(Provisional Translation)

September 17, 2021

Securities and Exchange Surveillance Commission

Petition for the issuance of a prohibition and suspension order by the court against acts in violation of the Financial Instruments and Exchange Act committed by SKY PREMIUM INTERNATIONAL PTE. LTD. and its officer

1. Details of the petition

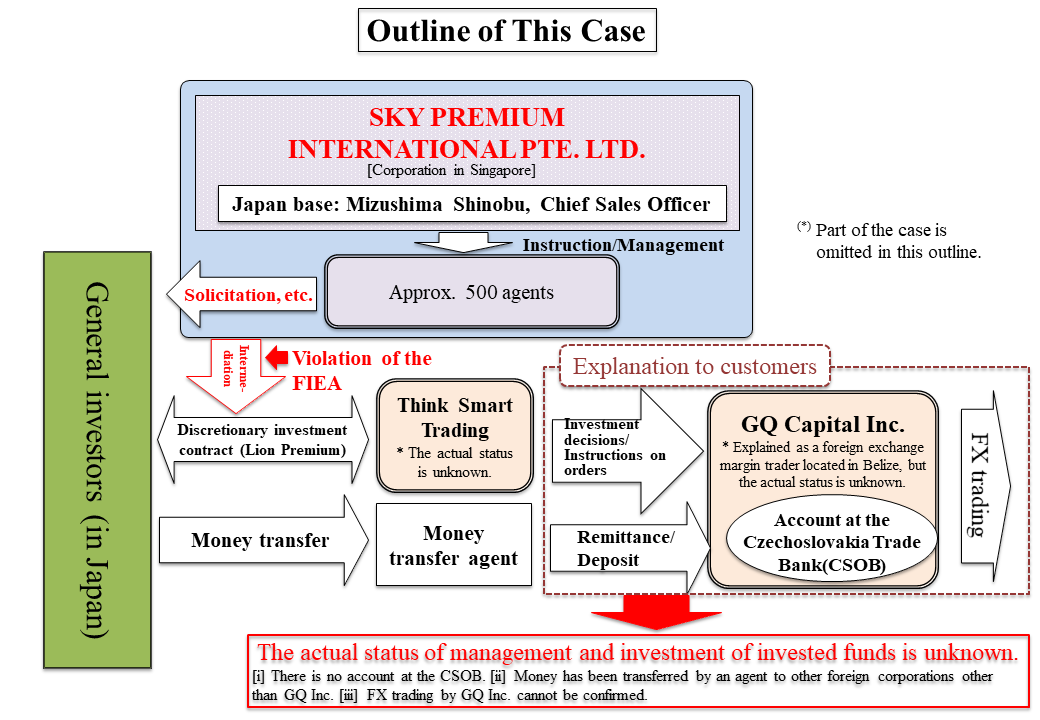

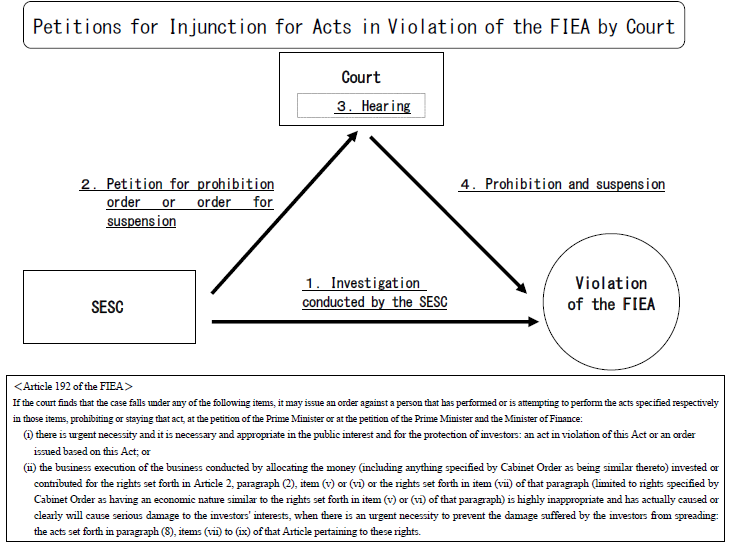

With regard to SKY PREMIUM INTERNATIONAL PTE. LTD. (based in the Republic of Singapore; not registered for engaging in financial instruments business; hereinafter, the "Company"), whose major business is membership organization business, the Securities and Exchange Surveillance Commission (SESC) conducted an investigation under Article 187, paragraph (1) of the Financial Instruments and Exchange Act (the "FIEA"). As a result, the fact described in 2. below was found. Accordingly, today, pursuant to the provisions of Article 192, paragraph (1) of the FIEA, the SESC filed a petition with the Tokyo District Court to issue an order against the Company and Mizushima Shinobu, its Chief Sales Officer (CSO), who is responsible for managing sales activities in Japan, (hereinafter, the Company and Mizushima Shinobu are collectively referred to as the "Company, etc.") to prohibit and suspend acts in violation of the FIEA (offering intermediary services for the conclusion of discretionary investment contracts on a regular basis without registration).

