[Notices]

○Electronic Share Certificate System launched on January 5, 2009!

The following are answers to some of the frequently asked questions on the Electronic Share Certificate System.

Q1. What is the Electronic Share Certificate System?

The Electronic Share Certificate System (hereafter referred to as “paperless shares”) refers to the system which, under the Act on Book-Entry Transfer of Company Bonds, Shares, etc., does away with all share certificates relating to the shares, etc. of listed companies, and which electronically manages shareholder rights, the administration of which had previously been premised on the existence of actual share certificates, by using accounts held at the Japan Securities Depository Center (JASDEC) or at securities companies or other financial institutions.

The Electronic Share Certificate System was launched on January 5, 2009, and the management of shareholder rights in listed companies was unified into electronic management based on a new share management system.

Q2. What are the advantages of the Electronic Share Certificate System?

The Electronic Share Certificate System has many advantages, including the following.

(1) For shareholders:

(i) The risk of loss or theft due to keeping share certificates at hand, and the risk of acquiring forged share certificates are eliminated.

(ii) When buying or selling shares, shareholders no longer have to actually deliver or receive the share certificates, and no longer need to apply to have the shares transferred in the shareholder registry.

(iii) When an issuing company changes its trade name or changes the trading unit, shareholders no longer need to submit their share certificates to an issuing company for exchange.

(2) For issuing companies (including shareholder registry administrators):

(i) When transferring shares in a shareholder registry, issuing companies no longer need to check whether the share certificates are forged.

(ii) Issuing companies can reduce their printing costs and stamp duties paid as a consequence of issuing share certificates, and can reduce their costs for collecting and delivering share certificates as a consequence of a corporate restructure (merger, share exchange, share transfer, etc. between companies).

(iii) Issuing companies no longer need to go through the registration procedures for lost share certificates.

(3) For securities companies:

(i) Securities companies can reduce the risks and costs associated with the safekeeping and delivery of share certificates.

(ii) Securities companies no longer need to go through procedures if a shareholder deposits share certificates with JASDEC, or if they withdraw share certificates deposited with JASDEC.

Q3. Under the Electronic Share Certificate System, what procedures are required of the shareholders?

(1) Shareholders, who had deposited share certificates with JASDEC prior to the launch of the Electronic Share Certificate System, do not need to take any special steps.

(2) Shareholders, who did not deposit share certificates with JASDEC prior to the launch of the Electronic Share Certificate System and who have kept them on hand, can have their rights preserved by having the issuing company open a “special account” in the name of the shareholder registered in the shareholder registry.

However, transactions such as the sale of shares and placement of mortgages cannot be performed using the special account. To conduct such transactions, the shareholder needs to open an account with a securities company and go through procedures to transfer the shares from the special account. Shareholders wishing to trade their shares should consult with a securities company or a trust bank, etc. that opens special accounts.

Q4. If the Electronic Share Certificate System was ushered in with share certificates still at hand and without having transferred their title, what procedures are necessary to restore the name of the special account to one's own name?

The following steps need to be taken in order to restore the name of a special account, which was opened in someone else's name, to one's own name.

(1) Apply jointly with the holder of the special account

(2) Apply by submitting any of the following documents:

(i) Document certifying inheritance

(ii) Court decision, record of settlement, etc.

(iii) Share certificates + a document certifying that the share certificates were acquired prior to the Electronic Share Certificate System (only during the first year following the Electronic Share Certificate System)

Persons wishing to go through these procedures should consult with a trust bank, etc. that opens special accounts.

Q5. How can share-backed transactions be conducted?

Following the launch of the Electronic Share Certificate System, if shares are to be pledged as collateral, this can be done by transferring them to the mortgagee's account at a bank, etc. Persons wish to conduct such a transaction should consult with the securities company or bank of the counterparty.

Even after the start of the Electronic Share Certificate System, it is still possible to ensure the anonymity of share-backed transactions.

Q6. Are pre-listed shares covered by the Electronic Share Certificate System?

The Electronic Share Certificate System covers shares that are listed on a securities exchange. Therefore shares that have not yet been listed (unlisted shares) are not covered by the system.

Note: In addition to certificates of listed shares, the Electronic Share Certificate System also covers listed investment securities and listed preferred equity investment securities.

