(Provisional Translation in English)

November 5, 2021

Securities and Exchange Surveillance Commission

Recommendation for Administrative Monetary Penalty Payment Order for Market Manipulation in shares of Yamaha Corporation by Evolution Trading Ltd

1. Contents of the Recommendation

The Securities and Exchange Surveillance Commission, today, made a recommendation to the Prime Minister and the Commissioner of the Financial Services Agency that an administrative monetary penalty payment order be issued in regard to market manipulation by Evolution Trading Ltd pursuant to Article 20(1) of the Act for Establishment of the Financial Services Agency. This recommendation is based on the findings of an investigation into market manipulation, whereby the following violation of laws and ordinances was identified.

Note: Evolution Trading Ltd had no relationship with the similar name company, (i) EVOLUTION JAPAN SECURITIES Co., Ltd. and (ii) EVOLUTION JAPAN ASSET MANAGEMENT Co., Ltd., both of which have been registered as Financial Instruments Business Operator in Tokyo, Japan.

2. Summary of the Findings Regarding Violations of Laws and Ordinances

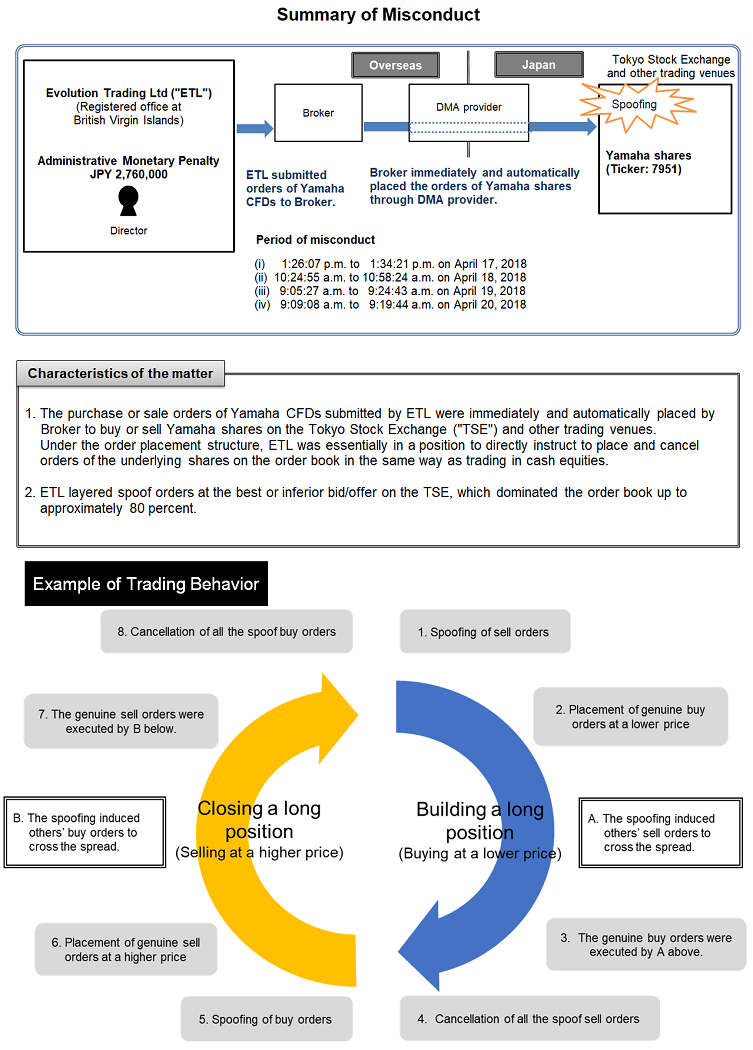

Evolution Trading Ltd (“ETL”), a company incorporated in the British Virgin Islands, traded contracts for difference (“CFDs”), whose underlying assets were Japanese stocks, with an overseas securities broker (“Broker”). On receipt of the order from ETL, the Broker in turn immediately and automatically placed an order to buy or sell underlying shares on the Tokyo Stock Exchange (“TSE”) and other trading venues through a direct market access provider. (Note: Under the order placement structure, ETL was essentially in a position to directly instruct the orders to buy or sell the underlying shares on the order book. The summary of misconduct is shown in Chart.)

ETL, through its director residing abroad during the course of his duties, placed orders with the Broker to buy or sell CFDs whose underlying assets were shares of Yamaha Corporation listed on the first section of the TSE (“Yamaha CFDs”), with no intention to execute them. This was done for the purpose of raising or depressing the share price by inducing purchases or sales of the shares by others, during the period of four business days from 1:26:07 p.m. on April 17, 2018, to 9:19:44 a.m. on April 20, 2018.

Specifically, under the order placement structure described above, ETL sold a total of 222,500 Yamaha CFDs at a favorable price, which was artificially raised through placing non-bona fide purchase orders of a total of 347,300 Yamaha CFDs at the best or inferior bid. Similarly, it purchased a total of 222,700 Yamaha CFDs at a favorable price, which was artificially depressed through placing non-bona fide sale orders of a total of 305,300 Yamaha CFDs at the best or inferior offer. (Note: The manipulative trading practice by ETL is typically known as layering or spoofing. The behavior of misconduct is shown in Appendix 1.)

This constituted a series of purchase or sale of OTC derivatives that would potentially mislead others into believing that purchase or sale of securities are thriving and cause fluctuations in prices of the shares listed on the TSE.

The act by ETL described above was recognized as “a series of Sales and Purchase of Securities, etc.” and “make an offer” conducted “in violation of Article 159(2)(i)” as stipulated under Article 174-2(1) of the Financial Instruments and Exchange Act (“FIEA”).

3. Calculation of the Amount of the Administrative Monetary Penalty

Pursuant to the FIEA, the amount of the administrative monetary penalty applicable to the above violation is a total of 2,760,000 yen. (Note: The amount is almost equal to the illicit profits gained from the series of purchase and sale of the CFDs by ETL. The calculation is shown in Appendix 2-1 to 2-4.)

4. Acknowledgements

We appreciate the assistance of the British Virgin Islands Financial Services Commission, the China Securities Regulatory Commission, the Hong Kong Securities and Futures Commission, the Monetary Authority of Singapore, and the Japan Exchange Regulation in this matter.

Chart

Search

Search