2. Facts

The Company is a foreign corporation that was established in the Republic of Singapore on February 20, 2013, and has been mainly engaged in membership organization business.

Without obtaining registration as prescribed in Article 29 of the FIEA, the Company has held investment seminars or otherwise had its approximately 500 agents solicit general investors in Japan to acquire LION PREMIUM* that is available only for its members (a foreign investment instrument falling under an instrument managed based on a discretionary investment contract; hereinafter, referred to as "Lion Premium"), and has subsequently provided advice and instruction concerning how to fill in an application form, thereby offering intermediary services for the conclusion of discretionary investment contracts for the relevant instrument between customers and Think Smart Trading (the company that allegedly makes investment decisions and gives instructions on orders for Lion Premium; whether the company has a juridical personality, whether the company really exists, and the actual status of the company are unknown).

The Company, etc. (including the Company's predecessor, NSC PLANNING K.K.) have offered intermediary services for the conclusion of discretionary investment contracts for long periods, including solicitation for acquisition of SAMURAI SYSTEM and Lion, predecessors of Lion Premium.

According to their explanation, they have had approximately 22,000 general investors (members) conclude contracts for Lion Premium (including its predecessors) (the number of members who hold investment balances at present is unknown), and the total amount invested by general investors based on these contracts amounts to approximately 120 billion yen (they allege that they have refunded approximately 50 billion yen to investors so far, but the outstanding amount of assets in custody is unknown).

The aforementioned acts of the Company, etc. fall under the investment advisory and agency business prescribed in Article 28, paragraph (3), item (ii) of the FIEA, and conducting such acts without registration constitutes a violation of Article 29 of the FIEA.

As it is highly likely that the Company, etc. will continue the aforementioned acts in violation of the FIEA, it is necessary to prohibit and suspend them from conducting those acts as expeditiously as practicable.

* Lion Premium is explained as an instrument for which foreign exchange margin trading (FX trading) is conducted by GQ CAPITAL INC. (explained as a foreign exchange margin trader established in Belize in 2015; hereinafter, referred to as "GQ Inc.") based on investment instructions given by Think Smart Trading, and funds invested by customers are separately managed in an account opened under the name of GQ Inc. at the Czechoslovakia Trade Bank (the "CSOB").

However, the investigation by the SESC revealed the following facts that are inconsistent with the explanation given to customers: [i] there is no account under the name of GQ Inc. at the CSOB; [ii] funds invested by customers have been transferred to accounts of multiple foreign corporations other than GQ Inc. in names irrelevant to Lion Premium; [iii] it cannot be confirmed that GQ Inc. is conducting FX trading. In this manner, the actual status of investment and management of funds invested by customers is unknown.

〇 The SESC filed a petition with the court for the issuance of an order to prohibit and suspend acts in violation of the Financial Instruments and Exchange Act (unregistered business operation) against SKY PREMIUM INTERNATIONAL PTE. LTD. (the "Company") (on September 17, 2021).

〇 The investigation conducted by the SESC revealed facts different from the Company's explanation to its customers regarding investment funds, and the actual status of the investment and management of the funds is unknown.

〇 The Company has not obtained registration for engaging in financial instruments business. GQ Inc. (also called "GQFX") has also not been registered as a company to engage in financial instruments business.

〇 The Company, etc. have conducted solicitation for acquisition of Lion Premium by such means as holding investment seminars titled "Sky Premium Official Seminar," etc., with its agents serving as lecturers, in Tokyo and other various areas nationwide or virtually online, or having its agents individually explain the details of the instrument to investors.

〇 The Company, etc. have offered intermediary services for the conclusion of contracts by having its members fill in application forms in Japanese themselves or having its members affix their signatures on application forms in Japanese which have been filled in by its agents in lieu of them in advance.

〇 The Company, etc. are also introducing installment-type overseas investment instruments offered by RL360 Insurance Company Limited, Premier Trust, Inc., and Cornhill Management, Ltd., in addition to Lion Premium, on its website, but they have not been registered for dealing with any of those instruments.

[To general investors]

〇 There have been many problematic cases where unregistered business operators failed to conduct trading as stipulated in agreed contracts. Please note that unregistered business operators are outside the FSA's supervisory authority and the FSA is not authorized to issue an order or disposition based on regulations for investor protection against them.

〇 Even if a business operator has been registered with a foreign authority, the relevant foreign authority may not supervise or give guidance regarding the business operator’s trade with customers with foreign nationalities or may not have supervisory authority equivalent to that of the FSA. Please note that registration with a foreign authority does not guarantee the application of regulations on investor protection equivalent to the relevant regulations in Japan.

〇 Generally, unregistered business operators, who are not conducting trading of certain instruments as stipulated in agreed contracts, may make refunds to customers upon their requests by allocating funds invested by other customers. However, please note that even if you have been able to receive refunds so far, such fact does not necessarily prove the credibility of the relevant instrument.