Q7. Are there any points to note following the launch of the Electronic Share Certificate System?

Following the launch of the Electronic Share Certificate System, it cannot be guaranteed that there will not be any fraudulent activity, such as acts to sell share certificates under the pretense of them having value, or acts of collecting share certificates under the name of the Financial Services Agency (FSA), a securities company or some other relevant organization (see Note).

The FSA, securities companies, relevant organizations and so forth do not collect share certificates. Extra care should be taken against such fraudulent activity.

Note: Even after the launch of the Electronic Share Certificate System, share certificates can still serve as important documentary evidence when restoring the name of an account, and so care should be taken with respect to their management and disposal.

○Watch out for malicious solicitations for funds!

Business operators must be registered to solicit investments in funds.

On September 30, 2007, the Financial Instruments and Exchange Act (FIEA) came into force, and an obligation to register with local finance bureaus (including the Fukuoka Local Finance Branch Bureau and the Okinawa General Bureau) was placed upon business operators engaged in soliciting general investors to invest in funds. (Business operators engaged in services for professional investors (= specially permitted businesses for qualified institutional investors, etc.) were similarly imposed with an obligation of notification.)

Specifically, business operators who

- Collect money from others (solicit for equity investments),

- Conduct some kind of business or investment, and

- Operate a system whereby revenues generated from the business or investment are distributed to the equity investors

are now required to register with, or notify, their local finance bureaus.

Registered fund managers and notified fund managers can be checked on the FSA website.

Great care should be taken against investment solicitations and so forth from unregistered persons.

Furthermore, when soliciting contributions and so forth, even registered fund managers must, for instance, abide by the following rules:

- When making public advertisements, the business operator must indicate that it is a financial instruments business operator, and must indicate its registration number; and with regard to the outlook of profits, the business operator shall not make any indications that are significantly contradictory to facts or seriously misleading.

- When the business operator intends to conclude a contract, it shall deliver to the customer in advance a document containing the business operator's registration number, an outline of the contract and an outline of the fees.

- The business operator shall not “deliver false information” or “solicit by providing an assertive judgment on uncertain matters.”

- The business operator shall not compensate for losses.

The FSA recommends that people act with caution if they are not sure whether a fund manager is trustworthy, even if that manager is registered.

With respect to notified fund managers, they are able to engage in business as long as they give notification to the FSA. At the time of notification, the FSA does not perform any screening or other kind of examination. Therefore, just because notification has been made does not necessarily mean that reliability can be assured, and so people should exercise great care when conducting transactions.

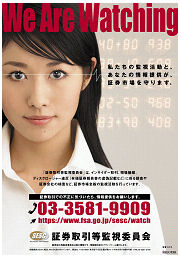

○Protecting the markets with information received from the public!

The mission of the Securities and Exchange Surveillance Commission![]() (SESC) is to ensure the fairness and transparency of Japan's markets and to protect investors, through exerting its authority of market surveillance, inspections of securities companies, administrative monetary penalties investigations, disclosure documents inspections and investigations of criminal cases.

(SESC) is to ensure the fairness and transparency of Japan's markets and to protect investors, through exerting its authority of market surveillance, inspections of securities companies, administrative monetary penalties investigations, disclosure documents inspections and investigations of criminal cases.

The SESC receives a wide range of information from the general public via phone, mail, fax and the internet, relating to suspected misconducts in the market such as those below. Information received is effectively used as reference material in its investigations, inspections and other activities. During business year 2008, the SESC received 6,412 items of information.

« Information on specific stocks »

|

Poster calling on the general public to provide information |

« Information on financial instruments business operators, etc. »

- Wrongful acts by securities companies, foreign exchange margin (FX) traders, management firms, investment advisory companies, etc. (inadequate explanation of risks, system-related problems, etc.)

- Problems related to business management systems or financial conditions (risk management, customer asset segregation, calculation of capital adequacy ratio, etc.)

« Other information »

- Information on suspicious financial instruments, suspicious funds (fraudulent fund-raising schemes, etc.) or on unregistered business operators

- Information on market participants who are likely to impair the fairness of markets (so-called speculator groups, etc.)

