, pursuant to Article 174-2 (8) of the FIEA and Article 33-13(i) of the Order for Enforcement of the FIEA.

(Note 3): The calculation is as below.

(637 units X 151.12 yen X 1,000,000) - (637 units X 151.12 X 1,000,000)

(Note 4): 10-year JGB Futures is a future transaction of standardized instruments and its value per unit is calculated by multiplying its nominal price per unit by 1,000,000.

(2) The amount of the administrative monetary penalty regarding the exceeding volume where the amount pertaining to the sales, etc. of the securities exceeds the amount pertaining to the purchase, etc. of the securities as described in (1) above is 218,370,000 yen (Note 5)(Note 6).

(Note 5): The amount is calculated as below:

(Value pertaining to the exceeding volume (1,805 units)) - (The lowest price as designated under Article 67-19 or Article 130 of the FIEA during a one-month period following the end of the acts of violation (151.00 yen) X the exceeding volume (1,805 units))

(Note 6): The calculation is as below:

{(1,628 units X 151.12 yen X 1,000,000) + (177 units X 151.13 yen X 1,000,000)} – (1,805 units X 151.00 yen X 1,000,000)

= 218,370,000 yen

[Reference]

Search

Search