〇 It is illegal to conduct financial instruments business without obtaining registration in Japan. Please check whether the counterparty is a registered business operator or not by referring to here.

Please access here for names or other information of business operators for which the FSA (Local Finance Buraus) issued a warning on the grounds that they have conducted financial instruments business without registration.

Please access here for names or other information of business operators for which the FSA (Local Finance Buraus) issued a warning on the grounds that they have conducted financial instruments business without registration.

〇 Please access here for notes on foreign exchange margin trading (FX trading).

〇 Please access here for notes on solicitation activities by unregistered business operators located overseas.

(Click to zoom in.)

(Click to zoom in.)

Reference

○Investment Advisory and Agency BusinessFinancial Instruments and Exchange Act (Extract)

(Definitions)

Article 2 (1) (Omitted)

(2) to (7) (Omitted)

(8) The term "Financial Instruments Business" as used in this Act means performance of any of the following acts (omitted):

(i) to (xii) (Omitted)

(xiii) agency or intermediation for the conclusion of an Investment Advisory Contract or a Discretionary Investment Contract;

(xiv) to (xviii) (Omitted)

(9) to (40) (Omitted)

Article 28 (1) (Omitted)

(2) (Omitted)

(3) The term "Investment Advisory and Agency Business" as used in this Chapter means the performance of any of the following acts on a regular basis, within the Financial Instruments Business:

(i) (Omitted)

(ii) an act set forth in Article 2, paragraph (8), item (xiii).

(4) to (8) (Omitted)

(Registration)

Article 29 A person may not engage in Financial Instruments Business if that person has not been registered by the Prime Minister.

Article 197-2 A person that falls under any of the following items is subject to punishment by imprisonment for not more than five years, a fine of not more than five million yen, or both:

(i) to (x)-3 (Omitted)

(x)-4 a person that has, in violation of Article 29, conducted Financial Instruments Business without obtaining registration from the Prime Minister;

(x)-5 to (xv) (Omitted)

Article 207 (1) If the representative of a corporation (Omitted) or the agent, employee, or other worker of a corporation or individual violates the provisions set forth in any of the following items in connection with the business or property of the corporation or individual, in addition to the offender being subject to punishment, the corporation is subject to punishment by the fine prescribed in the relevant item and the individual is subject to punishment by the fine prescribed in the provisions referred to in the relevant item:

(i) (Omitted)

(ii) Article 197-2 (excluding items (xi) and (xii)) or Article 197-3: a fine of not more than 500 million yen;

(iii) to (vi) (Omitted)

(2) and (3) (Omitted)

○Petition for an emergency court injunction

Financial Instruments and Exchange Act (Extract)

(Dispositions for Investigations Involving Inquiries)

Article 187 (1) The Prime Minister or the Prime Minister and the Minister of Finance may have the relevant officials reach the following dispositions for the purpose of conducting the investigations necessary for a hearing under the provisions of this Act, a hearing involving a disposition under the provisions of this Act, or a petition under the provisions of Article 192:

(i) ordering a person concerned or a witness to appear in order to hear that person's opinion, or having such a person submit a written opinion or a written report;

(ii) ordering an expert to appear so as to have the expert present an expert opinion;

(iii) ordering a person concerned to submit books, documents, and any other articles, or retaining submitted articles; and

(iv) inspecting the state of the business or assets, or the books, documents, and any other articles, of a person concerned.

(2) (Omitted)

(Issuance of Prohibition Orders and Stay Orders by the Court)

Article 192 (1) If the court finds that the case falls under any of the following items, it may issue an order against a person that has performed or is attempting to perform the acts specified respectively in those items, prohibiting or staying that act, at the petition of the Prime Minister or at the petition of the Prime Minister and the Minister of Finance:

(i) there is urgent necessity and it is necessary and appropriate in the public interest and for the protection of investors: an act in violation of this Act or an order issued based on this Act; or

(ii) (Omitted)

(2) to (4) (Omitted)

Article 198 A person that falls under any of the following items is subject to imprisonment for not more than three years, a fine of not more than three million yen, or both:

(i) to (vii) (Omitted)

(viii) a person that violates an order of the court under Article 192, paragraph (1) or (2).

Article 207 (1) If the representative of a corporation (omitted) or the agent, employee, or other worker of a corporation or individual violates the provisions set forth in any of the following items in connection with the business or property of the corporation or individual, in addition to the offender being subject to punishment, the corporation is subject to punishment by the fine prescribed in the relevant item and the individual is subject to punishment by the fine prescribed in the provisions referred to in the relevant item:

(i) and (ii) (Omitted)

(iii) Article 198 (omitted) or Article 198-3 to Article 198-5: a fine of not more than 300 million yen;

(iv) to (vi) (Omitted)

(2) and (3) (Omitted)

Search

Search