If you have any information like that described above, please be sure to submit it to the SESC. In addition to information on shares, the SESC also accepts a wide range of information on derivatives, bonds and other financial instruments. (Please note that the SESC does not accept individual requests for dispute resolution and inspections.)

To submit information via the internet, please access the Securities Watch & Report Portal![]() on the SESC website.

on the SESC website.

SESC Securities Watch & Report Portal

Information Processing Officer, Market Surveillance Division,

Executive Bureau, Securities and Exchange Surveillance Commission

Central Government Office Building No.7, 3-2-1 Kasumigaseki, Chiyoda-ku, Tokyo, JAPAN 100-8922

Direct line: +81 (3) 3581-9909

Switchboard: +81 (3) 3506-6000 (extensions 3091, 3093)

Fax: +81 (3) 5251-2136

https://www.fsa.go.jp/sesc/watch/![]()

○Beware of malicious phone calls from people pretending to be from the FSA or SESC! Warnings about unlisted shares.

Many reports have been received of people claiming affiliation with the Financial Services Agency (FSA), the Securities and Exchange Surveillance Commission (SESC) or other organizations with similar sounding names, and

who:

- Indicate they are “conducting a survey of victims related to unlisted shares,” or that “the unlisted shares the customer has at hand are safe because it has been decided to list them”; and then at about the same time, a person claiming to be the issuer of the unlisted shares suggests an additional purchase of the unlisted shares; or

- Indicate they are “negotiating on behalf of the victims of the unlisted shares for the company to repurchase the shares,” and who then request some kind of fee or remuneration.

Note: Examples of names that are suggestive of the Securities and Exchange Surveillance Commission:

Securities Surveillance Commission, NPO Securities Surveillance Commission, Securities and Exchange Audit Commission, Securities and Exchange Surveillance Association, etc.

Please be very careful of suspicious calls like those above. Personnel from the FSA and the SESC would never mention on the phone when unlisted shares are to be listed, or negotiate the purchase of unlisted shares. Nor would they ever outsource such operations.

If you receive such a call, please contact the FSA Counseling Office for Financial Services Users![]() or the SESC Securities Watch & Report Portal

or the SESC Securities Watch & Report Portal![]() and provide them with your information. Also, please report the incident to your nearest police station.

and provide them with your information. Also, please report the incident to your nearest police station.

♦ FSA Counseling Office for Financial Services Users

Phone (Navi-Dial): 0570-016811

* (from IP phones or PHS): +81 (3) 5251-6811

Fax: +81 (3) 3506-6699

♦ SESC Securities Watch & Report Portal

Information Processing Officer, Market Surveillance Division,

Executive Bureau, Securities and Exchange Surveillance Commission

Direct line: +81 (3) 3581-9909 Fax: +81 (3) 5251-2136

Switchboard: +81 (3) 3506-6000 (extensions 3091, 3093)

[Minister in His Own Words]

Please visit the “Press Conferences” section of the FSA website to read the press conference by the minister.

○Use of the “e-Gov e-Application System”

As an initiative to improve services and convenience for Japan's citizens, applications and notifications for which the Financial Services Agency (FSA) is the competent authority can be made electronically using the “e-Gov e-Application System![]() ” (http://shinsei.e-gov.go.jp/menu/smenu.html

” (http://shinsei.e-gov.go.jp/menu/smenu.html![]() ). Everyone is encouraged to actively use the system.

). Everyone is encouraged to actively use the system.

For details of the applications and notifications that can be processed using this system, please check with the “Search Via List of Laws![]() ” in the “Guide to Appliction & Notification Procedures, About the FSA Certification Authority” (http://www.fsa.go.jp/common/shinsei/index.html). Please also note that, to use this system, you are required to agree to the “Rules for Using the e-Gov e-Application System

” in the “Guide to Appliction & Notification Procedures, About the FSA Certification Authority” (http://www.fsa.go.jp/common/shinsei/index.html). Please also note that, to use this system, you are required to agree to the “Rules for Using the e-Gov e-Application System![]() ”.

”.

○ Advantages of using the “e-Gov e-Application System”

Anytime

|

|

|

Anywhere

|

*For a detailed description of how to use the “e-Gov e-Application System,” please check with “Click here to use the e-Gov e-Application System![]() ” on the e-Gov top page

” on the e-Gov top page![]() .

.

○ Subscribing to the Email Information Service (Japanese/English)

The Financial Services Agency provides an Email Information Service (Japanese and English) through its website. If you register your email address on the Japanese subscription page, we will email you once a day with the latest information, such as the monthly publication, “Access FSA,” and daily press releases.

If you register on the English subscription page, we will email you once a day with the latest information, such as the “What's New” information on the English website as well as the “FSA Newsletter.”

To register in Japanese, please access ![]()

![]() , and to register in English, please access Subscribing to E-mail Information Service

, and to register in English, please access Subscribing to E-mail Information Service

○ Subscribing to the SESC Email Information Service

The Securities and Exchange Surveillance Commission (SESC) provides an Email Information Service (Japanese/English) through its website. If you register your email address, we will email you with the latest information from the SESC website, such as recommendations relating to administrative action against financial instruments business operators and recommendations relating to orders for the payment of administrative monetary penalties.

*For further details and to register in Japanese, please access ![]()

![]() , and to register in English, please access Subscribing to E-mail Information Service on the SESC website.

, and to register in English, please access Subscribing to E-mail Information Service on the SESC website.

○ Subscribing to the CPAAOB Email Information Service

The Certified Public Accountants and Auditing Oversight Board (CPAAOB) provides an Email Information Service (Japanese/English) through its website. If you register your email address, we will email you with the latest information from the CPAAOB website.

*For further details and to register in Japanese, please access ![]()

![]() , and to register in English, please access Subscribing to E-mail Information Service on the CPAAOB website.

, and to register in English, please access Subscribing to E-mail Information Service on the CPAAOB website.

[Main Press Releases in November/December]

| November 6 |

Publication of the draft Cabinet Office Ordinances, etc. in the system for disclosure of corporate information, etc. pertaining to the 2009 partial revision of the Financial Instruments and Exchange Act etc. | ||

|---|---|---|---|

| 11 | Invitation for comments on the draft partial revisions to relevant Cabinet Orders, Cabinet Office Ordinances and Ministerial Ordinances following the introduction of the system for transferring beneficiary rights of trusts issuing beneficiary securities | ||

| 13 | Publication of the statement by the International Accounting Standards Committee Foundation (IASCF) Monitoring Board in response to the joint statement by the IASB and FASB | ||

| Development of institutional frameworks pertaining to financial and capital markets | |||

| Establishment of the “Project Team on Money-Lending Systems” | |||

| 16 | Administrative action against K.K. Asian Blue | ||

| 17 | Decision to order payment of an administrative monetary penalty for insider trading by a person receiving information from a tender offeror of We've Inc. shares | ||

| Fourth trial date for the case of a violation of the Financial Instruments and Exchange Act in relation to insider trading by an employee of Ajinomoto Co., Inc. | |||

| 18 | Concord Co., Ltd. | ||

| 20 | Administrative action against the Nisshin Shinkin Bank | ||

| Administrative action against Joule. Inc. | |||

| Decision to order payment of an administrative monetary penalty for insider trading by an employee of PwC Advisory Co., Ltd | |||

| Results of public comments on the draft amendment of the “Guidelines for Personal Information Protection in the Financial Field” | |||

| 25 | Decision to order payment of an administrative monetary penalty for the failure by Ebanco Holdings Limited to issue a public notice for commencing tender offer in relation to the purchase of bonds with warrants | ||

| 26 | Additions to the “Q&A on Stock Tender Offers” | ||

| 27 | Administrative action against Must LLC | ||

| 30 | Publication of the draft Cabinet Order, draft Cabinet Office Ordinance, draft supervisory guidelines and draft financial inspection manuals, etc. concerning temporary measures to facilitate financing for SMEs, etc. | ||

| Update of the Collection of Statistics on the Money Lending Business | |||

| Decision to order payment of an administrative monetary penalty for insider trading by an employee of Oriental Shiraishi Corporation (1) | |||

| Decision to order payment of an administrative monetary penalty for insider trading by an employee of Oriental Shiraishi Corporation (2) | |||

| Decision to order payment of an administrative monetary penalty for insider trading by an employee of Oriental Shiraishi Corporation (3) | |||

| Decision to order payment of an administrative monetary penalty for insider trading by a person receiving information from an employee of Oriental Shiraishi Corporation (1) | |||

| Decision to order payment of an administrative monetary penalty for insider trading by a person receiving information from an employee of Oriental Shiraishi Corporation (2) | |||

| Decision to order payment of an administrative monetary penalty for insider trading by a person receiving information from an employee of a firm that has concluded a contract with Oriental Shiraishi Corporation | |||

| Decision to order payment of an administrative monetary penalty for insider trading by a person receiving information from an officer of a firm that has concluded a contract with Oriental Shiraishi Corporation | |||

| Decision to order payment of an administrative monetary penalty for market manipulation relating to the shares of SBI Futures Co., Ltd. | |||

| December 1 |

Publication of the scheduled promulgation, etc. of the “Cabinet Office Ordinance for Partial Amendment of the Regulations, etc. for Terminology, Forms and Preparation of Consolidated Financial Statements,” etc. | ||

| 2 | Overview of the financial results of major banks, etc. as of end-September 2009 | ||

| Overview of the financial results of regional banks as of end-September 2009 | |||

| 3 | Publication of enforcement orders and cabinet office ordinances concerning temporary measures for facilitating the financing of small- and medium-sized enterprises, etc. | ||

| Fourth trial date for the case of a violation of the Financial Instruments and Exchange Act in relation to false statements contained in a prospectus relating to the secondary distribution of shares in BicCamera Inc. held by an officer of BicCamera Inc. | |||

| Administrative action against Wisdom Capital Inc. | |||

| 4 | Holding of the first Secretariat meeting of the “Project Team on Money-Lending Systems” (held November 30, 2009) | ||

| Publication of the guidelines and financial inspection manuals, etc. for financial supervision based on the Act Concerning Temporary Measures to Facilitate Financing for SMEs, etc. | |||

| Administrative action against Japan Post Bank Co., Ltd. and Japan Post Network Co., Ltd. | |||

| Administrative action against Japan Post Insurance Co., Ltd. and Japan Post Network Co., Ltd. | |||

| Exposures of Japanese deposit-taking institutions to subprime-related products and securitized products | |||

| 7 | Publication of draft Cabinet Orders and Cabinet Office Ordinances, etc. following the enforcement of laws on fund settlement | ||

| 8 | Holding of the “Roundtable Conference on the Certified Public Accountants System” | ||

| 9 | Decision on capital injections into The Towa Bank, Ltd. and The Bank of Kochi, Ltd. | ||

| Publication of the “Report by the Roundtable Committee on Fundamental Issues of the Financial System Council” | |||

| 10 | Holding of the Secretariat meeting of the “Project Team on Money-Lending Systems” | ||

| 11 | Decision to order payment of an administrative monetary penalty for insider trading by a person receiving information from an employee of Futaba Industrial Co., Ltd. | ||

| Status of crime involving counterfeit ATM cards | |||

| Holding of the “Symposium on Life Planning and Asset Management” | |||

| Results of public comments on the “Draft Cabinet Office Ordinance for Partial Amendment of the Cabinet Office Ordinance Relating to the Disclosure of Corporate Information, etc.” | |||

| Results of the public comment on the “Draft Cabinet Office Ordinance for Partial Amendment of the Regulations, etc. for Terminology, Forms and Preparation of Consolidated Financial Statements,” etc. and the “Draft Amendments to the Points to be Considered regarding the Disclosure of Corporate Information, etc. (Corporate Information Disclosure Guidelines)” | |||

| Report on the details of measures taken to deal with failed financial institutions | |||

| Invitation for comments on the “Draft Order to Partially Revise the Orders Pertaining to the Book-Entry Transfer of Company Bonds, Shares, etc.” | |||

| 14 | Concord Co., Ltd. | ||

| Publication of the “Draft Administrative Guidelines (Volume 3: for Non-Bank Finance Companies, 5 for Issuers of Prepayment Measures, 14 for Fund Transfer Service Providers) | |||

| Administrative action against Cosmo Securities Co., Ltd. | |||

| 16 | Easing of lending terms based on the “Measures to Facilitate the Easing of Lending Terms for Loans to Small- and Medium-Sized Enterprises” (July - September, 2009) | ||

| 17 | FSA and NPA publish “Draft Order for Partial Amendment of the Ordinance for Enforcement of the Act on Prevention of Transfer of Criminal Proceeds” | ||

| FSA publishes the “Collection of Examples of Issues Pointed out in Financial Inspections which Pertain to Finance Facilitation” | |||

| Publication of the “Draft Blueprint for the Development of Institutional Frameworks Pertaining to Financial and Capital Markets” | |||

| FSA updates press release on the “Announcement by the Basel Committee on the consultative proposals to strengthen the resilience of the banking sector” | |||

| 18 | Report on the Implementation Status of Business Revitalization Plans | ||

| Publication of examples of consolidated financial statements based on the International Financial Reporting Standards | |||

| 21 | Administrative action against Commodore Investment Co., Ltd | ||

| 22 | License issued for foreign non-life insurance business | ||

| Results of public comments on the “Enforcement Orders and Cabinet Office Ordinances Concerning Temporary Measures for Facilitating the Financing of Small- and Medium-Sized Enterprises, etc.” | |||

| Results of public comments on the “Guidelines and Financial Inspection Manuals, etc. for Financial Supervision Based on the Act Concerning Temporary Measures to Facilitate Financing for SMEs, etc.” | |||

| Outline of the results of the SME Business Sentiment Questionnaire | |||

| Results of public comments on the draft government ordinance and draft cabinet office ordinance, etc. on the 2009 partial revision of the Financial Instruments and Exchange Act etc. | |||

| Main items in the outline of the FY2010 Tax Reform which relate to the FSA | |||

| 24 | Promulgation of cabinet orders and cabinet office ordinances, etc. following enforcement of the Insurance Act, etc. | ||

| 25 | Taicom Securities Co., Ltd. | ||

| FSA publishes draft partial revision of the Comprehensive Guidelines for Supervision of Major Banks, etc. | |||

| FSA publishes draft partial revision of the Comprehensive Guidelines for Supervision of Agricultural Cooperatives, Credit Federations of Agricultural Cooperatives and the Norinchukin Bank | |||

| FSA publishes draft partial revision of the Comprehensive Guidelines for Supervision of Financial Instruments Business Operators, etc. | |||

| FSA publishes draft partial revision of the Comprehensive Guidelines for Supervision of Insurance Companies | |||

| Decision to order payment of an administrative monetary penalty against false statements made in the annual securities reports, etc. relating to Ardepro Co., Ltd. | |||

| Decision to order payment of an administrative monetary penalty against an employee of Yamazaki Construction Co., Ltd. | |||

| Disciplinary action against a certified public accountant | |||

| Investigation into how best to regulate mutual aid projects | |||

| FSA budget, organization and staff quota for FY2010 | |||

| 28 | FSA institutes public notice pertaining to the designation of designated rating agencies | ||

| Results of the public comments on the draft cabinet office ordinances, etc. pertaining to those parts of the 2009 partial revision of the Financial Instruments and Exchange Act, etc. regarding the corporate information disclosure system | |||

| Update of the Collection of Statistics on the Money Lending Business | |||

| Administrative action against The Asahi Fire & Marine Insurance Co., Ltd. and other companies. | |||

| Publication of the Draft Cabinet Office Ordinance, etc. for Partial Amendment of the Ordinance for Enforcement of the Insurance Business Act | |||

| Holding of the “2nd Roundtable Conference on the Certified Public Accountants System” | |||

Details of any items with an Access symbol, can be viewed by clicking on the Access symbol.

Site Map

- Press Releases & Public RelationsPage list Open

- Press Releases

- Press Conferences

- Official Statements

- FSA Weekly Review & ACCESS FSA

- Speeches

- For Financial Users

- Others

- Archives

- Laws & RegulationsPage list Open

- Name of Laws and Regulations(PDF)

- Recent Changes (Legislation, Ordinances, Guidelines)

- Guidelines

- Financial Instruments and Exchange Act

- Financial Monitoring Policy

- Public Comment

- No-Action Letter System

- Procedures concerning Foreign Account Management Institutions

Search

Search